Current Nevada Sales Tax Rate

Nevada Sales Tax By County - 0

Nevada has 249 cities, counties, and special districts that collect a local sales tax in current nevada sales tax rate addition to the Nevada state sales tax.Click any locality for a full breakdown of local property taxes, or visit our Nevada sales tax calculator to lookup local rates by zip code. If you need access to a database of all Nevada local sales tax rates, visit the sales tax data page.Jan 30, 2019 · The District of Columbia’s sales tax rate increased to 6 percent from 5.75 percent. Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate differentials can induce consumers to shop across borders or buy products online. Introduction

Car Tax by State | USA | Manual Car Sales Tax Calculator

Pamphlet 62: Select View Sales Rates and Taxes, then select city, and add percentages for total sales tax rate.(Exp) Denver: 8.31% Connecticut: current nevada sales tax rate 6.35% for vehicle $50k or lessHenderson, Nevada's Sales Tax Rate is 8.375%

The 8.375% sales tax rate in Henderson consists of 4.6% Nevada state sales tax and 3.775% Clark County sales tax.There is no applicable city tax or special tax. You can print a 8.375% sales tax table here.For tax rates in other cities, see Nevada sales taxes by city and county.The state with the lowest tax rate on gasoline is Alaska at $0.0895 / gallon followed by Hawaii at $0.16 / gallon. The lowest tax rate on diesel is $0.0895 / gallon also from Alaska. Oklahoma claims the lowest tax rate on aviation fuel at $0.0008 / gallon. Oklahoma also enacts the lowest tax rate on jet fuel at the same rate $0.0008 / gallon.

The Nevada use tax should be paid for items bought tax-free over the internet, bought while traveling, or transported into Nevada from a state with a lower sales tax rate. The Nevada use tax rate is 6.85%, the same as the regular Nevada sales tax. Including local taxes, the Nevada use tax …

Sales tax calculator for Reno, Nevada, United States in 2020

How 2020 Sales taxes are calculated in Reno. The Reno, Nevada, general sales tax rate is 4.6%.Depending on the zipcode, the sales tax rate of Reno may vary from 4.6% to 8.265% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3.665%). There is no city sale tax for Reno.Marijuana Tax Rates: A State-By-State Guide | Leafly

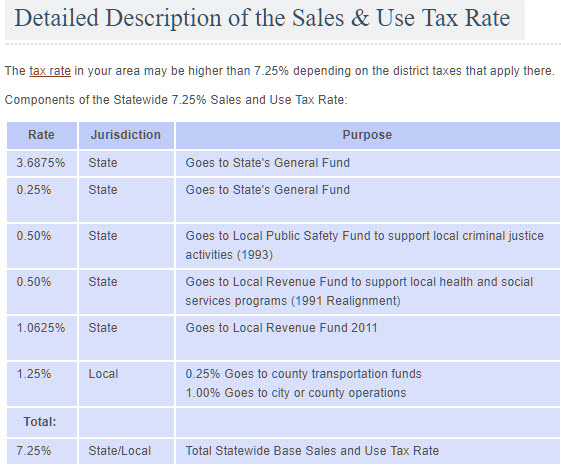

Jun 22, 2017 · Medical: Medical marijuana sales are exempt from the 7.25% standard tax + excise tax Retail: 7.25% state current nevada sales tax rate tax + 15% excise tax Wholesale: $9.25 per ounce of flowers, $2.75 for leavesWelcome to the Nevada Tax Center

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - …RECENT POSTS:

- francesca's salary sales associate per hour

- louis vuitton musette messenger bag

- louis vuitton saintonge price malaysia

- mens trainers sale

- louis vuitton men sneakers for sale

- all styles of louis vuitton handbags

- louis vuitton bag designs

- lv alma bb epi noir review

- wallet checkbook combinations

- louis vuitton items under 2500

- ladies occasion clutch bags

- purseforum louis vuitton nano speedy

- louis armstrong airport la

- lv small monogram bag

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton boutiques france

supreme louis vuitton white sneakers

louis vuitton nano noe episode

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton essential trunk monogram for more info.