Clarke County Sales Tax Rate 2019

Clarke’s clarke county sales tax rate 2019 current real estate tax rate is 71 cents per $100 of assessed value. At that rate, the owner of a house assessed at $150,000 receives an annual tax bill for $1,065.

Tax Rates | Georgia Department of Revenue

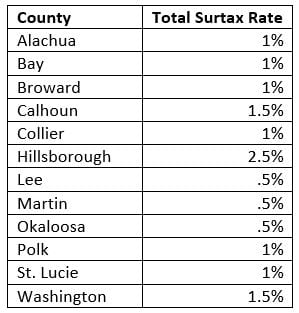

The tax rate for the portion of a motor vehicle sale that exceeds $5,000.00 is 6% because the 1% 2nd LOST and the 1% TSPLOST do not clarke county sales tax rate 2019 apply. ** Effective October 1, 2018, the generally applicable tax rate in Ware County is 9% (state sales tax at the statewide rate of 4% plus 5 local sales taxes at a rate of 1% each). The tax rate for the first ...New Title Ad Valorem Tax | Athens-Clarke County, GA ...

New Title Ad Valorem Tax - House Bill 386. Effective March 1, 2013, title transfer fees will increase for new purchases and penalties will increase if the title it not processed within the allotted time frame, 10 days for dealers, and 30 days for individual sales.The minimum combined 2020 sales tax rate for Clark County, Nevada is . This is the total of state and county sales tax rates. The Nevada state sales tax rate is currently %. The Clark County sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.

114 Court Street P.O. Box 9 Grove Hill, AL. Phone – 251-275-3376. Fax – 251-275-3498 louis vuitton outlet

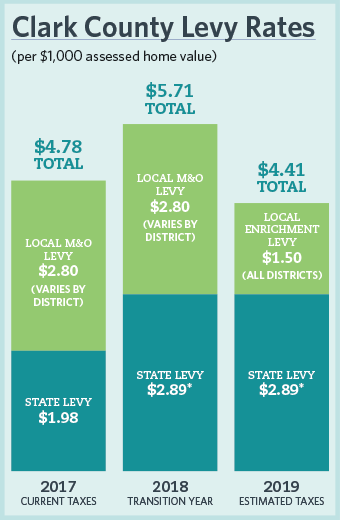

Clark County Treasurer's Tax Rate By District

CLARK COUNTY TAX RATES A tax district is an area defined within a county for taxing purposes. There are currently 111 separate clarke county sales tax rate 2019 tax districts in Clark County. The tax rate for each district is based on the amount of monies budgeted for government-provided services, such as schools, police, fire, parks, libraries, and capital projects, such as flood control and transportation.Ad Valorem Tax | Athens-Clarke County, GA - Official Website

The amount of tax is determined by the tax rate (mill rate) levied by various entities (one mill is equal to $1 for each $1,000 of assessed value, or 0.001) multiplied by the assessed value. Services & Benefits Property taxes, along with collection of sales tax, license and permit fees, fines and forfeitures, and charges for services, bring in ...From ACC Tax Sales Basic Information about Excess Tax Sale Funds… Under O.C.G.A. § 48-4-5, you may be eligible for excess tax sale funds if one of the following applies to you: You were the owner of record at the time of the tax sale. You were the owner of record of a security deed affecting the property at the time of the sale.

Clarke County Approves $255,982 for Local Businesses Through CARES Act Program

RECENT POSTS:

- macy's black friday 2019 puerto rico

- louis vuitton nice bb

- gucci bag for sale gumtree

- best black friday oled tv deals 2019

- free pattern for quilted crossbody bag

- louis vuitton roses pochette

- supreme louis vuitton duffle bag camo

- louis vuitton bag $600

- cheap louis vuitton in europe

- women bag backpack shoulder bag

- leviton tamper resistant outlet 10 pack

- identify fake louis vuitton wallet

- st louis cardinal ticket promotions

- filson large duffle bag sale

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton wall decal stickers

louis vuitton store london heathrow

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton speedy cost for more info.