Nevada Mo Sales Tax Rate

If I Buy A Car In Another State Where Do I Pay Sales Tax?

Jan 06, 2020 · As of 2019, New York has a car tax rate of 4 percent plus local taxes, whereas Pennsylvania has a state car tax rate of 6 percent, with some local rates much higher. What About Special Circumstances? Because U.S. state tax …Below is a list of state & local taxes and nevada mo sales tax rate fees on monthly cell phone service. The federal tax rate on wireless service (called the USF, or Universal Service Fund) is 6.64%. You can add the federal tax rate of 6.64% to the tax rate …

Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address. * indicates required field. Street Address. City. Zip Code. Transaction Date ... www.waterandnature.org State of Missouri…

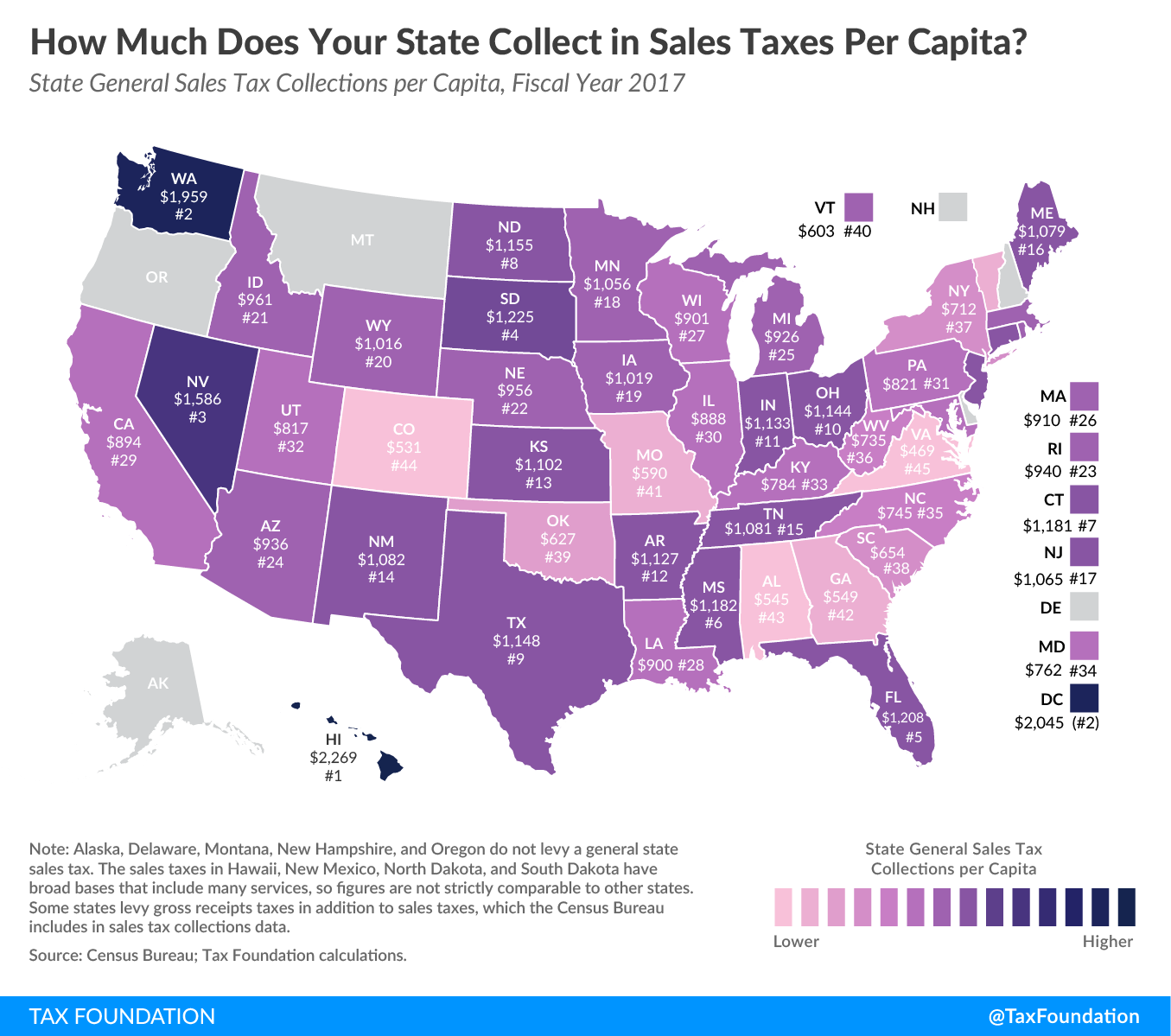

Mar 10, 2020 · Sales & Excise Tax: We used the percentage of income (middle income rate) spent on sales and excise taxes from WalletHub’s Best States to Be Rich or Poor from a Tax Perspective report. …

Want more bite-sized sales tax videos like this? Join our Sales Tax for eCommerce Sellers Facebook Group or check out TaxJar’s Sales Tax YouTube Channel. Illinois – SaaS is considered a non-taxable …

Should I Charge My Customers Out-of-State Sales Tax?

