Supreme Clothing Sales Tax

The days of escaping sales taxes by shopping online are ...

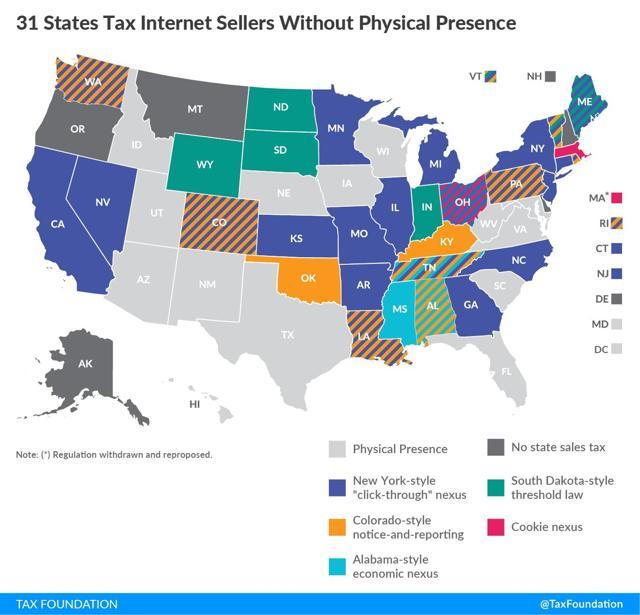

Texas joins other states that made adjustments after the U.S. Supreme Court ruled in 2018 that states could force out-of-state retailers to collect state and local sales taxes from their residents.eBay Announces They Will Start Collecting Sales Tax in 2019

Sep 18, 2018 · Now eBay is following the other two marketplaces to start collecting sales tax in those three states. The company released a notification to sellers that indicates eBay will be collecting and remitting sales tax on sales to buyers in those starting next year: Washington—starting Jan 1, 2019; Pennsylvania— starting July 1, 2019Apr 16, 2018 · The court first adopted its physical presence rule on sales tax collection in a 1967 case dealing with a catalog retailer. At the time, the court was concerned in part about the burden collecting ...

Texas Sales Tax Rate & Rates Calculator - Avalara

Sales tax is a tax paid to state and local tax authorities in Texas for the sale of certain goods and services. First adopted in 1961 and known as the "Limited Sales and Use Tax", sales tax is most commonly collected from the buyer at the point of sale.Illinois’s New Rules on Collecting Sales Tax. Effective October 1, 2018, remote sellers whose sales in Illinois exceed certain thresholds must register with the state, collect sales tax, and remit the tax to the state. Remote sellers are retailers that make sales from locations outside of Illinois.

Do International Sellers Have to Deal with Sales Tax in ...

You are an international seller who has no physical presence in the U.S., but who makes sales into the U.S. In this case, you may supreme clothing sales tax have economic nexus.A June 21, 2018 Supreme Court of the United States case allowed states to require online sellers with “economic nexus” in their state to comply with that state’s sales tax requirements.New York establishes its online sales tax rules. And ...

Jan 16, 2019 · The retailer made more than 100 sales of tangible personal property delivered in the state. The guidance clarifies the supreme clothing sales tax state’s sales and use tax law, which has been in place since 1965. However, it couldn’t enforce the law until June when the U.S. Supreme Court ruled in the South Dakota v.Jun 21, 2018 · Online sellers that haven't been charging sales tax on goods shipped to every state range from jewelry website Blue Nile to pet products site 0 to clothing retailer …

States can only require companies to collect taxes if the company has a physical presence in the state. The North Dakota State Supreme Court reversed this decision based on the ruling in another precedent setting case, Complete Auto Transit Inc. v. Brady decided in 1977, which loosened up the rules for physical presence within the state. The Quill Corporation appealed the State Supreme Court's ...

RECENT POSTS:

- louis vuitton belt size chart women's

- louis vuitton neverfull handles replacement

- louis vuitton horizon earphones price

- premium outlet mall st louis

- louis v keepall

- leather and canvas duffle bags for men

- valentino small leather shoulder bag

- louis vuitton heels saint

- louis vuitton don kanye reddit

- louisville basketball schedule 2020 21

- louis vuitton rivoli sneaker boot noir

- multi color soft leather handbags

- louis vuitton bond street london stores

- louis philippe logo font

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the coach crossbody messenger bag price for more info.