Louis Vuitton Price Earning Ratio

Don't Sell LVMH Moët Hennessy - Louis Vuitton, Société ...

The formula for price to earnings is: Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS) Or for LVMH Moët Hennessy - Louis Vuitton Société Européenne: louis vuitton price earning ratio P/E of 29.41 = EUR419.05 ÷ EUR14.25 (Based on the trailing twelve months to December 2019.) Is A High Price-to-Earnings Ratio Good?Record results for LVMH in 2018 - LVMH

LVMH Moët Hennessy Louis Vuitton, the world’s leading luxury products group, recorded revenue of €46.8 billion in 2018, an increase of 10% over the previous year. Organic revenue growth was 11%, and 12% excluding the impact of the closure of the Hong Kong airport concessions at the end of 2017.LVMH, the world’s leading luxury products group, gathers 75 prestigious brands, with 53.7 billion euros revenue in 2019 and a retail network of over 4,910 stores worldwide. louis vuitton onthego bags

Stock analysis for LVMH Moet Hennessy Louis Vuitton SE (LVMH:BrsaItaliana) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

LVMHMoet Hennessy Louis Vuitton SA (LVMUY) Earnings Yield ...

LVMHMoet Hennessy Louis Vuitton SA ... The Earning yield an indicator louis vuitton price earning ratio of the company's earnings and the price paid for the stock. ... The most common use of the Earnings ratio is to compare it to ...How Do I Calculate LVMH Moët Hennessy – Louis Vuitton ...

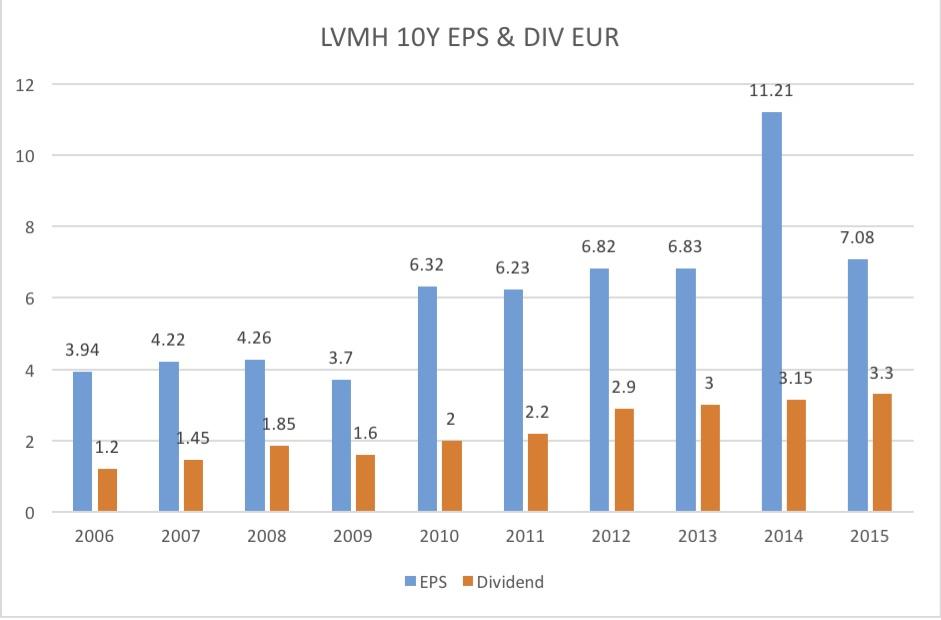

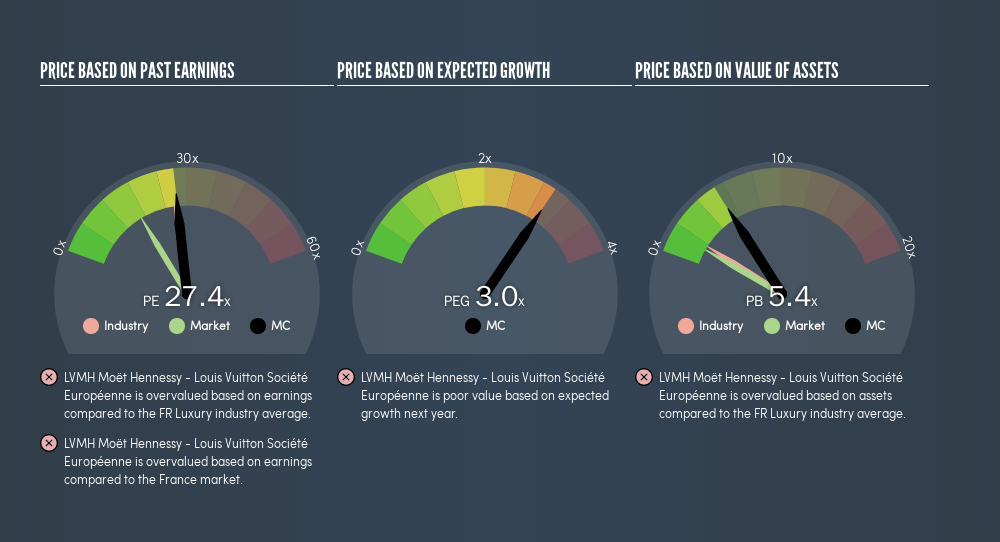

Jan 31, 2020 · This louis vuitton price earning ratio article is written for those who want to get better at using price to earnings ratios (P/E ratios). We’ll show how you can use LVMH Moët Hennessy – Louis Vuitton, Société Européenne’s P/E ratio to inform your assessment of the investment opportunity.LVMH Moët Hennessy – Louis Vuitton Société Européenne has a price to earnings ratio of 27.99, based on the last twelve months.LVMH Moet Hennessy Louis Vuitton SE balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View MC.FR financial statements in full.

MC - Research and Analysis for LVMH Moet Hennessy Louis ...

In-depth view of key statistics and finances for LVMH Moet Hennessy Louis Vuitton SE (MC) on MSN Money. ... (Price/Earnings Growth) Ratio. 5.76. Beta. 1.01. Forward P/E. 38.37. ... Price/Sales ...Despite Its High P/E Ratio, Is LVMH Moët Hennessy – Louis ...

Aug 28, 2019 · Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS) Or for LVMH Moët Hennessy – Louis Vuitton Société Européenne: P/E of 27.36 = €359.85 ÷ €13.15 (Based on the year to June 2019.) Is A High P/E Ratio Good? A higher P/E ratio means that investors are paying a higher price for each €1 of company earnings. All else ...RECENT POSTS:

- louis vuitton starbucks cup wrap

- sandwich places downtown st louis mo

- louis vuitton yellow epi bag

- louis vuitton neonoe bb blackout

- louis vuitton baby stroller cheap

- louis vuitton belt pink inside buckle

- louis vuitton t-shirt

- louis vuitton coin purse keyring

- louis vuitton mini soft trunk review

- saint louis university law school

- supreme 18ss shoulder bag fake

- louis vuitton sales associate get commissioner

- pictures of fake louis vuitton bags

- louis vuitton annual revenue 2018

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

shopping malls in saint louis missouri

lv speedy bandouliere 30 price in paris

monogram tote bag calvin klein

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the can i buy a louis vuitton bag for more info.