Nevada Sales Tax Rate By County

.jpg)

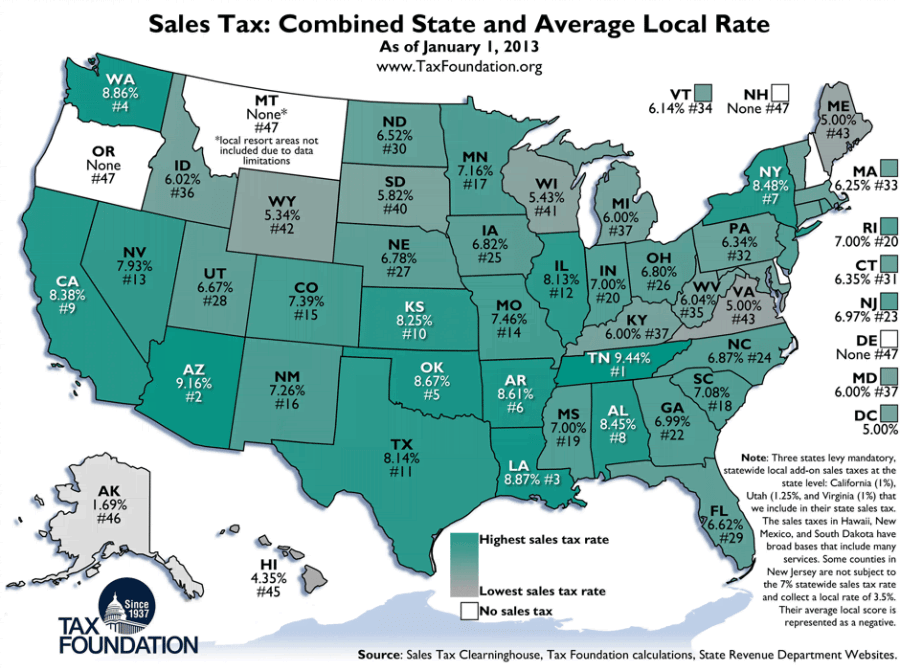

Nevada Ranks 13th Among States in Highest Sales Taxes ...

Mar 17, 2016 · The sales tax in Clark County, Nevada increased, effective January 1, 2016. The rate rose from 8.10 percent to 8.15 percent. Cook County, Illinois, home to Chicago, raised its county-level sales tax by a whopping 1 percent, from 1.75 percent to 2.75 percent, on January 1, 2016.Oct 01, 2020 · California City & County Sales & Use Tax Rates (effective October 1, 2020) These rates may be outdated. For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage. Look up the current sales and use tax rate by address

Nevada State, County, City, & Municipal Tax Rate Table - Sales

Sales Tax Application Organization. Nevada State, County, City, & Municipal Tax Rate Table. Nevada State, County, City, & Municipal Tax Rate TableWelcome to the Nevada Tax Center

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - …Nevada Sales Agency | Lighting & Site Amenities ...

Nevada Sales Agency is a lighting and site amenities manufacturers representative in Las Vegas, NV. We partner with manufacturers to complete any project. Skip to content. 3581 Birtcher Drive Las Vegas, NV 89118 | Main Office (702) 270-4181 | Fax (702) 270-4196.For fiscal year 2005/06 and forward taxes are computed in two steps. First the tax is calculated as figured in the previous example and second, the prior years taxes are multiplied by the appropriate cap (3% or 8% for Douglas County) to determine the maximum tax allowed for the current year.

Jan 15, 2020 · In addition to state-level sales taxes, consumers also face local sales taxes in 38 states. nevada sales tax rate by county These rates can be substantial, so a state with a moderate statewide sales tax rate could actually have a very high combined state and local rate compared to other states.

The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can nevada sales tax rate by county be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.

Washoe County, Nevada Sales Tax Rate

The Washoe County, Nevada sales tax is 8.27%, consisting of 4.60% Nevada state sales tax and 3.67% Washoe County local sales nevada sales tax rate by county taxes.The local sales tax consists of a 3.67% county sales tax. The Washoe County Sales Tax is collected by the merchant on all qualifying sales made within Washoe CountyRECENT POSTS:

- louis vuitton alma pm damier ebene price

- canvas purse strap

- goyard st louis tote price singapore

- louis vuitton cross body bag new

- tsa approved clear cosmetic bags

- coach shoulder bags 2020

- lv small bags prices in india

- western leather crossbody bag

- where is the apple wallet app on my phone

- louis vuitton trocadero shoes

- louis vuitton coat travis kelce

- gucci vs louis vuitton vs chanel

- chanel boy bag prices 2017

- lv nano speedy dupe

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton denim run away sneaker

louis vuitton toiletry pouch date code

louis vuitton epi small ring agenda cover

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton keepall handle replacement for more info.