State Of Nevada Sales Tax Rates By County

.jpg)

Incentives - Nevada Governor's Office of Economic Development

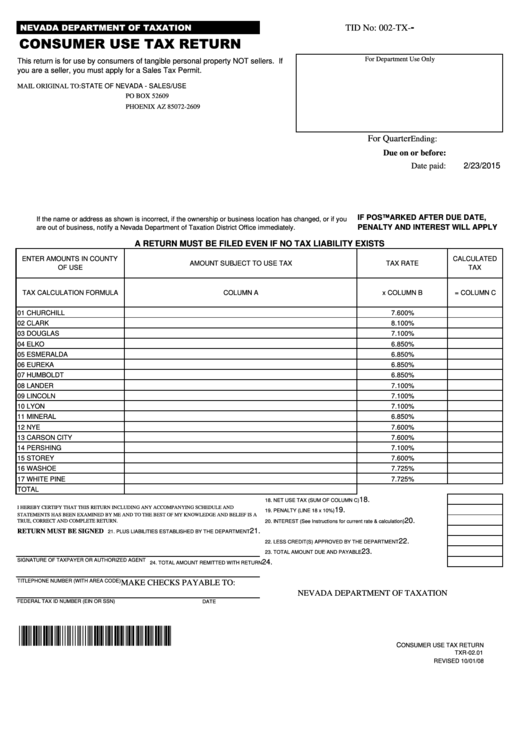

Sales and Use Tax Abatement - Sales and use tax abatement on qualified capital equipment purchases, with reductions in the rate to as low as 2%. Modified Business Tax Abatement - An abatement of 50 percent of the 1.475% rate …Nevada collects a 8.1% state sales tax rate on the purchase of all vehicles. Some dealerships may also charge a 149 dollar documentary fee. In addition to taxes, car purchases in Nevada state of nevada sales tax rates by county may be subject to …

Feb 06, 2020 · The state of nevada sales tax rates by county tax rate for all admission charges collected is 9%. ... Authorizes the holder to manufacture, assemble or produce an interactive gaming system for use and play in the State of Nevada …

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - Effective …

Nevada Aviation Fuel Tax . In Nevada, Aviation Fuel is subject to a state excise tax of $0.02 per gallon; counties state of nevada sales tax rates by county are able to impose county option taxes up to 8 cents per gallon. Point of Taxation: Sales made to end user or retailer. Sales between licensed suppliers are tax …

