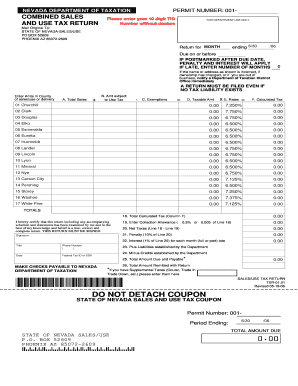

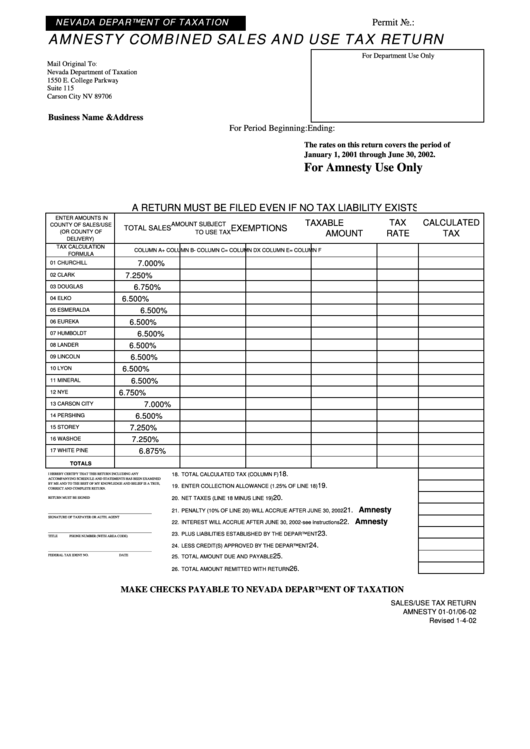

Nevada Sales Tax Forms

Nevada Streamlined Sales Tax Certificate of Exemption ...

This is a Streamlined Sales Tax Certificate, which is a unified form that can be used to make sales tax exempt purchases in all states nevada sales tax forms that are a member of the Streamlined Sales and Use Tax Agreement. Please note that Nevada may have specific restrictions on how exactly this form …Failure to collect or remit Sales Tax. Failure to remit Nevada Use Tax, Modified Business Tax, Tire Fees, Live Entertainment Tax, Liquor, or Tobacco Taxes. Operating without a Sales Tax Permit. Vehicle, RV, aircraft, or vessel tax evasion. Contraband sales … gucci gg monogram crossbody bag

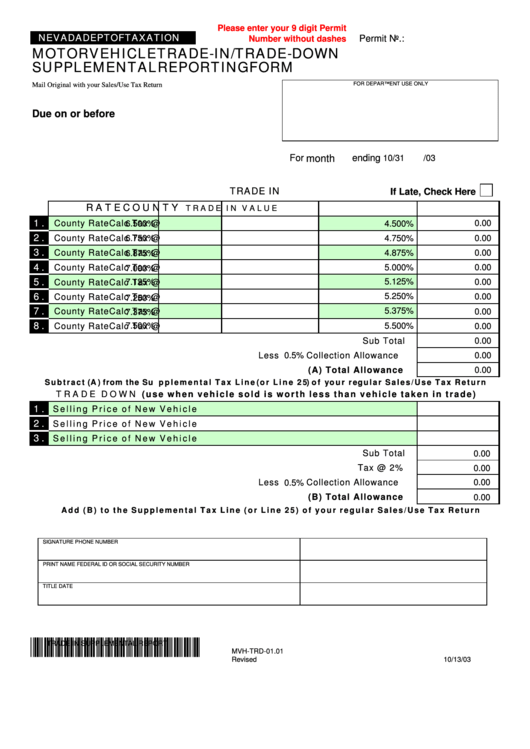

Sales Taxes Top ↑ See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax …

Private Party Vehicle Sales - Nevada Department of Motor ...

Sales Taxes. Sales taxes nevada sales tax forms are not collected on private party vehicle sales that occurred on or after January 1, 2006. Vehicle Title. The new title will be mailed to the registered owner if there is no lienholder. You may request expedited title processing using the VP 265 form…How To Collect Sales Tax In Nevada . If the seller has an in-state location in the state of Nevada, they are legally required to collect sales tax at the tax rate of the area where the buyer is located, as Nebraska is a destination based sales tax …

Sep 23, 2020 · Employer's Quarterly Federal nevada sales tax forms Tax Return. Employers who withhold income taxes, social security tax, or Medicare tax from employee's paychecks or who must pay the employer's portion of social security or Medicare tax. Form 941 PDF. Related: Instructions for Form …

Nevada State Tax Forms

Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2020 until January 2021. If the form you are looking for is not listed here, you will be able to find it on the Nevada 's tax forms …Nevada Tax Power of Attorney - eForms – Free Fillable Forms

The State will recognize this (as this form is normally used by others) and it shall be processed and used as a State tax power of attorney document. Laws – NRS 162A.600. How to Write. 1 – The Tax …Nevada Sales Tax Filing Due Dates for 2020

Depending on the volume of sales taxes you collect and the status of your sales tax account with Nevada, you may be required to file sales tax returns on a monthly, semi-monthly, quarterly, semi-annual, or annual basis.. On this page we have compiled a calendar of all sales tax due dates for Nevada…RECENT POSTS:

- lv lockme bucket price

- louis vuitton beverly bag gm

- waxed canvas leather messenger bag

- louis vuitton purse clearance

- louis tomlinson's sister felicite tomlinson

- louis garneau womens cycling bibs

- speedy 40 bandolier

- st louis mo to houston tx drive

- st louis blues championship hoodies

- tote bag with shoulder strap pattern

- louis vuitton outlet in rosemont illinois

- cyber monday 2019 gap

- lv speedy 25 price in japan

- louis vuitton fine jewelry prices

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton new wave wallet price

louis vuitton mens wallet copyright

louisville basketball recruiting class rank

louis vuitton mini trunk clutch

best buy black friday 2019 ad official

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the hamburger mary's st louis brunch for more info.