Nv Sales Tax Form 2020

Sales tax rules for craft fair sellers: Source: Alaska: Although there’s no state sales tax in Alaska, many municipalities have a local sales tax and policies vary by locality. In the Kenai Peninsula Borough, for example, “all sellers are REQUIRED to register for sales tax collection” [emphasis theirs], including sellers at temporary events.

TC-62S, Sales and Use Tax Return for Single Place of Business

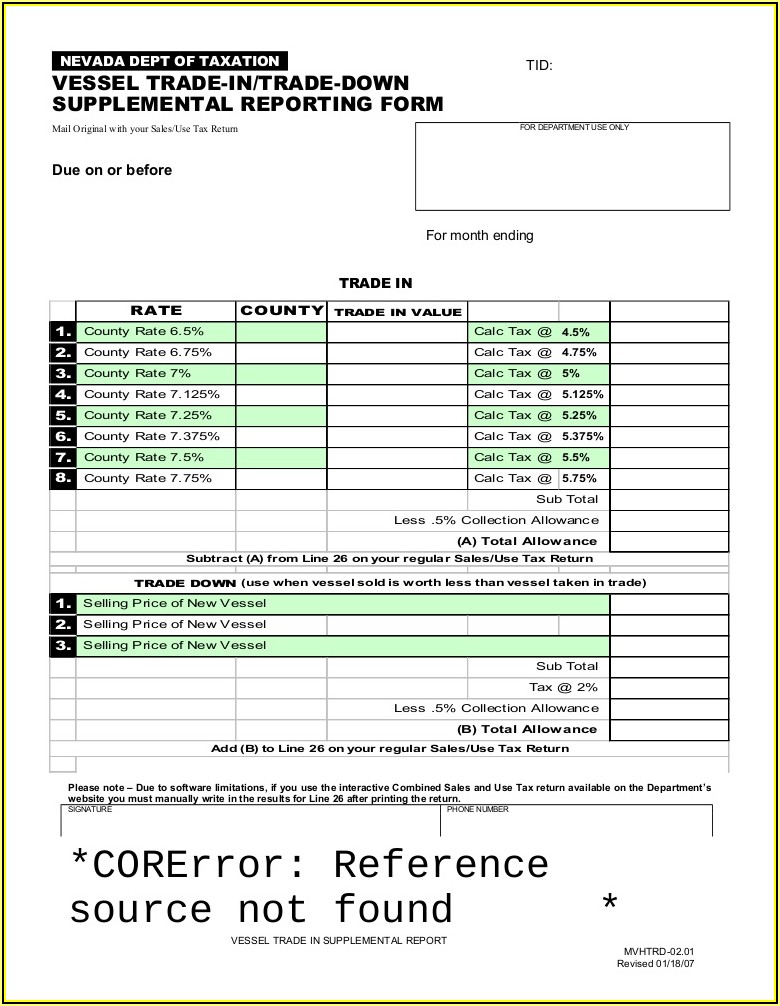

sales tax rates at 0 62001 9998 TC-62S Rev. 5/19 Single Place of Business a. Non-food and prepared food sales $ X (taxable sales) (tax rate) $ X (taxable sales) (tax rate) original ustc formSales tax forms (current periods)

