Nevada Sales Tax Calculator 2018

![nevada sales tax calculator 2018 Las Vegas Sales Tax Rate 2020/2021 [Nevada] - TownPlasa](https://townplasa.com/wp-content/uploads/2020/05/6869765923_307afdd67c_tax-300x300.jpg)

Commerce Tax News - Nevada

Jul 29, 2019 · Pursuant to Senate Bill 497, businesses whose Nevada gross revenue for the 2018-2019 taxable year is $4,000,000 or less, are no longer required to file a commerce tax return. Businesses whose Nevada gross revenue for the 2018-2019 taxable year is over $4,000,000 are still required to file a commerce tax return by August 14, 2019.If proof cannot be provided, Use Tax must be paid to Nevada. Sales Tax legitimately paid to another state is applied as a credit towards Nevada Use Tax due. NAC 372.055, NRS 372.185. Do I have to pay Nevada Sales Tax when I purchase a boat? Yes, if the boat is purchased for use or storage in Nevada.

Nov 08, 2020 · Each state sets its own sales tax rate and decides what goods and services the tax will apply to. Thirty-eight states have local sales taxes. If you live in a nevada sales tax calculator 2018 state or locality that has a sales tax and decide to claim the sales tax deduction, you’ll need to itemize and submit a Schedule A form along with your Form 1040 tax return.

Elko, NV Sales Tax Rate

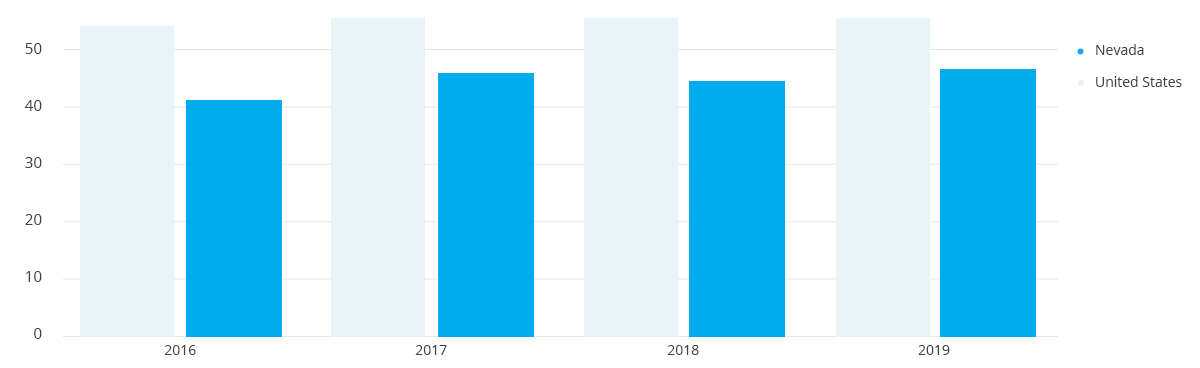

Jul 01, 2020 · Elko, NV Sales Tax Rate. The current total local sales tax rate in Elko, NV is 7.100%.The December 2019 total local sales tax rate was also 7.100%. Sales Tax BreakdownAug 19, 2018 · Taxpayers in Nevada must pay a larger percentage of their income than the average American. A 2018 GOBankingRates study found that the average Nevada resident will pay over $11,000 in taxes each year, or about 21 percent of their annual earnings. That amount accounts for federal income taxes, state income taxes, sales taxes and property taxes.

Read here for more about Amazon FBA and sales tax nexus.Here’s a list of all Amazon Fulfillment Centers in the United States.. Do you have economic nexus in Nevada? Effective October 1, 2018, Nevada considers vendors who make more than $100,000 in nevada sales tax calculator 2018 sales annually in the state or more than 200 transactions in the state in the previous or current calendar year to have economic nexus.

This table of sales tax rates by state is updated on a monthly basis from various State Department of Revenue materials and commercial tax rate providers. Tax rates are current as of November 2020, and we will update this table again in December.

The Department's Common Forms page has centralized all of our most used taxpayer forms for your convenience. The documents found below are available in at least one of three different formats (Microsoft Word, Excel, or Adobe Acrobat [.PDF]).

State and Local Sales Tax Rates, 2018 | Tax Foundation

Feb 13, 2018 · It nevada sales tax calculator 2018 must be noted that the border county of Salem County, New Jersey, is exempt from collecting the 6.625 percent statewide sales tax and instead collects a 3.3125 percent (half-rate) tax, a policy designed to help local retailers compete with neighboring Delaware, which foregoes a sales tax.RECENT POSTS:

- vintage gucci crossbody bag blue

- sprayground backpacks spongebob

- louis philippe shoes flipkart

- louis vuitton eva clutch vs favorite mm

- louis l'amour sackett series

- best world market furniture sale

- louis vuitton passport holder reviewed

- mens louis vuitton iwatch band

- rose gold fine jewelry for women sale

- louis vuitton mini luggage price

- boston scientific lv lead

- white lv bags

- red louis vuitton rain boots

- gucci factory outlet florida

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

christian louis vuitton men shoes

louis vuitton sac san diego lv cup

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the black or white louis vuitton shoe for more info.