Sales Tax Rate Nevada 2020

Sales Tax Rates By State 2020 - www.lvspeedy30.com

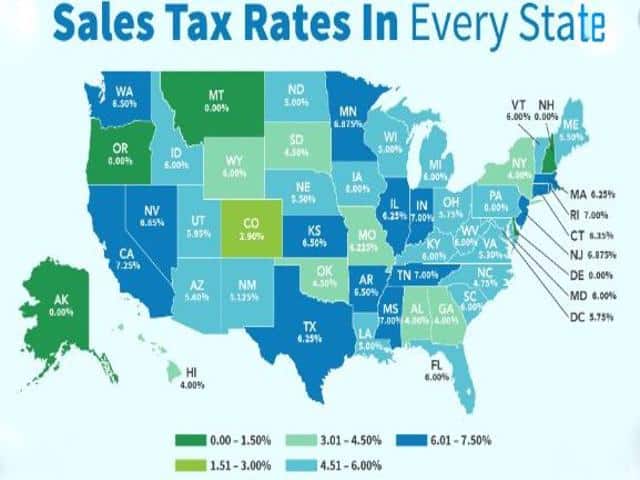

Many states allow local governments to charge a local sales tax in addition to the statewide sales tax, so the actual sales tax rate may vary by locality within each state. Choose any state for more information, including local and municiple sales tax rates is applicable. For state use tax rates, see Use Tax By State. louis vuitton supreme jacquard denim trucker jacketFor more accurate sales tax rates, consider automating sales tax calculation with Avalara AvaTax. You’ll get address-level precision in real time, at the point of sale — without looking up rates or maintaining sales tax rate nevada 2020 a rate table database.

Sales Tax Rates

Jul 01, 2020 · Find the latest United States sales tax rates. www.lvspeedy30.com is your one stop shop for all US city sales tax rates. 2019 rates included for use while preparing your income tax deduction. ... Wed Jul 01 2020: Nevada (NV) Sales Tax Rates: 6.850%: 6.850 - 8.375%: Sat Feb 01 2020: New Hampshire (NH) Sales Tax Rates: 0.000%: 0.000%: New Jersey (NJ ...The Nevada use tax should be paid for items bought tax-free over the internet, bought while traveling, or transported into Nevada from a state with a lower sales tax rate. The Nevada use tax rate is 6.85%, the same as the regular sales tax rate nevada 2020 Nevada sales tax. Including local taxes, the Nevada use tax …

State and Local Sales Tax Rates, 2020 Key Findings • Forty-five states and the District of Columbia collect statewide sales taxes. • Local sales taxes are collected in 38 states. In some cases, they can rival or ... Nevada’s combined ranking moved from 14 th to 12. The biggest driver of this change was a 0.125

The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.

Taxes about to increase | Las Vegas Review-Journal

Jun 30, 2009 · Chicago is the highest at 10.25 percent, while Los Angeles has a 9.25 percent sales tax rate. The Nevada sales tax rate will be 6.85 percent, eighth highest among the 50 states. ... 2020 - …White Pine County, Nevada Sales Tax Rate - Avalara

The minimum combined 2020 sales tax rate for White Pine County, Nevada is . This is the total of state and county sales tax rates. The Nevada state sales tax rate is currently %. sales tax rate nevada 2020 The White Pine County sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.Nevada

RECENT POSTS:

- louis vuitton madrid serrano madrid spain

- louis vuitton code lookup

- houses for sale las vegas nv 89108

- lv neonoe bucket bag

- disney christmas 2020 dates

- louis vuitton hampstead

- what size refills for louis vuitton agenda mm

- louis vuitton leather name tag

- cabazon outlets & desert hills premium outlets

- louis vuitton monogram bracelet

- saint louis arch video of inside

- women's wallets on sale

- league of legends x louis vuitton x nike

- louis vuitton baxter dog lead

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

how to sell vintage louis vuitton luggage tags

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton bracelet lock mechanism for more info.