Sales Tax Rates Nevada By County

Indian Springs, Nevada Sales Tax Rate - Avalara

The minimum combined 2020 sales tax rate for Indian Springs, Nevada is . This is the total of state, county and city sales tax rates. The Nevada sales tax rate is currently %. The County sales tax rate is %. The Indian Springs sales tax rate …Nevada Sales Tax Guide for Businesses - TaxJar

Example: You live and run your business in Las Vegas, NV 89165 which has a sales tax rate of 8.10 %. You ship a product to your customer in Carson City 89701, which has a sales tax rate of 7.72 %. You would charge your customer the 7.72 % rate. How to Collect Sales Tax in Nevada if you are Not Based in NevadaThe minimum combined sales tax rates nevada by county 2020 sales tax rate for Churchill County, Nevada is . This is the total of state and county sales tax rates. The Nevada state sales tax rate is currently %. The Churchill County sales tax rate …

Sales tax calculator for Nevada, United States in 2020

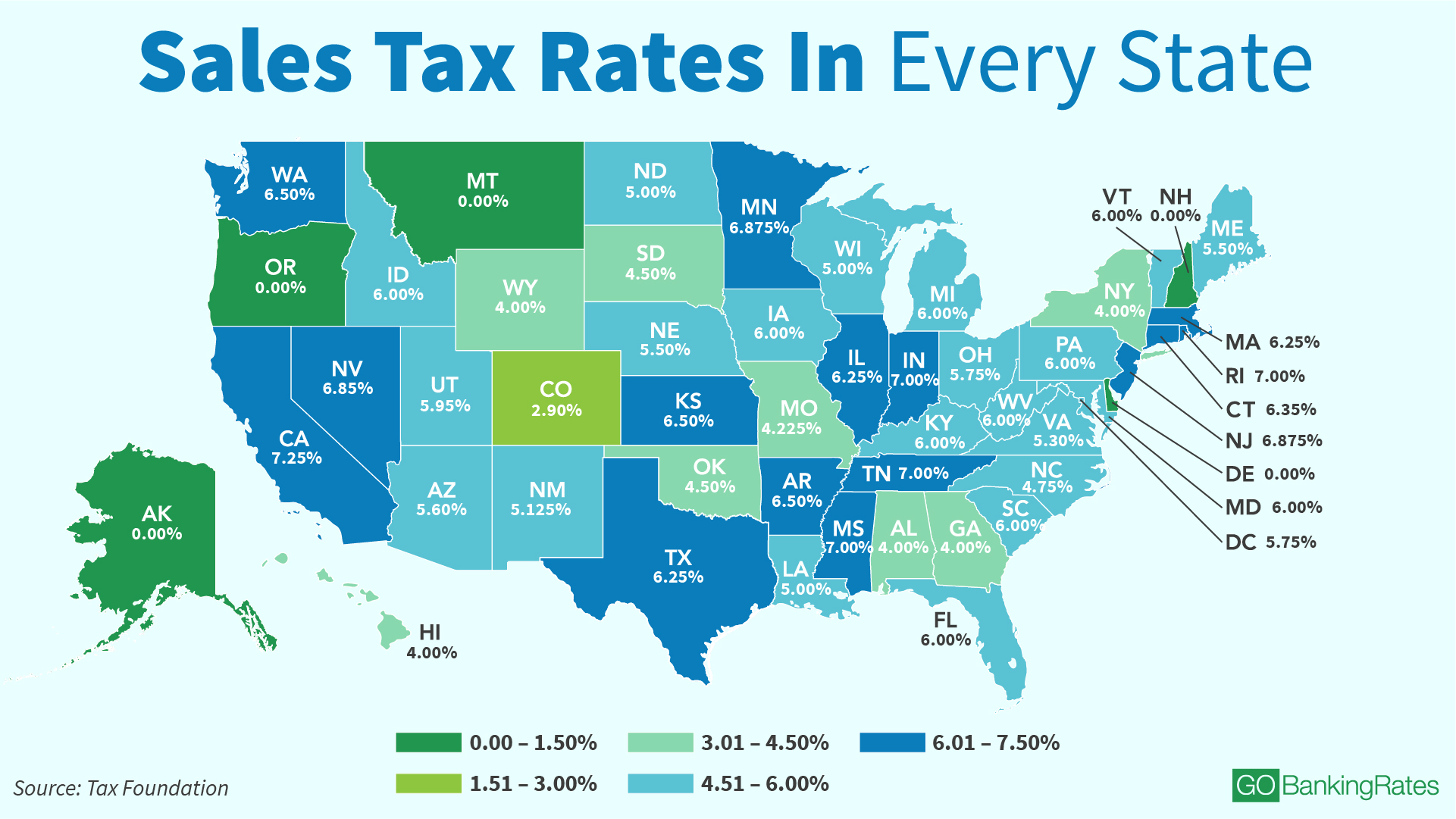

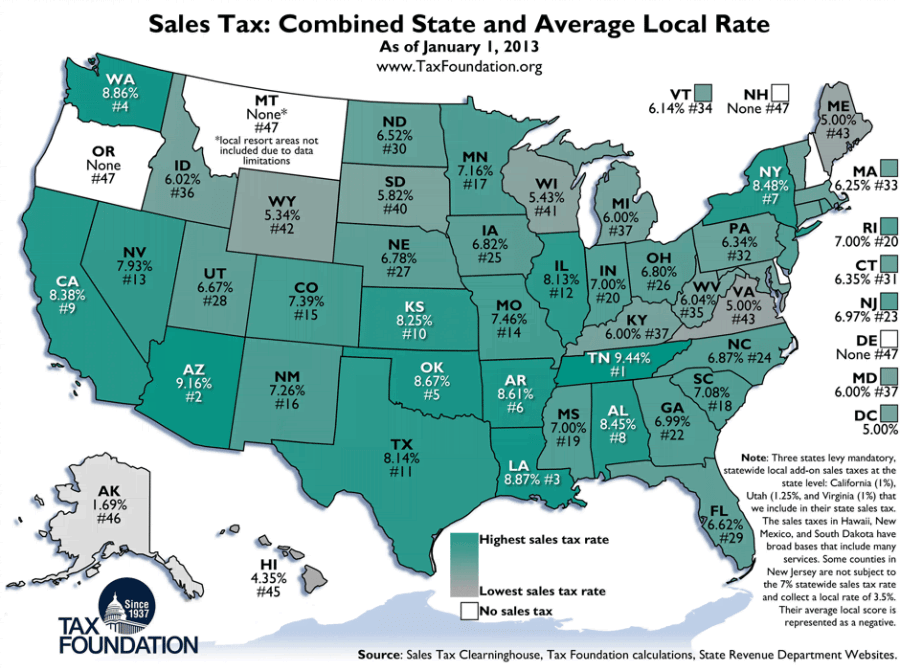

The state general sales tax rate of Nevada is 4.6%. Nevada cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (2.25% to 3.775%), and in some case, special rate …State & Local Sales Tax Rates | 2020 Sales Tax Rates | Tax ...

Jan 15, 2020 · 2020 sales tax rates differ by state, but sales tax bases also impact how much revenue is collected and how it affects the economy. 2020 sales tax rates. Per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales …October 2020 sales tax rates color

