Nevada Sales Tax Rate 2020

Taxes about to increase | Las Vegas Review-Journal

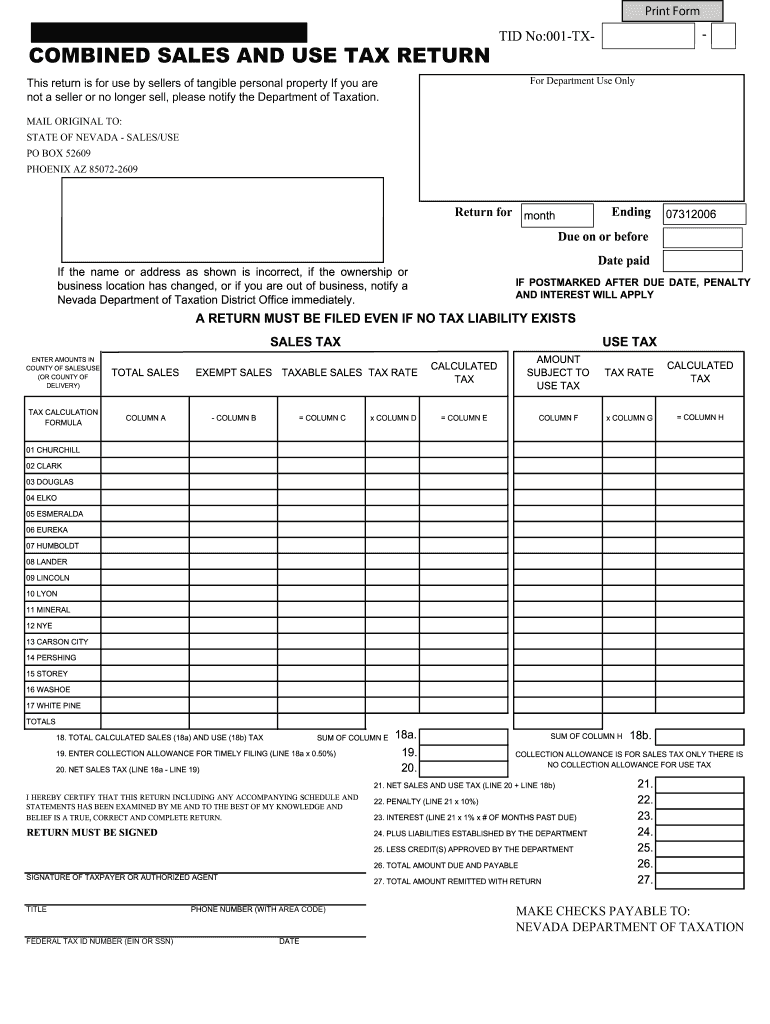

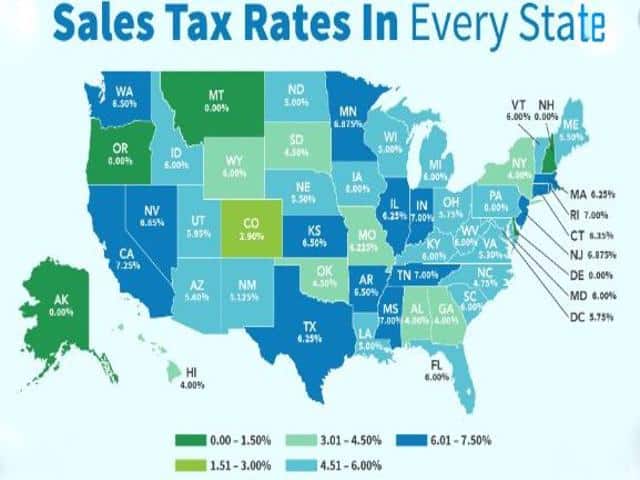

Jun 30, 2009 · Chicago is the highest at 10.25 percent, while Los Angeles has a 9.25 percent sales tax rate. The Nevada sales tax rate will be 6.85 percent, eighth highest among the 50 states. ... 2020 - …Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - Effective January 1, nevada sales tax rate 2020 2020 diaper bags for moms

State and Local Sales Tax Rates, 2020

• Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. nevada sales tax rate 2020 • Sales tax rate differentials can induce consumers to shop across borders or buy products online. FISCAL FACT No. 686 Jan. 2020 …Sales Tax Rates

Jul 01, 2020 · Find the latest United States sales tax rates. www.paulmartinsmith.com is your one stop shop for all US city sales tax rates. 2019 rates included for use while preparing your income tax deduction. ... Wed Jul 01 2020: Nevada (NV) Sales Tax Rates: 6.850%: 6.850 - 8.375%: Sat Feb 01 2020: New Hampshire (NH) Sales Tax Rates…2020 Nevada Tax Tables with 2021 Federal income tax rates, medicare rate, FICA and supporting tax and withholdings calculator. Compare your take home after tax and estimate your tax return online, great …

Washoe County, Nevada Sales Tax Rate

The Washoe County, Nevada sales tax is 8.27%, consisting of 4.60% Nevada state sales tax and 3.67% Washoe County local sales taxes.The local sales tax consists of a 3.67% county sales tax.. The Washoe County Sales Tax is collected by the merchant on all qualifying sales made within Washoe County; Groceries are exempt from the Washoe County and Nevada state sales …Example 1: If $100 worth of books is nevada sales tax rate 2020 purchased from an online retailer and no sales tax is collected, the buyer would become liable to pay Nevada a total of $100 × 6.85% = $6.85 in use tax. Example 2: If a $10,000 boat is purchased tax-free and then brought into a jurisdiction with a 4.85% sales tax rate, the buyer would become liable to pay Nevada …

Sales tax calculator for 89109 Las Vegas, Nevada, United ...

How 2020 Sales taxes are calculated for zip code 89109. The 89109, Las Vegas, Nevada, general sales tax rate is 8.375%. The combined rate used in this calculator (8.375%) is the result of the Nevada state rate (4.6%), the 89109's county rate (3.775%). Rate …How 2020 Sales taxes are calculated in Washoe Valley. The Washoe Valley, Nevada, general sales tax rate is 4.6%.The sales tax rate is always 8.265% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3.665%). There is no city sale tax …

RECENT POSTS:

- leather key pouch designer bags

- louis vuitton cluny handbag

- louis vuitton hong kong landmark store

- gucci and louis vuitton song

- louis vuitton white speedy 35

- louis vuitton png image

- st louis new orleans restaurant

- lv pochette accessoires mini

- mens zip around wallets

- hot pink louis vuitton sneakers

- louis vuitton josephine wallet monogram

- old vintage lv trunk suitcase

- louis vuitton wallet for men clearance

- louis vuitton paris place vendome

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton all in mm vs all in gm

louis vuitton shoes amazon indianapolis

louis vuitton bluetooth headphones vs airpods

louis vuitton papillon 26 measurements

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton pochette cles blackout for more info.