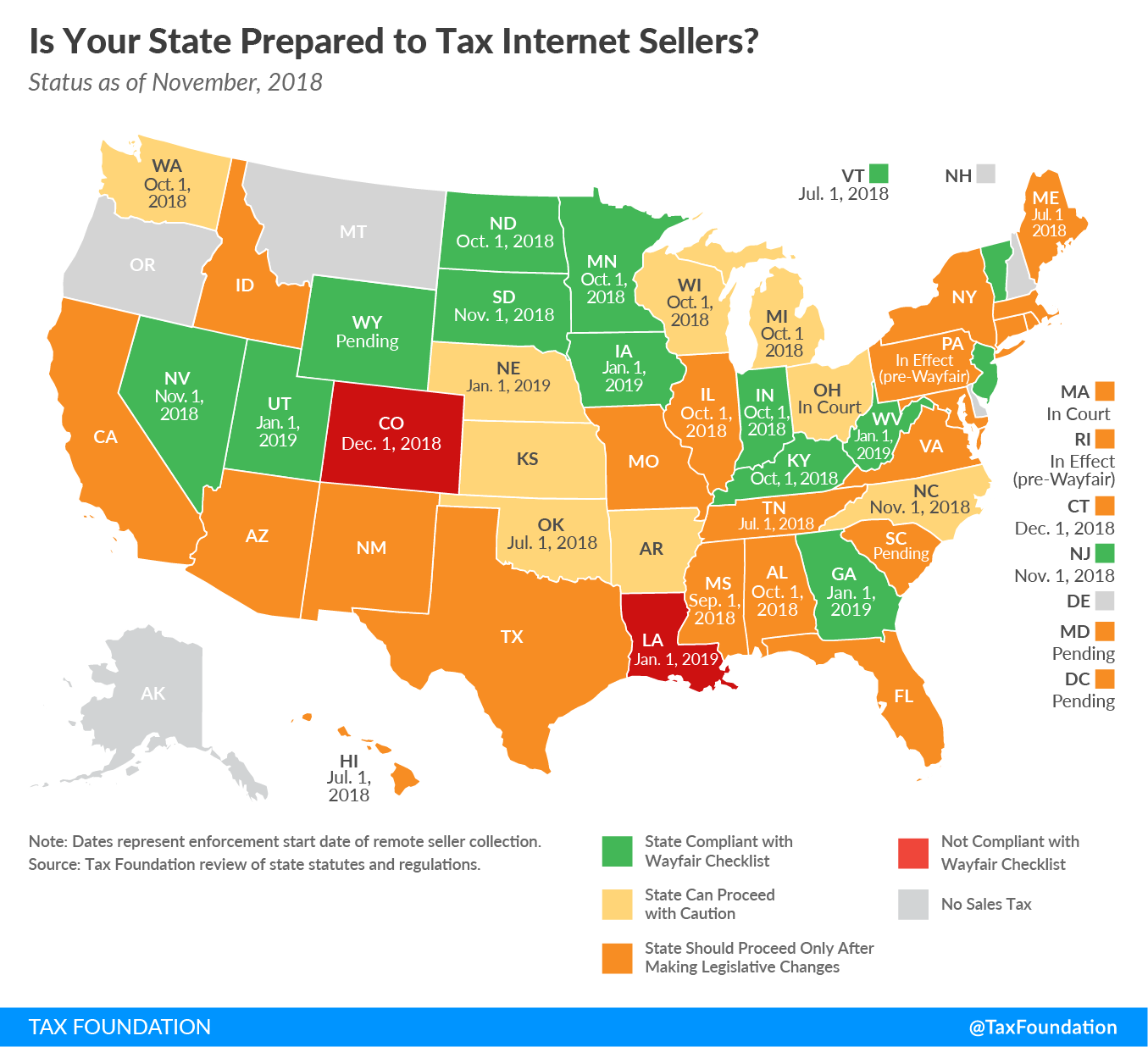

Feb 20, 2020 · Whether you must charge your customers out-of-state sales taxes comes down to whether you're operating in an origin-based nevada mo sales tax rate state or a destination-based tax state. The process of determining which tax rates must be applied to individual purchases is called "sales tax …The Pilot's Guide to Taxes - AOPA

