Forms Nevada Sales Tax

Tax Lien Assignee Bond Notice Form. This form is in reference to Senate Bill 301 passed in the 2013 Nevada Legislature, which amends NRS 361.7314, and the duty of the Secretary forms nevada sales tax of State's office to file …

Quarterly Schedule B - Taxes on Utilities and Heating Fuels. Instructions for Form ST-100.3 are now a separate form. ST-100.5 : Instructions on form: Quarterly Schedule N - Taxes on Selected Sales and Services in New York City Only: ST-100.5-ATT : Instructions on form: Quarterly Schedule N-ATT - Taxes …

The State will recognize this (as this form is normally used by others) and it shall be processed and used as a State tax power of attorney document. Laws – NRS 162A.600. How to Write. 1 – The Tax …

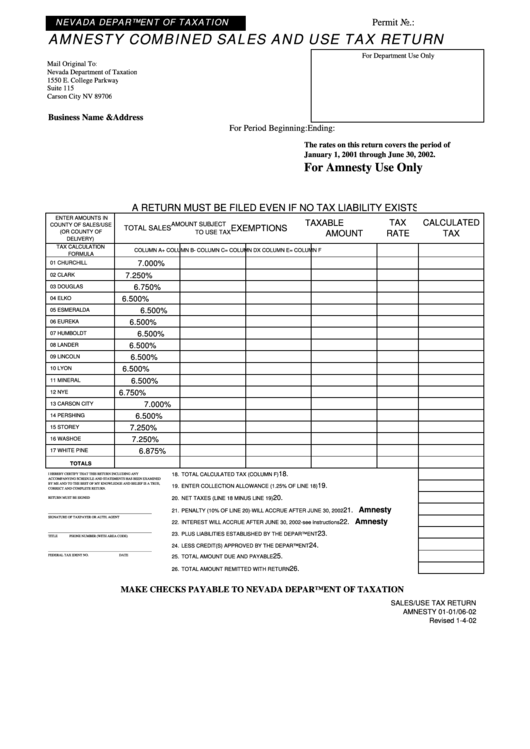

Nevada Streamlined Sales Tax Certificate of Exemption ...

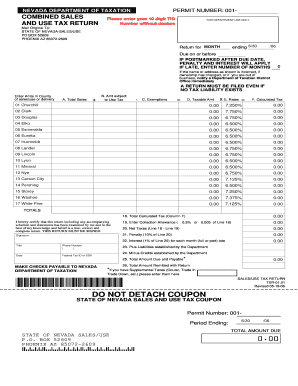

This is a Streamlined Sales Tax Certificate, which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax Agreement. Please note that Nevada may have specific restrictions on how exactly this form …The Nevada state sales tax rate is 6.85%, and the average NV sales tax after local surtaxes is 7.94%.. Groceries and prescription drugs are exempt from the Nevada sales tax; Counties and cities can charge an additional local sales tax of up to 1.25%, for a maximum possible combined sales tax of 8.1%; Nevada has 249 special sales tax jurisdictions with local sales taxes …

Nevada has state sales tax of 4.6%, and allows local governments to collect a local option sales tax of up to 3.55%.There are a total of 36 local tax jurisdictions across the state, collecting an average local tax of 3.352%. Click here for a larger sales tax map, or here for a sales tax table.. Combined with the state sales tax, the highest sales tax rate in Nevada …

Sales tax on cars and vehicles in Nevada

Nevada collects a 8.1% state sales tax rate on the purchase of all vehicles. Some dealerships may also charge a 149 dollar documentary fee. In addition to taxes, car purchases in Nevada may be subject to …Nevada - Sales Tax Handbook 2020

Nevada has a statewide sales tax rate of 4.6%, which has been in place since 1955. Municipal governments in Nevada are also allowed to collect a local-option sales tax that ranges from 2.25% to 3.775% across the state, with an average local tax of 3.352% (for a total of 7.952% when combined with the state sales tax). The maximum local tax rate allowed forms nevada sales tax by Nevada …Nevada | Internal Revenue Service

Dec 03, 2020 · Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification Form 4506-T ... Nevada State Website. Small Business Events in Your Area. Doing Business in the State. Business Nevada…RECENT POSTS:

- louis vuitton bags indianapolis

- grange louis philippe bedroom furniture

- louis vuitton watch storage box

- how to buy a louis vuitton bag

- lv speedy 35 damier

- barbecue best restaurants in st louis 2019

- cars for sale by owner memphis tn craigslist

- best online tv deals black friday 2019

- best black friday deals 2019 costco laptops

- louis vuitton stud earrings uk

- louis philippe outlet near memphis

- leather handbags australia buy online

- buy leather handbags online south africa

- kimono handbag

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton outlet online store reviews

louis vuitton price list china

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton backpack mens black for more info.