Sales Tax Nevada Calculator

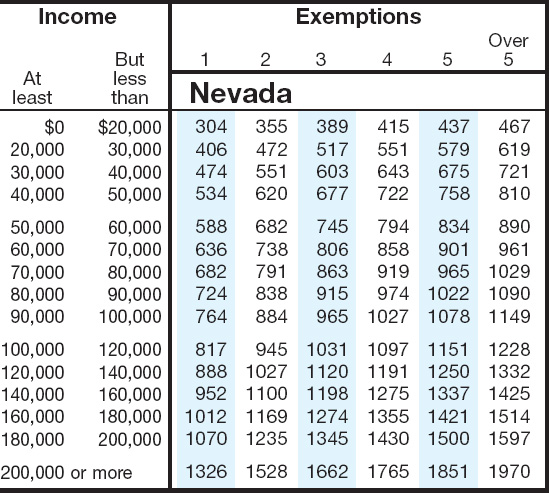

Tax Forms - Nevada

The Department's Common Forms page has centralized all of our most used taxpayer forms for your convenience. The documents found below are available in at least one of three different formats (Microsoft Word, Excel, or Adobe Acrobat [.PDF]).Sales Tax Calculator - 0

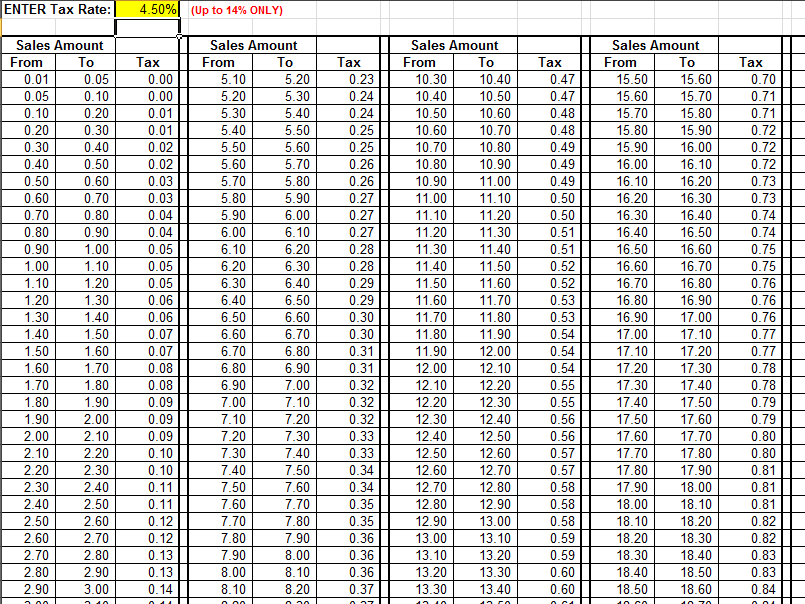

Our sales tax calculator will calculate the amount of tax due on a transaction. The calculator can also find the amount of tax included in a gross purchase amount.Jul 01, 2020 · Sales Tax Calculator. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. The sales tax added to the original purchase price produces the total cost of the purchase.

Las Vegas, Nevada's Sales Tax Rate is 8.375%

Higher sales tax than any other Nevada locality -0.225% lower than the maximum sales tax in NV The 8.375% sales tax rate in Las Vegas consists of 4.6% Nevada state sales tax and 3.775% Clark County sales tax .Jan 01, 2020 · Welcome to the Nevada Tax Center The easiest way to manage your business tax filings with the Nevada Department of Taxation. Log In or Sign Up sales tax nevada calculator to get started with managing your business and filings online.

Reverse Sales Tax Calculator Nevada

How Does Reverse Sales Tax Calculator Nevada Work? Sometimes, you might need to figure out the total amount to pay without the sales tax amount added to it. In that area, you will in need of relying on a “ Reverse Sales Tax Calculator ”, and guess what, we’ve got that too on our page for your convenience.What transactions are subject to the sales tax in Nevada?

In the state of Nevada, sales tax sales tax nevada calculator is legally required to be collected from all tangible, physical products being sold to a consumer. Some examples of items that exempt from Nevada sales tax are certain kinds of machinery, groceries, prescription medication, and medical devices.Nevada State Tax Calculator - Good Calculators

You are able to use our Nevada State Tax Calculator in to calculate your total tax costs in the tax year 2020/21. Our calculator has recently been updated in order to include both the latest Federal Tax Rates, along with the latest State Tax Rates.How to Calculate Cannabis Taxes at Your Dispensary

Aug 14, 2020 · Sales tax. The sales tax is the traditional tax we’re all used to paying when we make purchases. The tax rate differs from state to state and city to city, usually it’s between 4 percent and sales tax nevada calculator 17 percent. For example, the rate in Oregon is 17% while the sales tax in Montana is 4%.RECENT POSTS:

- mens leather crossbody bag sale

- louis vuitton shop in towson md

- macy's clearance furniture outlet locations

- louis vuitton sneakers 2020 black

- authentic louis vuitton men's bag

- genuine leather crossbody wallet

- vintage designer resale online

- men's leather shoulder bags ebay

- louis vuitton price philippines

- st louis pass galveston tx

- cheap sunglasses brands

- louis vuitton used travel bags

- louis vuitton favorite monogram pm

- how to tell if your louis vuitton belt is real

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

dr allen jacobs podiatrist st louis

louisiana average weather year round

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the minnetonka women's boots sale for more info.