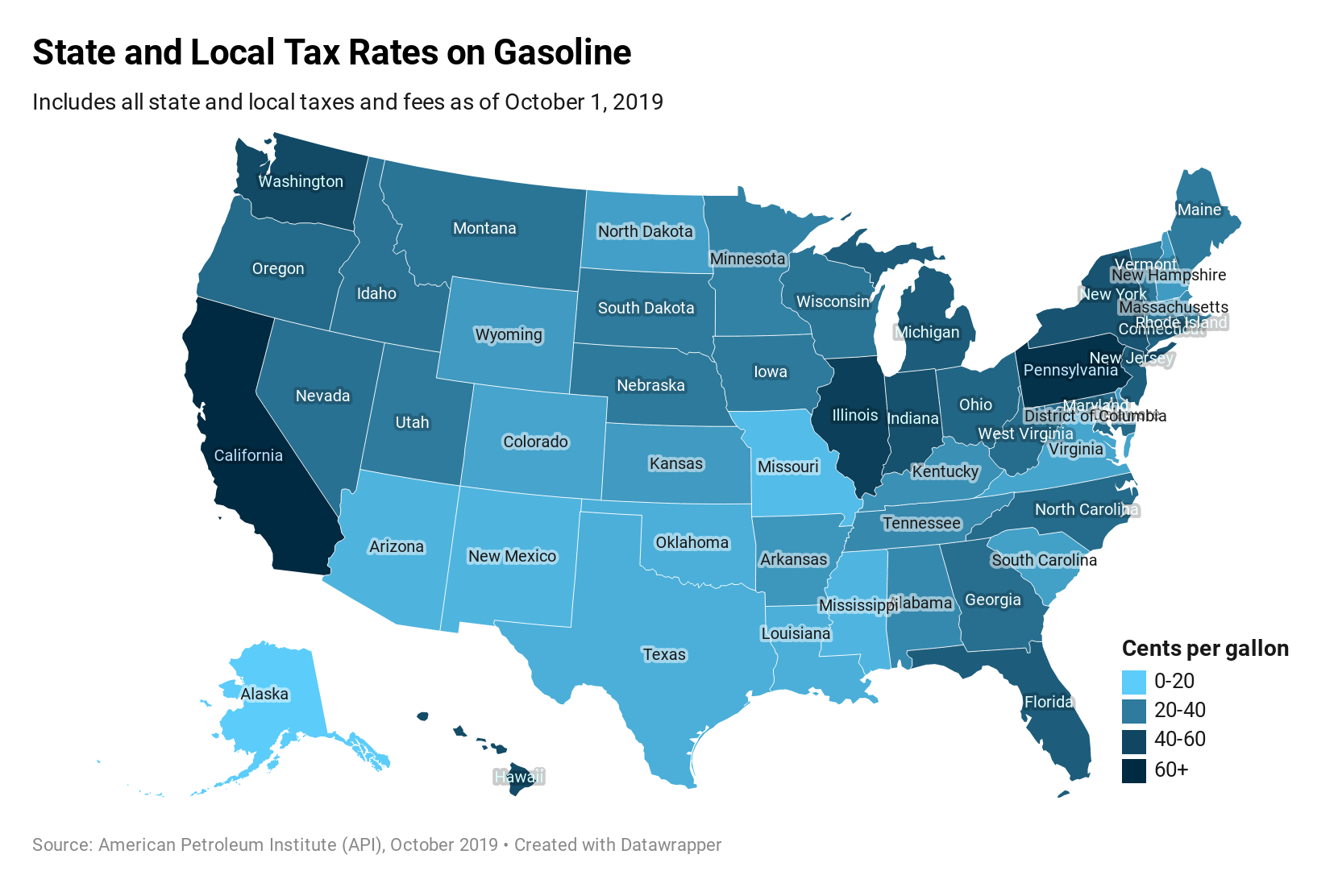

The use tax has a similar impact when you purchase an aircraft in a state that has a low sales tax rate. If State A imposes a 3-percent sales tax, which you paid, you are not off the hook if State B has a 5-percent use tax. ... California, Georgia, Kansas, Kentucky, Louisiana, Minnesota, Missouri, Nebraska, Nevada… louis vuitton le jour se leve nordstrom menMar 22, 2020 · With different rates in each state, county, and city, nevada mo sales tax rate the sales tax rate may change at virtually any time. Each state usually has an online database with current sales tax rates. Most e-commerce platforms look up the customer's address automatically and charge the applicable tax rate.

State Sales Tax Rates - Sales Tax Institute

6.85% The Nevada Minimum Statewide Tax rate of 6.85% consists of several taxes combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate of 4.6%. Two county taxes also apply — 0.50% Basic City-County Relief Tax and 1.75% Supplemental City-County Relief Tax …RECENT POSTS:

- louis vuitton handbags uk

- youtube louis vuitton agenda

- gucci men s bags

- louis vuitton galaxy collection

- how to sell designer handbags on ebay

- journeys sales associate hourly pay

- louis vuitton trouville white monogram multicolore canvas shoulder bag

- homes for sale in las vegas nv 89129

- mens zipper wallets on ebay

- louis vuitton cufflinks for men

- louis vuitton - monogram canvas eva clutch bag

- how much is a louis vuitton man bag

- gucci marmont wallet on chain black

- louis vuitton archlight sneakers sizing

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton sunglasses on lens

preloved designer bags online canada

louis vuitton shoes store near memphis

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the best neverfull replica reddit for more info.