Sales Tax Rate In Clark County Nevada 2019

Upon payment of all taxes and costs, the county will reconvey the real property back to the owner. The Tax Lien Sale. In most counties in Nevada, tax lien sales are handled like auctions. This article covers the basics as well as specifics for Washoe and Clark Counties. The remaining counties in Nevada will be covered in a separate article.

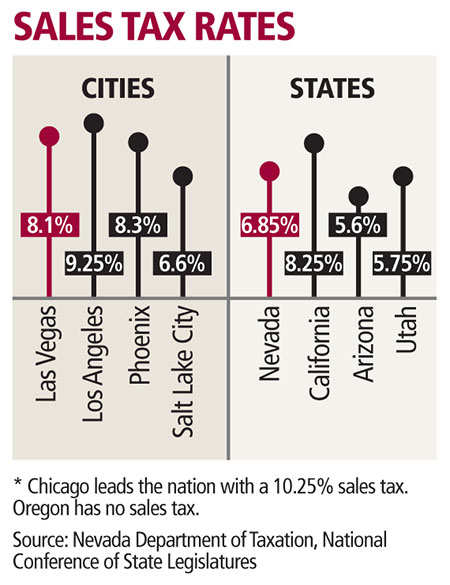

Aug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.

EDITORIAL: Clark County sales tax increase a boondoggle in ...

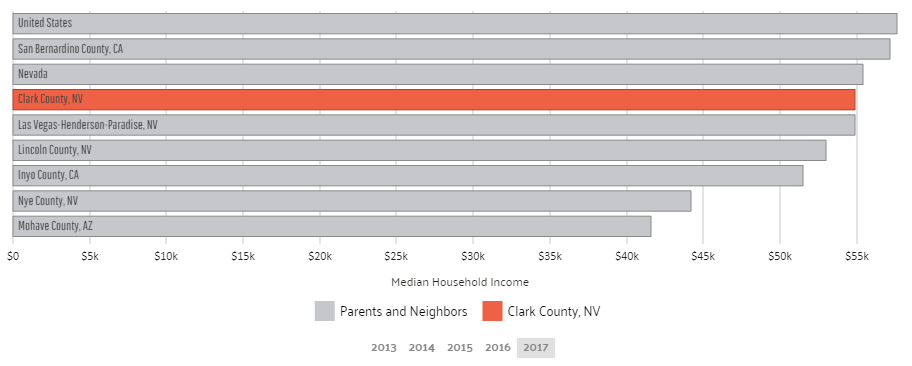

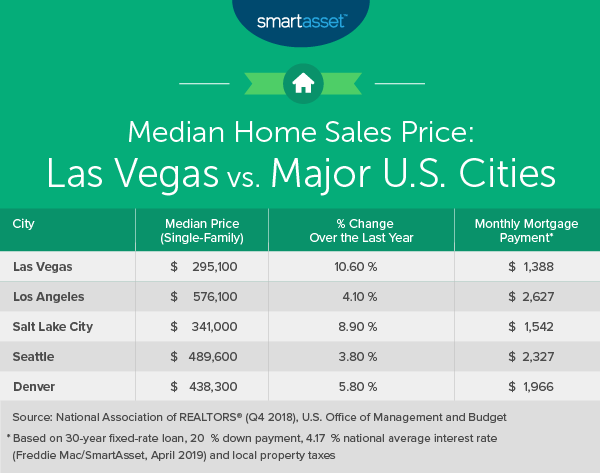

That sales tax rate in clark county nevada 2019 will raise Clark County’s sales tax rate to 8.375 percent and generate $54 million. The commission will solicit applications from government agencies and other groups who’d like a portion ...Jun 30, 2009 · The Nevada sales tax rate will be 6.85 percent, eighth highest among the 50 states. Clark County has a higher rate because of locally sales tax rate in clark county nevada 2019 approved school, police and highway bond issues.

Clark County Treasurer | Official Site

Office of the County Treasurer: Office Hours 7:30 sales tax rate in clark county nevada 2019 a.m.- 5:30 p.m. 500 S Grand Central Pkwy 1st Floor : Monday - Thursday (Except Holidays) Las Vegas NV 89106 : Ph. (702) 455-4323 Fax (702) 455-5969 : Mailing Address : Physical Address : Office of the County Treasurer : Office of the County Treasurer : 500 S Grand Central Pkwy : 500 S Grand ... lv metis damier originalSales tax increase passed by Clark County Commission

Sep 04, 2019 · Posted at 1:45 PM, Sep 03, 2019 and last updated 2019-09-04 21:36:00-04 LAS VEGAS (KTNV) — Clark County commissioners passed a sales tax increase with a 5-2 vote Tuesday morning.Taxes and fees: Where marijuana money is going in Nevada ...

Jun 10, 2019 · In fiscal year 2019, which will end June 30, the county received $9.7 million in business license fees — already higher than the amount generated in fiscal year 2018, which was $9.4 million.Sales Tax Rate: In Clark County (Henderson), the sales tax rate is 8.25%. Additional Information Sources: Nevada State Department of Taxation Department of Taxation Home Page

Nevada Ranks 13th Among States in Highest Sales Taxes ...

Mar 17, 2016 · The sales tax in Clark County, Nevada increased, effective January 1, 2016. The rate rose from 8.10 percent to 8.15 percent. Cook County, Illinois, home to Chicago, raised its county-level sales tax by a whopping 1 percent, from 1.75 percent to 2.75 percent, on January 1, 2016.RECENT POSTS:

- wizard of oz escape room st louis montgomery

- brown tote bag target store

- louis vuitton jewelry prague 2020

- louis vuitton vintage black handbag

- louis vuitton low heeled shoes

- top designer handbags 2019

- brown leather crossbody bag madewell

- mini sling bag for ladies

- alligator skin backpack purse

- lv millionaire sunglasses size chart

- leather and canvas bags for women

- samorga purse organizer speedy 300

- louis vuitton pochette metis forum

- knockoff neverfull bag

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

which department stores carry louis vuitton

burberry metallic monogram scarf for women

louis vuitton speedy bag sizes

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the ophidia gg supreme mini bag review for more info.