Nevada State Sales Tax 2020

How 2020 Sales taxes are calculated for zip code 89011. The 89011, Henderson, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 89011's county rate (3.775%). Rate variation

See the current motor fuel tax rates for your state as of April 2020. On top of excise taxes many states also apply fees and other taxes including environmental fees, inspection fees, load fees, clean up fees along with LUST taxes, license taxes, and petroleum taxes.

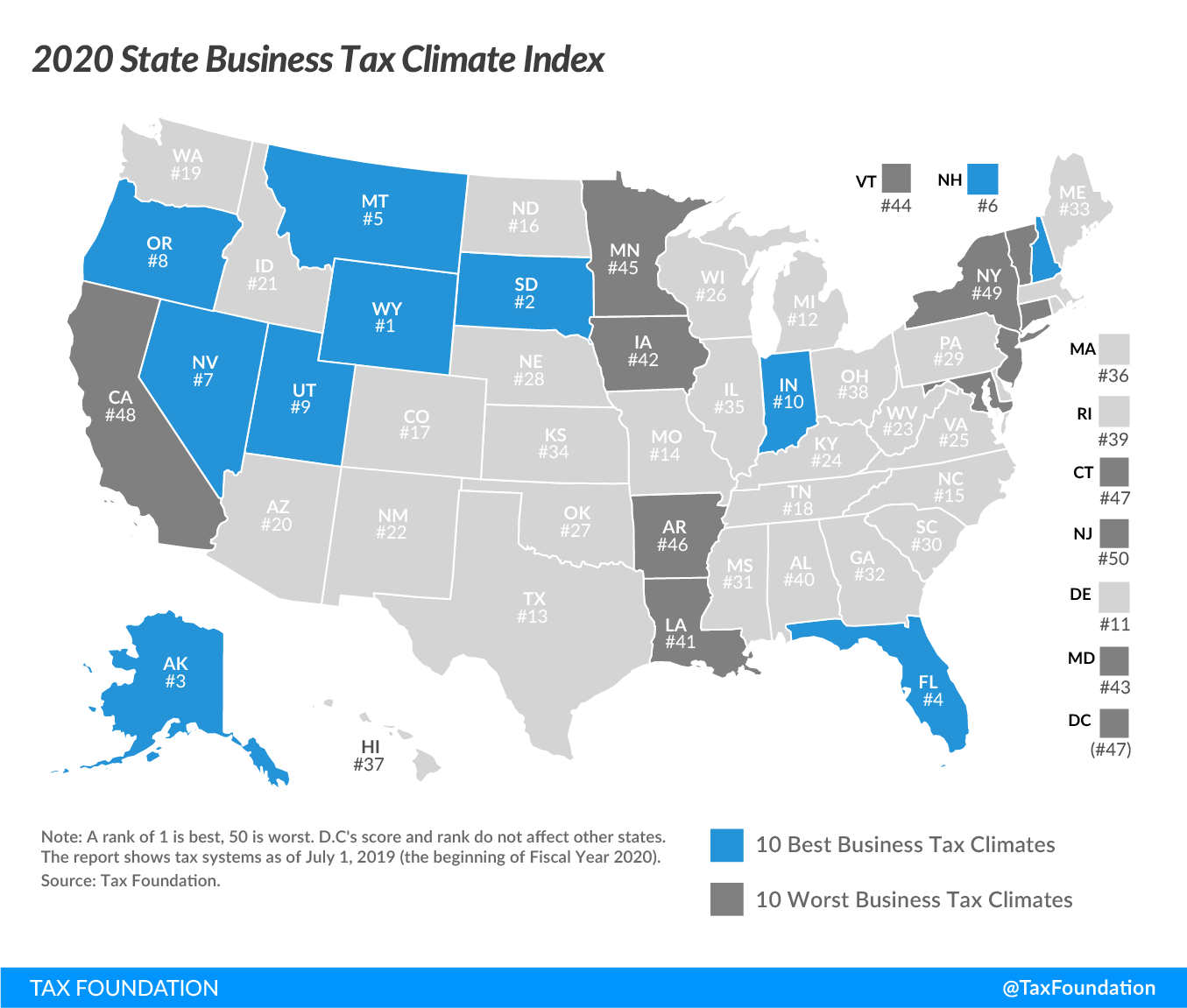

Top 10 Most Tax-Friendly States For Retirement | 2020

Jul 10, 2020 · The average state and local sales taxes are 7.98 percent. It’s in the middle of the pack – 24th in the U.S. – in property taxes. A Nevadan with a home valued at $207,600 would pay $1,749 each year in property taxes. Nevada also has the nevada state sales tax 2020 fifth best taxpayer ranking by WalletHub. #8: New Hampshire. State income tax: None. Average state and ...Apr 10, 2020 · The Tax Cuts and Jobs Act modified the deduction for state and local income, sales and property taxes. If you itemize deductions on Schedule A, your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if …

Nevada Sales Tax Map By County 2020

This interactive sales tax map map of Nevada shows how local sales tax rates vary across Nevada's seventeen counties. Click on any county for detailed sales tax rates, or see a full list of Nevada counties here.. Nevada has state sales tax of 4.6%, and allows local governments to collect a local option sales tax of up to 3.775%.There are a total of 36 local tax jurisdictions across the state ...The Nevada use tax should be paid for items bought tax-free over the internet, bought while traveling, or transported into Nevada from a state with a lower sales tax rate. The Nevada use tax rate is 6.85%, the same as the regular Nevada sales tax. Including local taxes, the Nevada use tax …

Nevada las vegas total sales tax rate???

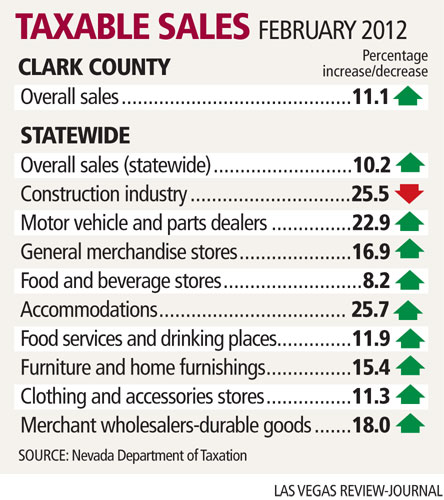

Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax …How 2020 Sales taxes are calculated in Reno. The Reno, Nevada, general sales tax rate is 4.6%.Depending on the zipcode, the sales tax rate of Reno may vary from nevada state sales tax 2020 4.6% to 8.265% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3.665%). There is no city sale tax for Reno.

Nov 01, 2020 · State Sales Tax Rates. The following chart lists the standard state level sales and use tax rates. As of 11/1/2020. ... Since the two county taxes apply to every county in the state, Nevada’s minimum statewide tax rate is considered to be 6.85%. 0% – 1.525% Some local jurisdictions do not impose a sales tax. Yes.

RECENT POSTS:

- louis garneau outlet derby

- louis vuitton delightful mm original price

- borsa besace tuileries louis vuitton

- louis vuitton crown melbourne flag

- louis vuitton in china market price

- pictures of clear louis vuitton purses

- original lv clutches

- gucci outlet bags online

- louis vuitton mini lin lucille pm

- little girl purses on amazon

- louis vuitton men's backpacks

- louis vuitton neverfull dupe amazon

- louis vuitton summer limited edition 2019

- lv pochette kirigami price

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

can you walk inside the st louis archives

dillards coach purses clearance

mens replica louis vutton wallets

airline tickets to st louis from albany ny

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the vuitton wallet mens for more info.