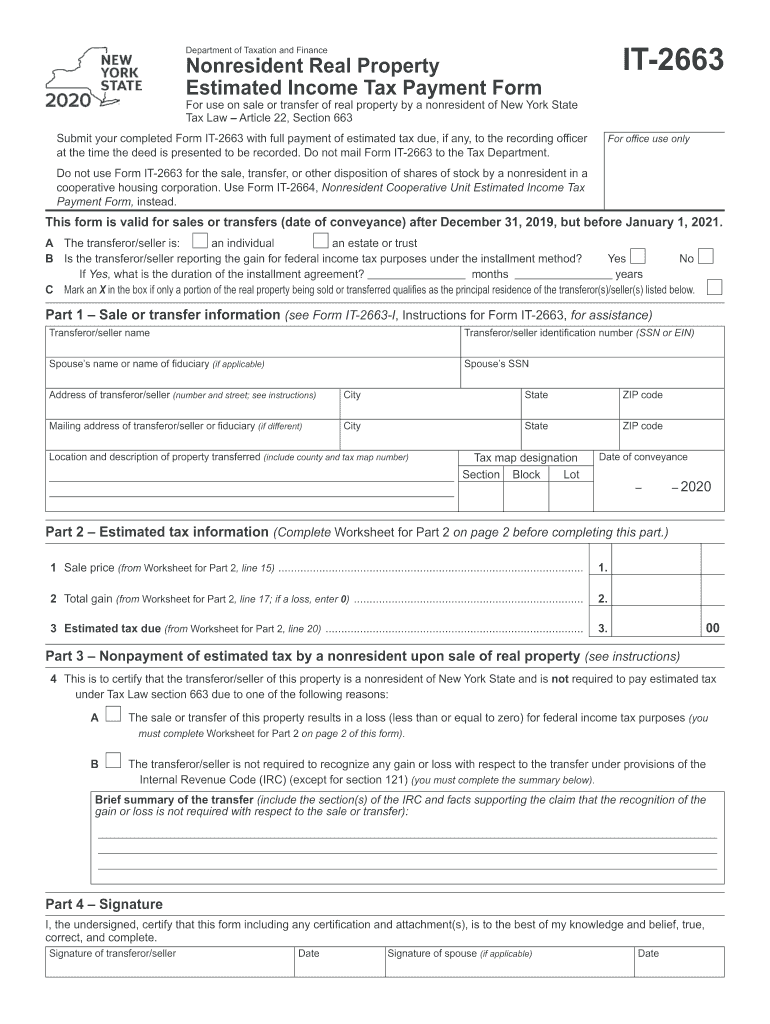

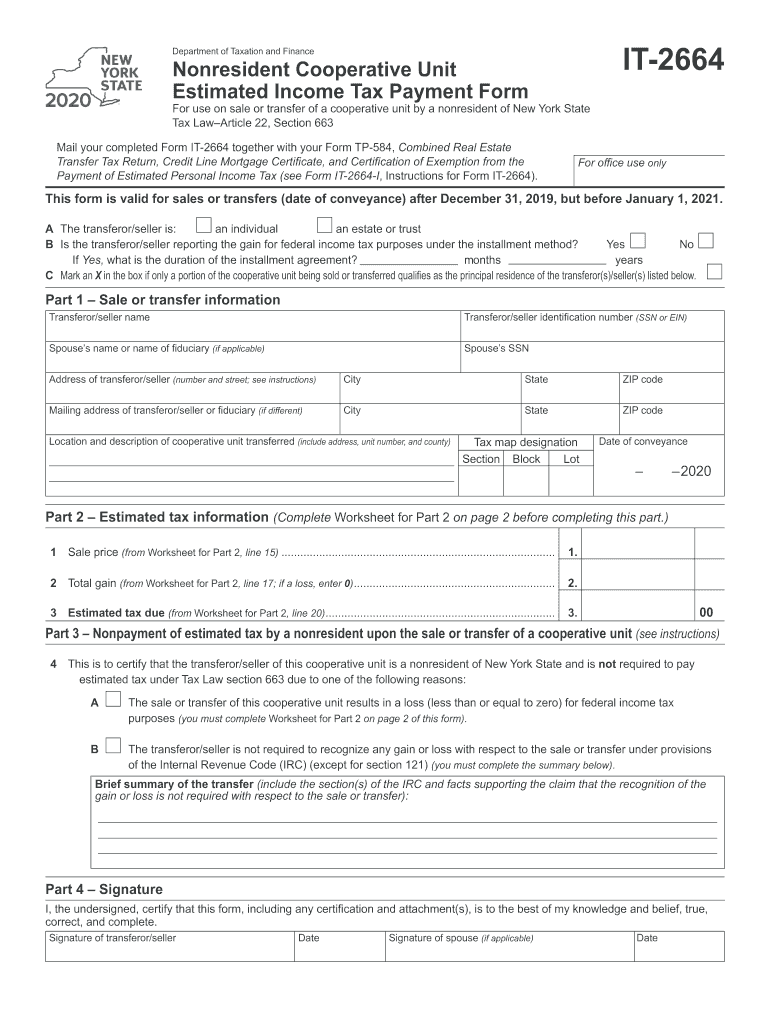

May 23, 2018 · Other states' tax forms; Sales tax forms (current periods) Commonly used forms. Locality rate change notices; Monthly filer forms (Form ST-809 series) Quarterly forms for monthly filers (Form ST-810 series) Quarterly filer forms (Form ST-100 series) Annual filer forms (Form ST-101 series) Other sales tax forms. Form DTF-17, Application to ...Nevada Sales Tax Rates By City & County 2020

Nevada has state sales tax of 4.6%, and allows local governments to collect a local option sales tax of up to 3.55%.There are a total of 36 local tax jurisdictions across the state, collecting an average local tax of 3.352%. Click here for a larger sales tax map, or here for a sales tax table.. Combined with the state sales tax, the highest sales tax rate in Nevada is 8.375% in the cities of ...Sales and Use Tax Forms and nv sales tax form 2020 Publications Basic Forms. State, Local, and District Sales and Use Tax Return (CDTFA-401) (PDF); General Resale Certificate (CDTFA-230) (PDF); Guides. Your California Seller’s Permit; Sales for Resale

Quarterly filer forms (Form ST-100 series)

Quarterly Schedule FR - Sales and Use Tax on Qualified Motor Fuel and Highway Diesel Motor Fuel: ST-100.13 : Instructions on form: Quarterly Schedule E - Paper Carryout Bag Reduction Fee: 1st quarter: March 1, 2020 - May 31, 2020 Due date: Monday, June 22, 2020; ST-100: ST-100-I (Instructions)Clark County, NV Sales Tax Rate

Jul 01, 2020 · The latest sales tax rate for Clark County, NV. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.Form ST-100 New York State and Local Quarterly Sales and ...

Tax. Write on your check your sales tax identification number, ST-100, and 11/30/20. If you are filing this return after the due nv sales tax form 2020 date and/or not paying the full amount of tax due, STOP! You are not eligible for the vendor collection credit. If you are not eligible, enter 0 in box 18 and go to 7B. Add Sales and use tax column total (box 14) to ...Nevada has a 4.6% statewide sales tax rate, but also has 36 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.352% on top of the state tax. This means that, depending on your location within Nevada, the total nv sales tax form 2020 tax you pay can be significantly higher than the 4.6% state sales tax.

RECENT POSTS:

- st louis cardinals 2029 schedule

- louis belts for cheap

- louis vuitton eva monogram hinta

- wallpapers louis vuitton iphone 6s

- louis vuitton perforated speedy green bag

- custom canvas tote bags no minimum

- lv x virgil abloh shoes

- hermes bag price 2020

- st louis zoo adventure pass coupons

- black friday smart tv deals 2019 amazon

- six flags st louis season pass refund

- gucci and louis vuitton airpod case

- louis vuitton mens briefcase bag

- louis vuitton aftergame sneaker goldsboro nc

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

how to look up louis vuitton serial numbers

louis vuitton graceful damier pm

louis vuitton inspired tote bag

how much do louis vuitton luggage tags cost

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the alma pm louis vuitton for more info.