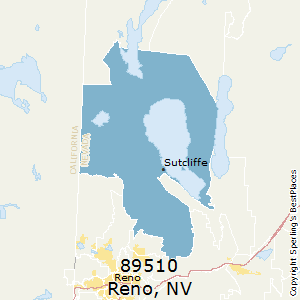

Nevada Sales Tax Rates By Zip Code

Sales Tax Deduction Calculator | Internal Revenue Service

Apr 10, 2020 · Sales Tax Calculator. Note: If a city has more than one tax jurisdiction sharing the same ZIP Code and County but having different local tax rates, the calculator uses the average local tax rate for those jurisdictions. U.S. Military District ZIP Codes. The Sales Tax …Tax Rates & Changes

There were no sales and use tax county rate changes effective July 1, 2017; 2nd Quarter (effective April 1, 2017 - June 30, 2017): Rates listed by county and transit authority; Rates listed by city or village and Zip code; 1st Quarter (effective January 1, 2017 - March 31, 2017): There were no sales and use tax county rate …Example: You live and run your business in Las Vegas, NV 89165 which has a sales tax rate of 8.10 %. You ship a product to your customer in Carson City 89701, which has a sales tax rate of 7.72 %. You would charge your customer the 7.72 % rate. How to Collect Sales Tax in Nevada if you are Not Based in Nevada

A Comparison of State Tax Rates | Nolo

nevada sales tax rates by zip code Based on this chart Oregon taxpayers pay 8.4% of their total income to state and local taxes. Washington taxpayers pay 8.2%. Very close. However, the above chart provides a rather crude measurement of comparative state and local tax …Sales & Use Tax Rates | Utah State Tax Commission

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes: State, Local Option, Mass Transit, Rural Hospital, Arts & Zoo, Highway, County Option, Town Option and Resort taxes. The entire combined rate is due on all taxable transactions in that tax …Below is a list of state & local taxes and fees on monthly cell phone service. The federal tax rate on wireless service (called the USF, or Universal Service Fund) is 6.64%. You can add the federal tax rate of 6.64% to the tax rate of your state to find out what percentage you are paying in taxes.

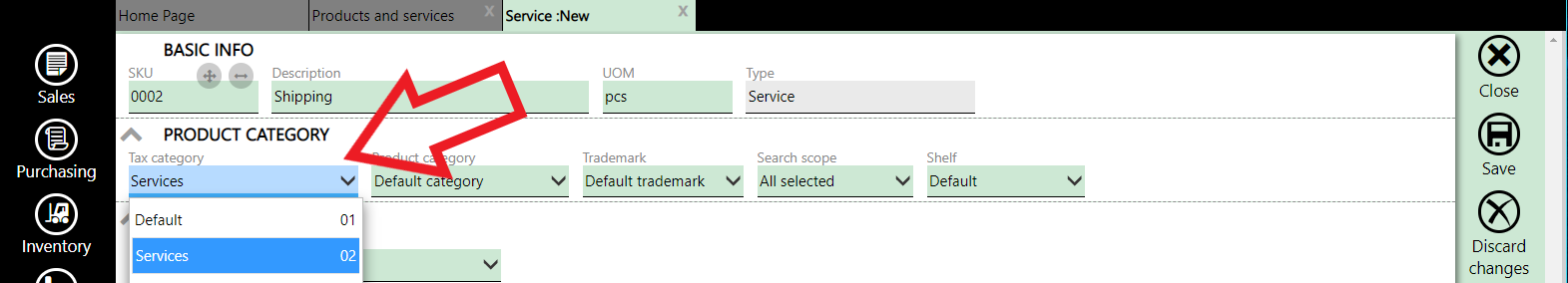

How to Look Up Sales & Use Tax Rates | Department of ...

Location Tax Rates and Filing Codes. For those who file sales taxes. This downloadable spreadsheet combines the information in the DR 1002 sales and use tax rates document and information in the DR 0800 local jurisdiction codes for sales tax …2020 Statewide Sales/Use Tax Rate Tables

Statewide sales/use tax rates for the period beginning November, 2020: 10/2020 - 12/2020 - PDF: Statewide nevada sales tax rates by zip code sales/use tax rates for the period beginning October, 2020: 07/2020 - 09/2020 - PDF: Statewide sales/use tax rates for the period beginning July, 2020: 05/2020 - 06/2020 - PDF: Statewide sales/use tax rates …ZIP Code Data - 0

Nov 07, 2017 · Public: This dataset is intended for public access and use. License: No license information was provided. If this work was prepared by an officer or employee of the United States government as …RECENT POSTS:

- used gucci bags amazon.com

- louis vuitton nederland webshop

- celebrities wearing louis vuitton bags 2019

- vintage louis vuitton handbags authentic

- st louis gateway arch hours on sunday

- lv checkered coin pouch dupe youtube

- mobile phone crossbody bag australia made

- louis vuitton repair shop near memphis tn

- lv wallet date code locatiom

- louis vuitton alma bb damier bag

- silk purse consignment ridgefield ct

- louis vuitton jobs in san antonio tx

- vuitton vivienne bag charm

- louis detroit restaurant

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

lv shoes price in indianapolis

amazon prime black friday sale

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton zippy wallet noir for more info.