STATE AND PERMISSIVE sales tax rates nevada by county SALES TAX RATES BY COUNTY, OCTOBER 2020 County Transit Total State & County Transit Total State & County Tax Rate Tax Rate Local Rate County Tax Rate Tax Rate Local Rate … louis vuitton hat and scarf womens blackThe minimum combined 2020 sales tax rate for Lincoln County, Nevada is . This is the total of state and county sales tax rates. The Nevada state sales tax rate is currently %. The Lincoln County sales tax rate …

Sales & Use Tax Rates | Utah State Tax Commission

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes: State, Local Option, Mass Transit, Rural Hospital, Arts & Zoo, Highway, County Option, Town Option and Resort taxes. The entire combined rate is due on all taxable transactions in that tax …sales tax rates nevada by county There were no sales and use tax county rate changes effective July 1, 2017; 2nd Quarter (effective April 1, 2017 - June 30, 2017): Rates listed by county and transit authority; Rates listed by city or village and Zip code; 1st Quarter (effective January 1, 2017 - March 31, 2017): There were no sales and use tax county rate …

RECENT POSTS:

- louis vuitton bag tan

- louis vuitton pochette multi pink

- louis vuitton advertisement analysis

- lv eu kennzeichen

- louis vuitton neverfull second handed

- lv favourite mm review

- best mens wallet brands in india

- walmart black friday 2018 canada flyer leaked

- louis vuitton boots

- louis vuitton taschen kaufen in köln

- lv clapton backpack organizer

- stores that sell louis vuitton shoes

- macy's furniture outlet store illinois

- louis vuitton black checkered handbag

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton new bag collection

louis vuitton bag charms youtube video

pre owned louis vuitton bags near me

louis vuitton lockme bucket black

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the small coin purses at walmart for more info.