Nv State Sales Tax Rate 2020

![nv state sales tax rate 2020 Tax Implications of Selling Commercial Real Estate [2020 Guide] Property Cashin](https://propertycashin.com/wp-content/uploads/2020/05/2020-State-Capital-Gains-Rates-Table.png)

States With Highest and Lowest Sales Tax Rates

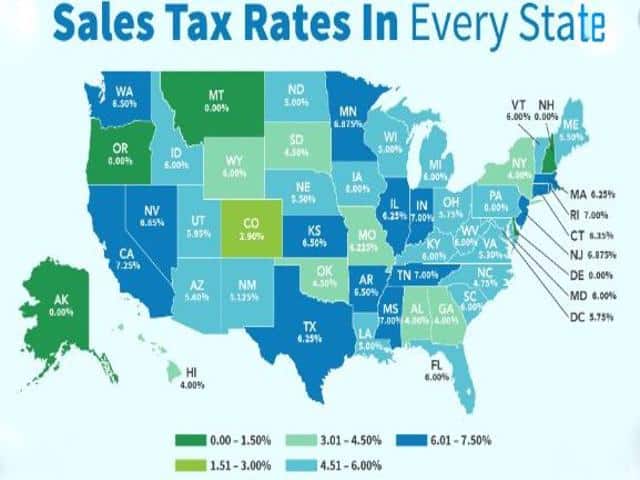

Oct 21, 2020 · The lowest state and local sales taxes after Alaska’s are in Hawaii (4.44 percent), Wyoming (5.34 percent), Wisconsin (5.43 percent) and Maine (5.5 percent). On the other end of the spectrum is Tennessee, whose state sales tax is 9.55 percent — the highest in the U.S.State of Nevada

Job Growth 1st nv state sales tax rate 2020 For the past 8 consecutive months October 2018 - May 2019Nevada Vehicle Registration Fees

Sales Taxes Top ↑ See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax payments with the title ...nv state sales tax rate 2020 Oct 01, 2020 · Changes to Monthly Report of State Sales and Use Tax Gross Collections and Gross Retail Sales (January 2002) ... State and Local Taxes; Statistical Abstract 2004 - Appendix; ... 2020. Expand. Sales and Use Tax Rates Effective October 1, 2020 louis vuitton outlet sale

New Nevada laws set to take effect in 2020

Aug 31, 2020 · New Nevada laws set to take effect in 2020 With the new year coming in just days, some changes and additions to state laws regarding guns, marijuana …The Nevada State State Tax calculator is updated to include the latest Federal tax rates for 2015-16 tax year as published by the IRS.. The Nevada State State Tax calculator is updated to include the latest State tax rates for 2020/2021 tax year and will be update to the 2021/2022 State Tax Tables nv state sales tax rate 2020 once fully published as published by the various States.

Nevada las vegas total sales tax rate???

Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax rate …Aug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.

Apr 10, 2020 · The Tax Cuts and Jobs Act modified the deduction for state and local income, sales and property taxes. If you itemize deductions on Schedule A, your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if …

RECENT POSTS:

- designer shoulder handbags sale uk

- ioffer louis vuitton makeup bag

- plane tickets lax to st louis

- louis vuitton mens side bag

- gucci dupe purse on amazon

- louis vuitton bag cover

- lv pallas clutch size

- sterling silver monogram rings for women

- ebags handbags ' purses

- louis vuitton besace south bank

- louis vuitton vavin gm review

- louisiana lottery pick 4

- cheap louis vuitton clothing for mens

- louis vuitton menswear

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton store in orlando

outlet stores near los angeles ca

kim jones louis vuitton supreme court

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the 2018 lv bags for more info.