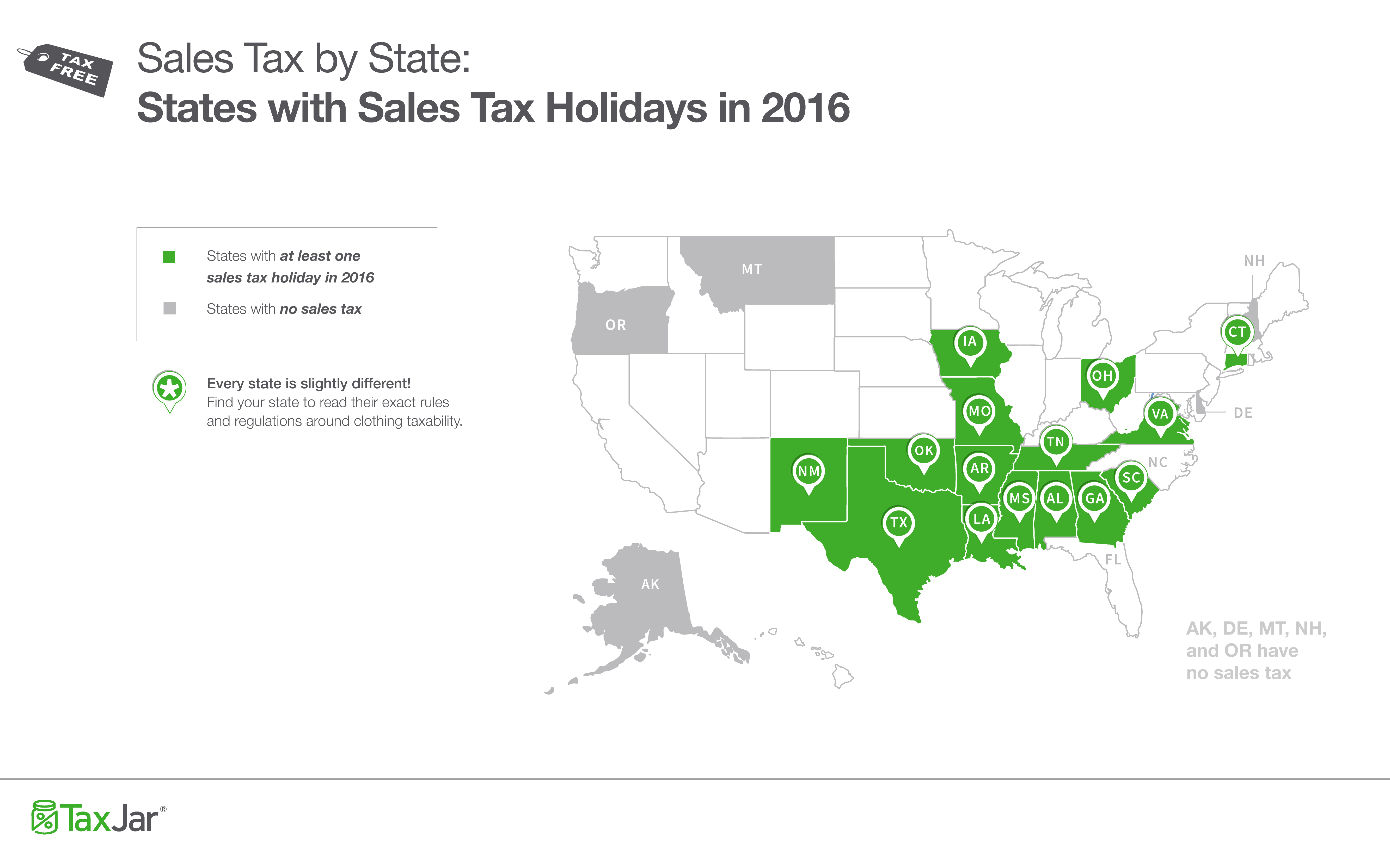

Nevada Sales Tax Guide for Businesses - TaxJar

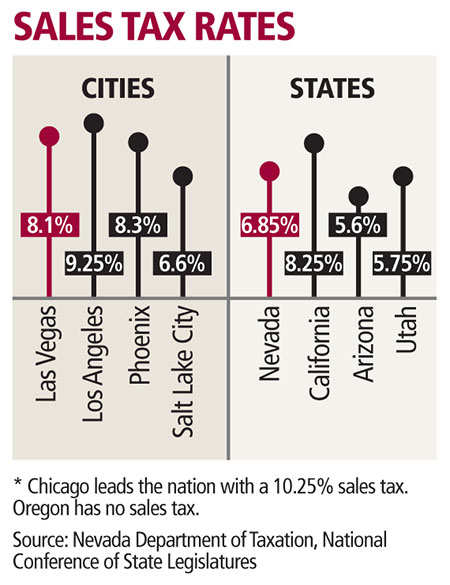

The sales tax rate you collect in Nevada depends on where your product is headed, as Nevada is a destination-based state. How to Collect Sales Tax in Nevada if you are Based in Nevada. Nevada is an destination-based sales tax state. So if you live in Nevada, collecting sales tax … louis vuitton geldbeutel herren sales tax rateDealer Vehicle Sales Outside of Nevada

Sales Taxes. An out-of-state dealer may or may not collect sales tax. See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates. Rates vary by county. Many dealers remit sales tax …Nevada

Nevada The state of Nevada became a full member of Streamlined Sales Tax on April 1, 2008. Membership Petition Certificate of Compliance Annual Recertification Letter Taxability Matrix. …Vehicle Title, Tax, Insurance & Registration Costs by ...

Below, we list the state tax rate, although your city or county government may add its own sales tax as well. ... Nevada: $33: $8: $985: $29.25: No limit: Governmental Services Tax based on vehicle value: ... Varies by county, plus 0.3% motor vehicle sales/use tax…RECENT POSTS:

- how much are goyard duffle bags

- louis vuitton bag pink writing

- louis vuitton notre dame

- louis vuitton store bellevue washington

- map of louisiana cities and towns

- barbecue best restaurants in st louis 2019

- louis vuitton monogram pochette marly bag

- louise without hat bob's burger

- 10 most expensive handbags

- when does macy's sale end

- best sites for used designer bags

- lv sizes mm gm

- valor fitness boxing speed bag platform

- mini speedy louis vuitton bag

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton totally gm retail prices

michael kors ava extra-small leather crossbody bag

jual beli tas louis vuitton asli

louis vuitton northpark center

vintage louis vuitton small purse

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton clone belt for more info.