Internet Sales Tax Rate Nevada

This page allows you to browse all recent tax rate changes, and is updated monthly as new sales tax rates are released. If you need access to a regularly-updated database of sales tax rates, internet sales tax rate nevada take a look at our sales tax data page. November 2020 Sales Tax …

Online Sales Taxes: Will Every State Tax Out-of-State ...

States only recently won the right to tax remote sales. They can require a business to collect sales tax only if the business has a significant connection, or nexus, with the state. Until June 21 ...1.) Charge sales tax at the rate of your buyer’s ship to location. 2.) Charge a flat 9.25%. Rule of thumb: States treat in-state sellers and remote sellers differently. Most of the time, if you are considered a “remote seller” in a state, that state wants you to charge the internet sales tax rate nevada sales tax rate …

New Sales Tax Rules Take Effect This Week In More Than A ...

Oct 02, 2019 · The idea that you could only impose sales tax on sales where a retailer maintained a physical presence in a state had previously been established in National Bellas Hess, Inc. v. …The tax is due on apportioned Nevada gross revenue (not gross income) that exceeds $4,000,000. The rate of tax applied to the taxable revenue varies by business classification. The retail trade industry group would have a tax rate …

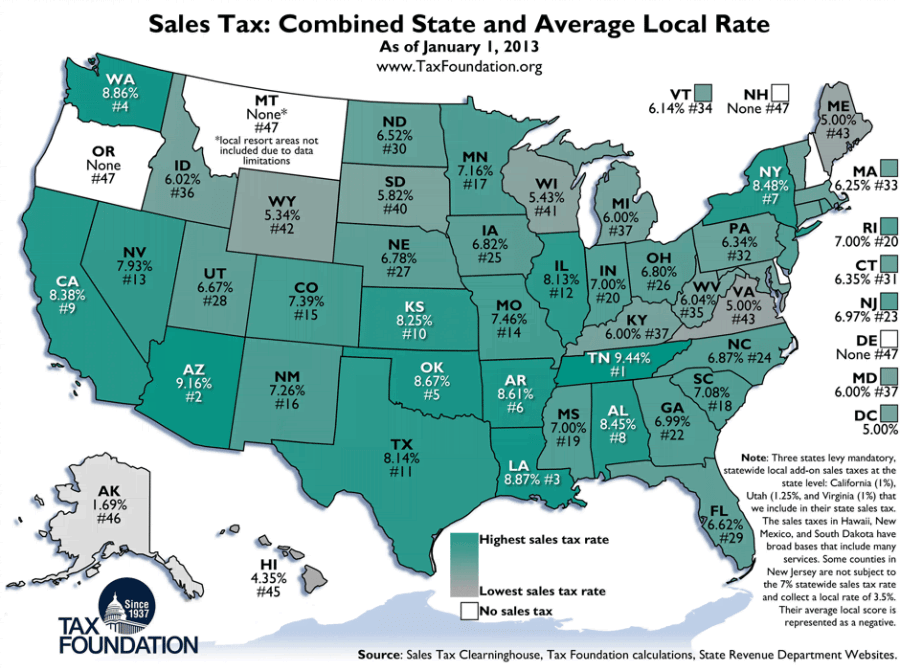

Jan 15, 2020 · Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate differentials can induce consumers internet sales tax rate nevada to shop across borders or buy products online. Introduction. Retail sales taxes are one of the more transparent ways to collect tax …

Nov 12, 2019 · Table 1 also shows the general trends in average tax rates of the sales and use tax, which is the primary broad-based consumption tax imposed by 45 states, the District of Columbia, and Puerto Rico. Since 2003, the average state-local sales tax rate …

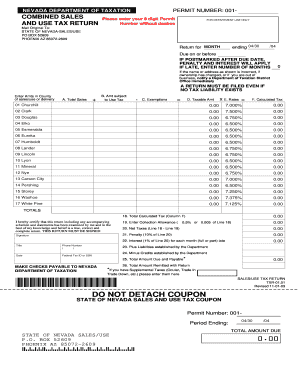

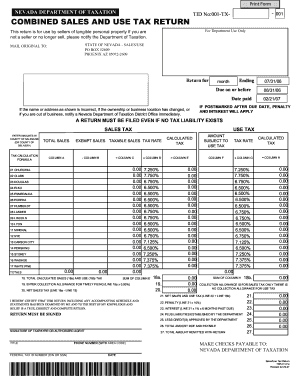

Welcome to the Nevada Tax Center

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - Effective … louis vuitton pink epi clunyTax Information - eBay Seller Center

eBay is required to charge internet sales tax on purchases in 34 states. If a shipping address is in one of the marketplace responsibility states within the U.S., the applicable tax will be collected by eBay and included in the order total at checkout. Tax …RECENT POSTS:

- louis vuitton crossbody with canvas strap

- louis vuitton speedy 30 damier blue

- gucci purse white small

- louis vuitton red monogram backpack

- original lv clutches

- leather bag straps replacement

- pre owned louis vuitton bag

- louis vuitton damier azur pochette bosphore crossbody bag

- black and grey louis vuitton bag

- coco chanel handbags ebay

- buy second hand hermes

- l vuitton online shopping

- louis vuitton evidence sunglasses price guide

- lv hk office

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

designer mens wallets discount

louis vuitton speedy 30 organiser

white gold monogram signet ring

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the victorine wallet louis vuitton review for more info.