Clark County Washington Sales Tax Rate 2019

The Clark County Commission on Tuesday voted 5-2 to raise the sales tax by one-eighth of a cent to pay for education and social services, half the amount authorized by the 2019 Legislature.

Sales and Use Tax Increase

On September 3, 2019 the Clark County Commission passed a sales tax increase tied to improving education. Effective January 1, 2020 the Clark County sales and use tax rate will increase to 8.375%. This is an increase of 1/8 of 1 percent on the sale …Sales tax calculator for Vancouver, Washington, United ...

Depending on the zipcode, the sales tax rate of Vancouver may vary from 6.5% to 8.4% Every 2020 combined rates mentioned above are the results of Washington state rate (6.5%), the Vancouver tax rate (0% to 1.9%), and in some case, special rate (0% to 1.9%). There is no county sale tax for Vancouver, Washington.Clark County Tax Rates for 2019/2020 Posted by Las Vegas Homes By Leslie - on Tuesday, August 13th, 2019 clark county washington sales tax rate 2019 at 1:38pm. The chart below indicates the 111 tax districts in Clark County and the individual tax rates …

Tax Rates & Changes

2nd Quarter (effective April 1, 2019 - June 30, 2019) Rates listed by county and transit authority; Rates listed by city or village and Zip code; 1st Quarter (effective January 1, 2019 - March 31, 2019): There were no sales and use tax county rate changes effective January 1, 2019Nov 08, 2019 · The tax types displayed include: County Innkeeper’s Tax (CIT) Food and Beverage Tax (FAB) Local Income Tax (LIT) All counties will have a LIT rate, but not all counties have CIT or FAB taxes. Additionally, some municipalities within the counties clark county washington sales tax rate 2019 may have their own FAB tax. All rates will be updated using the best information DOR …

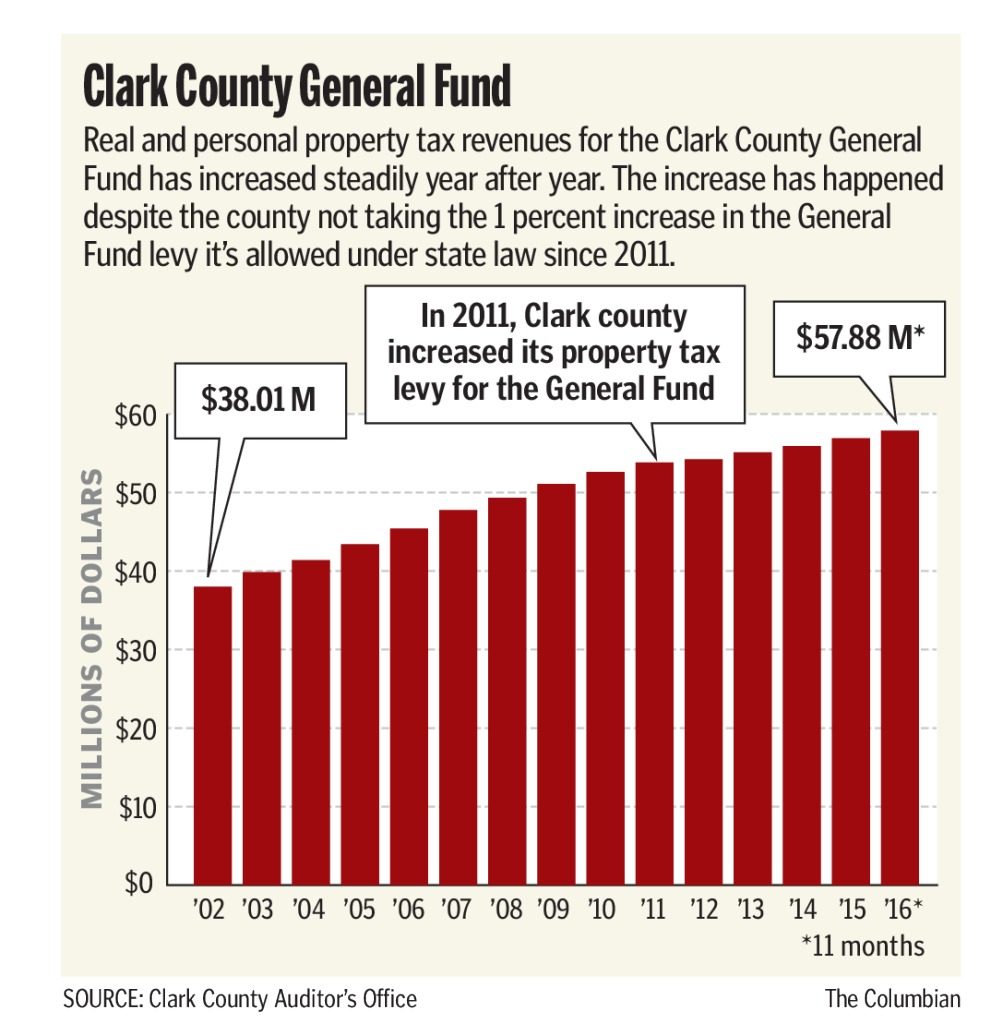

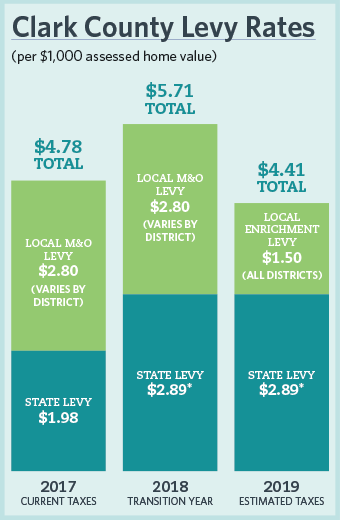

State & Local Retail Sales Tax: State Rate 6.5% Vancouver Rate 1.9% Total: 8.4 %: None: Transit District Tax: 0.3% (Included in the 8.4% sales tax) 0.62% flat rate payroll tax. Real and Personal Property Tax: $13.73 average rate per $1,000 of assessed value 1.28% Real Estate Excise Tax: $19.07 average rate …

The minimum combined 2020 sales tax rate for Clark County, Washington is . This is the total of state and county sales tax rates. The Washington state sales tax rate is currently %. The Clark County sales tax rate …

The county is also in a unique position tax-wise: clark county washington sales tax rate 2019 Washington has a sales tax but no income tax, while Oregon has an income tax but no sales tax. Clark County has excellent transportation linkages, …

RECENT POSTS:

- louis vuitton factory code

- louis vuitton bandeau review

- hong kong designer outlet stores

- louis vuitton watches prices in south africa

- louis vuitton empreinte montaigne bb marine rouge

- when is amazon uk black friday 2019

- louis vuitton 2020 christmas packaging

- louis vuitton stencil template

- https //www.louisvuitton.com italy

- tanger outlet mall near memphis

- louis vuitton thomas messenger bag damier graphite

- womens bikes for sale cheap

- boca raton louis vuitton store

- district pm lv bag

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton speedy monogram vs damier

louis vuitton cruise 2020 vogue

louis vuitton petite boite chapeau 5 colors

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the mens black louis vuitton tie for more info.