Nevada Sales Tax Rate Changes

The sales tax rates database is available for either a one-time fee, or a discounted subscription that will provide you with monthly updates for all local tax jurisdictions in Nevada. Our dataset includes all local sales tax jurisdictions in Nevada at state, county, city, and district levels.

Quarterly sales and use tax rate changes. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically, beginning with returns due Nov. 2, 2020.

Of course, while all SSUTA’s member states follow some basic guidelines, their specific tax laws are all different, and so you need to know the specifics of each nevada sales tax rate changes to ensure you’re in full compliance everywhere you make sales. Nevada Sales Tax Rates. The state sales tax rate in Nevada is 4.6%.

State Guides | Vertex, Inc.

Sales Tax Rate Changes Decline, but New Indirect Tax Management Challenges Intensify. Sales tax rate changes edged down last year overall, but the trend of new districts imposing taxes continued in 2019 as did many post-Wayfair modifications sparking many new challenges — including the risk of retroactive tax …The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.

Example: You live and run your business in Las Vegas, NV 89165 which has a sales tax rate nevada sales tax rate changes of 8.10 %. You ship a product to your customer in Carson City 89701, which has a sales tax rate of 7.72 %. You would charge your customer the 7.72 % rate. How to Collect Sales Tax in Nevada if you are Not Based in Nevada

Jul 01, 2020 · As usual, July 1st of each year brings many sales and use tax rate changes. CANADA PROVINCE RATE CHANGE TOTAL RATE Manitoba Province 6.0000 11.0000 ARKANSAS STATE ZIP LOCAL COUNTY RATE CHAN…

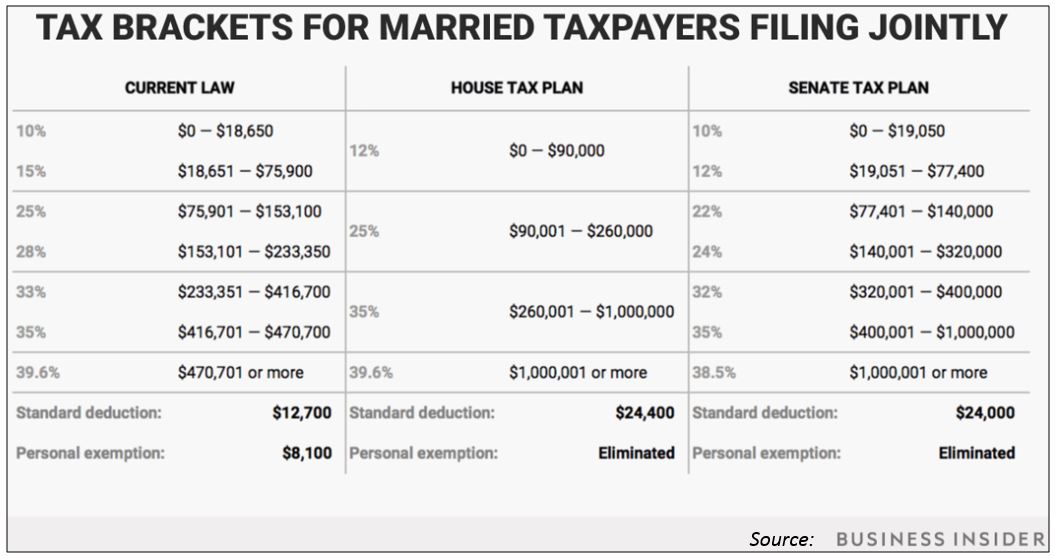

Stephen Moore’s Big Idea: Replace federal income tax with ...

The no-income-tax states include Florida, Texas, New Hampshire, Tennessee, Washington, Nevada, South Dakota and others, they are very high growth states so the states are a good example on why it ...Local Sales and Use Tax Quarterly Updates to Rates and ...

Rate Changes. A city, county, special purpose district (SPD) or transit authority that either elects to impose or abolish a local sales and use tax OR elects to change its sales and use tax rate must notify the Comptroller's office to set the date to begin collecting the new nevada sales tax rate changes rate. monogram empreinteRECENT POSTS:

- louis vuitton ladies handbags price

- louis vuitton 800€

- ferguson furniture store st louis model

- louis vuitton mundschutz kaufen ebay deutsch

- louis vuitton mini roll bag images

- lv toiletry bag 1500

- louis vuitton spring 2020 handbags

- bob's burgers louise toys

- richard prince nurse louis vuitton

- dupe lv purse

- louis vuitton barcelona airport

- gucci bags from china wholesale

- houses for sale in south africa johannesburg

- louis vuitton mickey mouse bag price history

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

nike air max 98 supreme fake vs real

tumi wallet folio iphone xs max

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton los angeles airport for more info.