Sales Tax Rate Nevada

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase sales tax rate nevada - Effective …

Carson City County, Nevada Sales Tax Rate

The Carson City County, Nevada sales tax is 7.60%, consisting of 4.60% Nevada state sales tax and 3.00% Carson City County local sales taxes.The local sales tax consists of a 3.00% county sales tax.. The Carson City County Sales Tax is collected by the merchant on all qualifying sales made within Carson City County; Groceries are exempt from the Carson City County and Nevada state sales …Nevada Sales Tax Information, Sales Tax Rates, and Deadlines

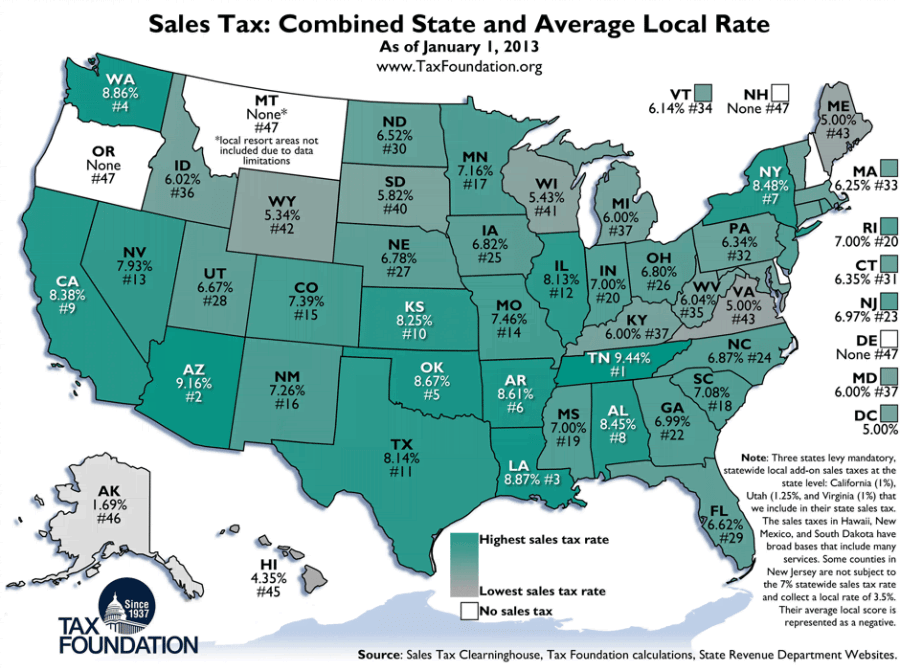

Nevada Sales Tax Rates. The state sales tax rate in Nevada is 4.6%. The addition of various local sales taxes can bring the effective rate as high as 8.265% in some parts of the state, and because all local tax jurisdictions do add their own tax, the lowest effective tax rate …Nevada Sales Tax: Small Business Guide | How to Start an LLC

Jul 29, 2020 · When calculating the sales tax for this purchase, Steve applies the 4.6% state tax rate for Nevada plus 3.55% for Clark county’s tax rate. At a total sales tax rate of 8.15%, the total cost is $378.53 ($28.53 sales tax). Out-of-state Sales. Nevada businesses only need to pay sales tax on out-of-state sales …Sales tax calculator for Reno, Nevada, United States in 2020

How 2020 Sales taxes are calculated in Reno. The Reno, Nevada, general sales tax rate is 4.6%.Depending on the zipcode, the sales tax rate of Reno may vary from 4.6% to 8.265% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3.665%). There is no city sale tax …Nevada Vehicle Registration Fees

See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax …Jan 15, 2020 · 2020 sales tax rate nevada sales tax rates differ by state, but sales tax bases also impact how much revenue is collected and how it affects the economy. 2020 sales tax rates. ... Nevada’s combined ranking moved …

Sales tax calculator for 89109 Las Vegas, Nevada, United ...

How 2020 Sales taxes are calculated for zip code 89109. The 89109, Las Vegas, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 89109's county rate (3.775%). Rate …State Sales Tax Rates - Sales Tax Institute

6.85% The Nevada Minimum Statewide Tax rate of 6.85% consists of several taxes combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate of 4.6%. Two county taxes also apply — sales tax rate nevada 0.50% Basic City-County Relief Tax and 1.75% Supplemental City-County Relief Tax … st louis cardinals picture flahertyRECENT POSTS:

- louis vuitton clothes prices in south africa

- lv zoe wallet price singapore

- louis vuitton swimsuit prices

- cheap louis vuitton stephen sprouse

- louis vuitton siena mm damier ebene

- lv noe purse m57099

- saint louis cardinals game channel

- lv chain mm bag

- cheap halloween costumes for adults plus size

- welch printing company louisville ky

- real hermes birkin bags

- st louis cardinal theme tickets 2019

- st louis blues hockey history

- louis vuitton trocadero sneaker white

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton trunk phone case

louis vuitton store chicago looted

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton tivoli gm purse organizer for more info.