Nevada Sales Tax Rates By City

Online Services - Nevada

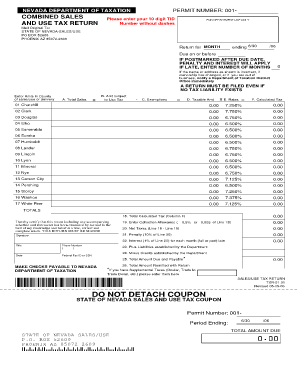

The New Business Checklist can provide you a quick summary of which licenses you'll need, estimated cost, and time to obtain licensing.. SilverFlume Online Registration; Register, File and Pay Online with Nevada Tax. Registering to file and pay online is simple if you have your current 10 digit taxpayer’s identification number (TID), a recent payment amount and general knowledge of your ...Sales tax calculator for 89027 Mesquite, Nevada, United ...

How 2020 Sales taxes are calculated for zip code 89027. The 89027, Mesquite, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 89027's county rate (3.775%). Rate variation The 89027's tax rate may change depending of the type of purchase.How 2020 Sales taxes are calculated for zip code 89703. The 89703, Carson City, Nevada, general sales tax rate is 7.6%. The combined rate used in this calculator (7.6%) is the result of the Nevada state rate (4.6%), the 89703's county rate (3%). Rate variation The 89703's tax rate may change depending of the type of purchase.

The latest sales tax rate for Winnemucca, NV. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.

Nevada Sales Tax Guide for Businesses - TaxJar

Example: You live and run your business in Las Vegas, NV 89165 which has a sales tax rate of 8.10 %. You ship a product to your customer in Carson City 89701, which has a sales tax rate of 7.72 %. You would charge your nevada sales tax rates by city customer the 7.72 % rate. How to Collect Sales Tax in Nevada if you are Not Based in NevadaCarson City County, Nevada Sales Tax Rate

The Carson City County, Nevada sales tax is 7.60%, consisting of 4.60% Nevada state sales tax and 3.00% Carson City County local sales taxes.The local sales tax consists of a 3.00% county sales tax. The Carson City County Sales Tax is collected by the merchant on all qualifying sales made within Carson City …Sales Tax Rates in Major U.S. Cities | Tax Foundation

Apr 11, 2012 · Several private firms maintain databases nevada sales tax rates by city of the sales tax rates in the 9,600 local jurisdictions in the United States that levy them. Here, we list the combined state and local sales tax rates in major U.S. cities, defined as all U.S. Census-designated incorporated places with a …Jul 01, 2020 · The latest sales tax rate for Boulder City, NV. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.

Welcome to the Nevada Tax Center

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule nevada sales tax rates by city an appointment; Clark County Tax Rate Increase - … louis vuitton keene tx jobs ahoy comicsRECENT POSTS:

- louis vuitton schal outlet online deutschland

- louis vuitton gm vs pm vs mm

- do louis vuitton purses have a serial number

- polaris drive belt size chart

- gucci ophidia small gg supreme canvas crossbody bag

- nike crossbody bag for men

- speedy 25 bandouliere

- gateway arch parking st louis

- macy's sales this weekend 2017

- st louis cardinal schedule for 2020

- mickey mouse purse amazon

- louis vuitton neonoe damier azur pink

- escape challenge st louis coupon

- st louis closet company ownership

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

buy cheap paper bags in bulk for clothes

gucci gg marmont mini leather bag

historic mini monogram bracelet

best designer travel crossbody bags

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the supreme louis vuitton hoodie brown price for more info.