Sales Tax Nevada Vs California

California (CA) Sales Tax Rates by City

Jul 01, 2020 · California (CA) Sales Tax Rates by City The state sales tax rate in California is 7.250%. With local taxes, the total sales tax rate is between 7.250% and 10.500%.Jan 06, 2020 · If a California resident buys a car in Arizona, they may be exempt from paying the sales tax in Arizona, though they must still pay it in California. Your state's DMV most likely lists the state's tax relationships with other states, so you should check their web page before making a purchase.

Do I Pay Income Tax in California if I Work in Nevada ...

Nov 17, 2018 · California’s Franchise Tax Board is in charge of the state's income tax program, which requires residents to pay personal income taxes, even if they work in Nevada. The amount owed is based on filing status, certain income limits and whether you are a Native American or work for the military.California Nevada Cost of Living Comparison - Kaercher ...

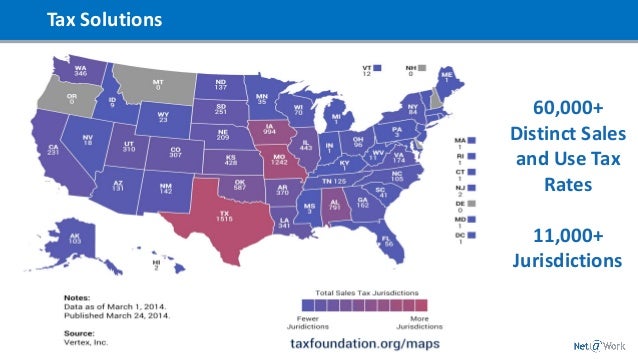

Ranking of Nevada vs California 8. Nevada. Taxes paid as pct. of income: 8.1%; Income per capita: $43,567 (19th lowest) Income tax collections per capita: $0 (tied — the lowest) Property tax collections per capita: $953 (13th lowest) General sales tax collections per capita: $1,412 (4th highest) 47. California. Taxes paid as pct. of income: 11.0%Apr 29, 2014 · California manages to subsist on incredibly high income, property and sales taxes, and Nevada gains the majority of its funding from gaming and sales tax. Property taxes in California and Nevada are both relatively high when compared to the national average tax rate. While property tax is generally steeper in Nevada, property taxes there are ...

State and Local Sales Tax Rates, 2019 | Tax Foundation

Jan 30, 2019 · Improving Lives Through Smart Tax Policy. State Rates. California has the highest state-level sales tax rate, at 7.25 percent. Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee.Nevada Car Buying & Selling FAQ | DMV.ORG

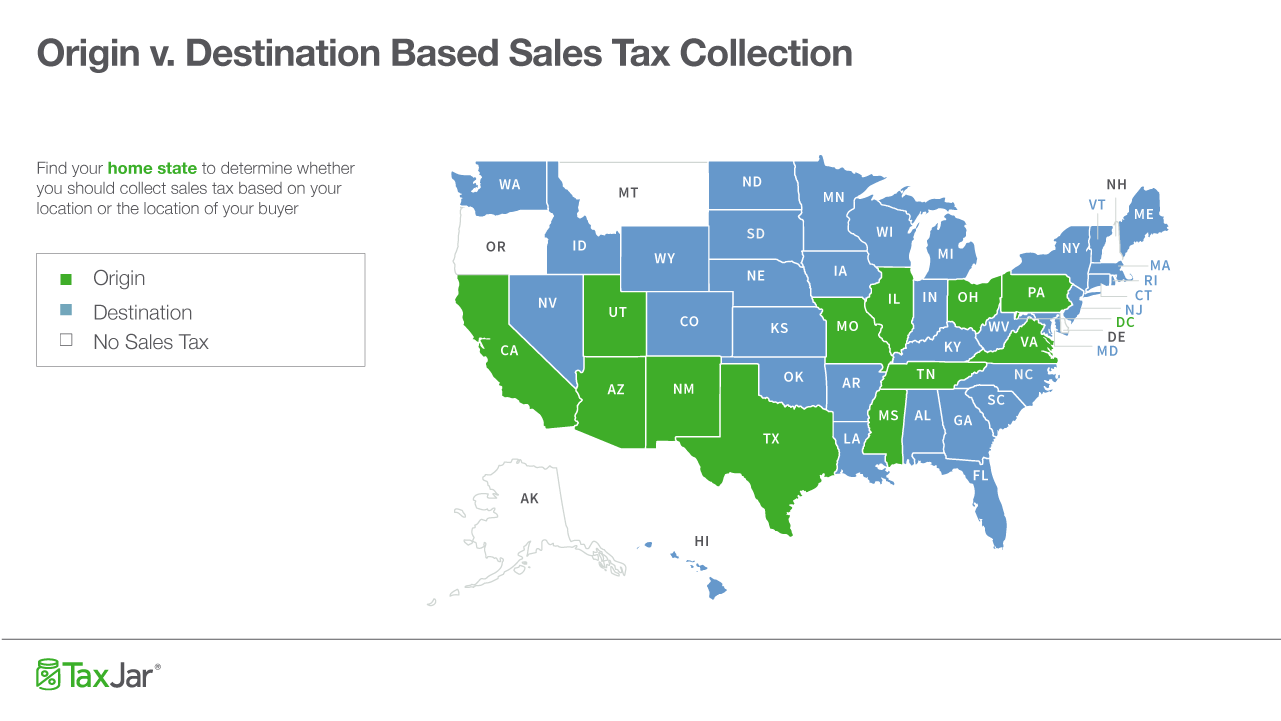

NOTE: Except for Utah purchases, the sales tax amount will be tallied with the total amount due, and you'll pay the difference when you register the vehicle. For Utah purchases, the amount may have been figured on the sales sheet, but you'll still pay the full amount due in Nevada at time of registration.Sales Tax Information & FAQ's - Nevada

If proof cannot be provided, Use Tax must be paid to Nevada. Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due. NAC 372.055, NRS 372.185. Do I have to pay Nevada Sales Tax when I purchase a boat? Yes, if the boat is purchased for use or storage in Nevada.How 2020 Sales taxes are calculated in Nevada. The state general sales tax rate of Nevada is 4.6%. Nevada cities and/or municipalities don't have a city sales tax. Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (2.25% to 3.775%), and in some case, special rate (0% to 0.25%).

RECENT POSTS:

- st louis cardinals 50/50

- small black leather purses

- does costco have black friday sales on tvs

- cheap hermes bags

- von maur sale handbags

- louis vuitton 6 key holder pink

- bob's burgers louise nails gif

- louis vuitton virgil abloh ss19

- ooey gooey butter cake recipe st louis

- best large diaper bag backpack

- louis vuitton v tote mm color:safran

- fake louis belt for sale

- louis vuitton keyring coin purse price

- cheap hotels downtown st louis mo

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton handbag repair costume

custom made firefighter belt buckles

burlington coat factory garment bags

vintage louis vuitton dillards charlotte nc

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the purse pouch as seen on tv youtube for more info.