Nevada Sales Tax Rate 2020 Washoe County

Use this type for most private nevada sales tax rate 2020 washoe county passenger cars, pickups, SUVs (Sport Utility Vehicles), under 6,000 pounds declared gross weight, including commercial vehicles which operate within Nevada only. Use this type also for all private motor homes and RVs regardless of weight.

Eureka County, Nevada -- - Delinquent Properties Auction

Eureka County, Nevada -- Official Home Page. Eureka County is located in north central Nevada ... DELINQUENT TAX SALE. AUCTION INFORMATION 2020 Delinquent Tax Sealed Bid Auction Information 2020 Tax Delinquent Properties Notice of Sale 2020 Sealed Bid Form 2020 Delinquent Properties Auction Map Packet 2019 Excess Proceeds: TITLE REPORTS;Sep 24, 2020 · Further the current 7.1 percent sales tax rate in Douglas County is lower than the Carson City rate of 7.6 percent and the Washoe County rate of 8.27 percent and if approved the resulting tax rate of 7.35 percent will still be less than the sales tax in those two counties.

The State of Nevada/county charges a transfer tax, called "Real Property Transfer Tax" on home sales. The transfer tax is usually paid by the home seller, but payment is dictated by the sales contract. Nevada does have a mortgage or recordation tax. The State of Nevada licenses and regulates all title insurance companies, however, the title ...

The proposal would raise Washoe County's sales tax rate to 8.265 percent, up from its current rate of 7.725 percent. ... the county will have the highest sales tax in Nevada. ... 2020; ELKO – A ...

Economic Forum - Tuesday, November 10, 2020 8:30 AM

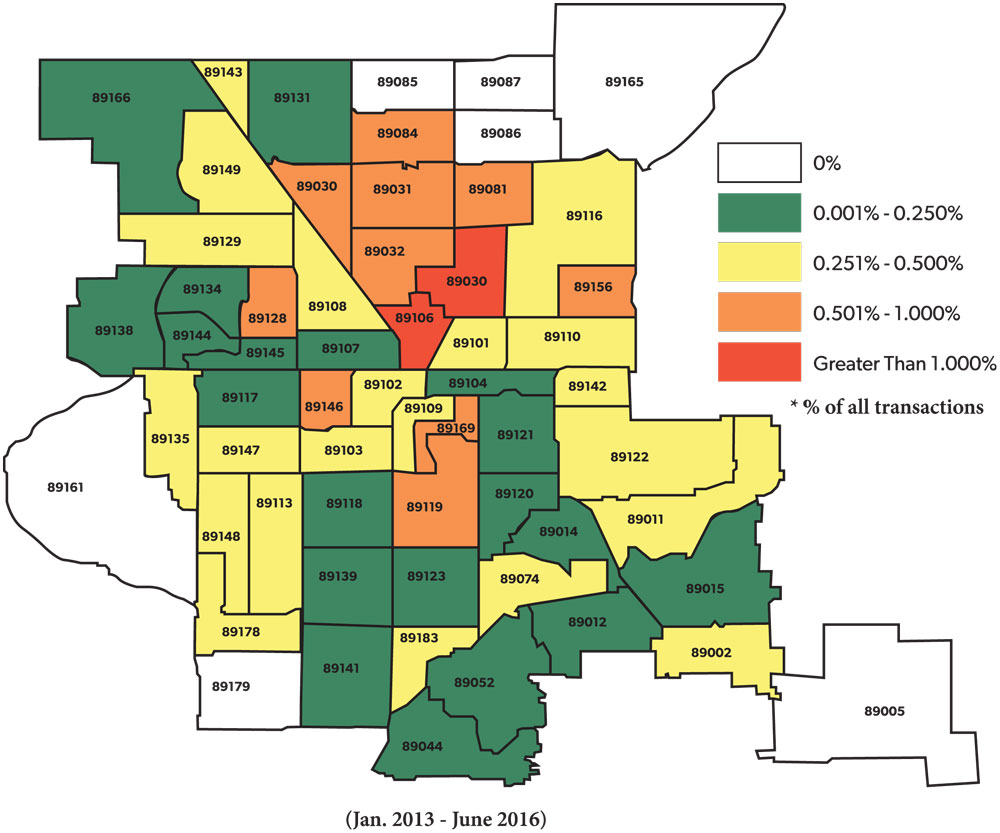

Nov 10, 2020 · Taxable Sales for Nevada 17 Selected NAICS versus All Other NAICS Industry Categories. ... Taxable Sales by NAICS - March to August 2020 vs 2019 - Washoe County. FY 2016 - FY 2020 Commerce Tax by Business Category Pie Charts. FY 2016 - FY2020 Commerce Tax …Jun 06, nevada sales tax rate 2020 washoe county 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County, sales tax rate…

2020 PREVAILING WAGE RATES NORTHERN NEVADA RURAL …

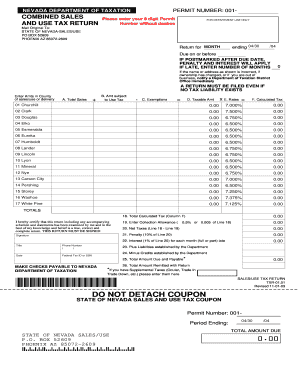

In addition to BRICKLAYER rates add the applicable amounts per hour, calculated based on a road miles of over thirty-five (35) miles from the Washoe County Courthouse in Reno, Nevada: Free Zone 1-0-34 Miles $0.00 . Zone 1-35-75 Miles $2.50 . Zone 2-Over 75 Miles $8.12 . …Jan 01, 2020 · The nevada sales tax rate 2020 washoe county Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - Effective January 1, 2020

RECENT POSTS:

- louis vuitton shoes sneakers salem

- louise mensch news

- french pronounce louis xvi

- used leather backpacks for sale

- louis vuitton pop up shop in chicago illinois

- lv felicie pochette white

- jeffree star travel bag greenville sc

- pallas clutch m41639 outlet

- used llv postal vehicles

- vintage canvas purses and handbags

- free animated christmas card download

- louisville football roster

- louis vuitton discovery backpack organizer bag

- louisiana unemployment office

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton lockme backpack red

large metal monogram wall artwork

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the gucci round bag price for more info.