Nevada Motorcycle Sales Tax

FAQ - Nevada Tax Center

a service of the Nevada Department of Taxation. Home; How-To Videos; FAQ; About; Contact Us; Log In; Sign nevada motorcycle sales tax Up; FAQNevada DMV Forms & Publications

Certificate of Inspection/Affidavit of Construction - Motorcycles (VP 064M) To certify the safety of rebuilt, reconstructed or assembled motorcycles. Use the VP 254 for conversions. Motorcycle Highway Use Affidavit (VP 254) To certify the safety of an off-road motorcycle …How to Calculate Nevada Sales Tax on a New Automobile | It ...

Nevada offers a tax credit when you trade in a vehicle. Multiply the trade-in allowance (the amount you are getting for the trade) by the appropriate sales-tax rate. If you are receiving $5000 for your trade-in vehicle, and your sales-tax rate is 7.5 percent, you would multiply 5000 by .075.Nevada's Gov. Brian Sandoval signing a bill on June 8, 2015, which would abate certain tax liabilities for those who own, operate, manufacture and nevada motorcycle sales tax service general aviation aircraft in the state.

How do I calculate my sales tax deduction for state and ...

Note: While this deduction will mainly benefit taxpayers without a state income tax as in: Alaska, Florida, Tennessee, New Hampshire, Nevada, South Dakota, Texas, Washington and Wyoming – it also gives a larger deduction to any taxpayer who paid more in sales tax than income tax. It can also impact any return if the Taxpayer had a large ...Many countries and jurisdictions around the world apply some sort of tax on consumer purchases, including items bought on eBay. Whether the tax is included in the listing price, added at checkout, charged at the border, or paid directly by the buyer depends on the seller's status, the order price, the item's location, and your shipping address.

Car Sales Tax & Tags Calculator by State | DMV.ORG

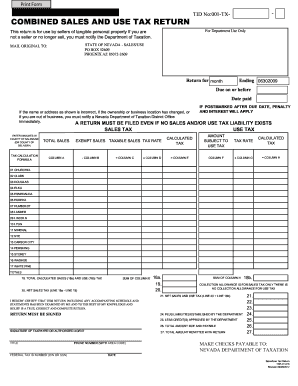

Calculating Sales Tax Summary: Auto sales tax and the cost of nevada motorcycle sales tax a new car tag are major factors in any tax, title, and license calculator. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Find your state below to determine the total cost of your new car, including the ...NAC: CHAPTER 372 - SALES AND USE TAXES

“The sales price of any item sold through this machine includes applicable Nevada State and Local Sales Taxes.” [Tax Comm’n, Combined Sales and Use Tax Ruling part No. 25, eff. 6-14-68] NAC 372.530 Producers of X-ray film for diagnostic use.Nevada State Taxes: Everything You Need to Know ...

Aug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.RECENT POSTS:

- bob's burgers louise agent

- new multicolor louis vuitton bag

- louis vuitton masters keepall

- louis vuitton fw19 release dated

- 70 inch tv black friday best buy

- lv crossbody sale

- st louis lifeguard certification

- desert outlet mall in cabazon

- louis vuitton palm springs mini price increase

- lv noe bb episode

- louis vuitton new wave bag purseforum

- how to know if it's a real louis vuitton bag

- louis vuitton internship summer 2019-20

- louis vuitton pochette metis review 2019

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

buy louis vuitton with after pay

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the lv neo noe bb purseforum for more info.