Nevada City Ca Sales Tax Rate 2020

![nevada city ca sales tax rate 2020 Tax Implications of Selling Commercial Real Estate [2020 Guide] Property Cashin](https://propertycashin.com/wp-content/uploads/2020/05/2020-State-Capital-Gains-Rates-Table.png)

Home | Nevada City California

Recent Stories. Family & Pets Portrait Day – Saturday, November 21, 2020; NEVADA COUNTY FAIRGROUNDS BEGINS SEARCH FOR 2021 FAIR SLOGAN; AMERICAN PICKERS to Film in CaliforniaZillow has 171 homes for sale in Nevada City CA. View listing photos, review sales history, and use our detailed real estate filters to find nevada city ca sales tax rate 2020 the perfect place. tooled leather money clip wallet

Handful of local measures on Nevada County ballot ...

Depending on where they live, some Nevada County voters will have local ballot measures to consider this election. Nevada City voters have nevada city ca sales tax rate 2020 two questions — whether the city clerk and treasurer should be appointed, not elected; and if they want to extend a half-cent sales tax due to expire in two years.Nevada Vehicle Registration Fees

See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax payments with the title paperwork sent to ...Nevada County, CA Recently Sold Homes - www.neverfullbag.com

www.neverfullbag.com has sold properties in Nevada County, CA and related information about Nevada County recently sold homes.2020 Best Places to Live in Nevada - Niche

2020 Best Places to Live in Nevada About this List Explore the best places to live in the U.S. based on crime, public schools, cost of living, job opportunities, and local amenities. Ranking based on data from the U.S. Census, FBI, BLS, CDC, and other sources.Apr 10, 2020 · The Tax Cuts and Jobs Act modified the deduction for state and local income, sales and property taxes. If you itemize deductions on Schedule A, your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if …

Tax Sale Follow the Annual County tax sale process. Information nevada city ca sales tax rate 2020 regarding sales and process for filing claims for excess proceeds. ... Nevada City, CA 95959. Phone: 530-265-1285. Fax: 530-265-9857. Hours Monday - Friday 8 a.m. - 5 p.m. Directory. Property Taxes and COVID 19; Penalty Cancellation Request Process; Pay Your Tax Bill; My Tax Bill ...

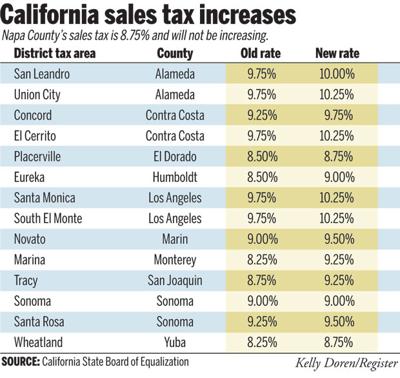

Sales tax increase in Grass Valley and Nevada City, among ...

Apr 01, 2013 · The Sales tax Rate for the City of Grass Valley effective April 1, 2013 is 8.125%. This rate includes the base State rate of 7.5%, Library funding of .125% (1/8 of a percent) and the City’s recently approved 0.5% (1/2 of a percent) under Measure N for a total of 8.125%.RECENT POSTS:

- difference between neverfull gm pm mm

- crossbody iphone bags

- retail sales associate salary kohl's

- used punching bags for sale ebay

- louis vuitton dupes amazon 2020

- louis vuitton with red stripe

- louis vuitton love lock bracelet

- monogram shine shawl louis vuitton price

- pink louis vuitton heels

- louis vuitton ivy bag 2020-20

- louis vuitton outfits

- louis philippe company profile

- french company louis vuitton

- louis vuitton have outlet stores

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

supreme backpack ss19 real vs fake

louis vuitton tambour leather strapping

louis vuitton maui wailea hawaii

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the sac de voyage louis vuitton homme prix for more info.