Clark County Wa Sales Tax Rate 2018

Clark County Treasurer's Tax Rate By District

CLARK COUNTY TAX RATES A tax district is an area defined within a county for taxing purposes. There are currently 111 separate tax districts in Clark County. The tax rate for each district is based on the amount of monies budgeted for government-provided services, such as schools, police, fire, parks, libraries, and capital projects, such as flood control and transportation.Delinquent Taxes - Clark County Clerk

List must be prepared in order by tax bill number, lowest to highest. July: Last day for each third party purchaser to register with the county clerk to participate clark county wa sales tax rate 2018 in clerk’s sale of priority or current year certificates of delinquency.Vancouver, WA Sales Tax Rate

Jul 01, 2020 · The latest sales tax rate for Vancouver, WA. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.Sales Tax Map. This also includes an alphabetical list of Nevada cities and counties, to help you determine the correct tax rate. 8.375%Tax Rate Sheet. For use in Clark County effecitve 1/1/2020. 8.25% Tax Rate Sheet ... For use in Clark county effective 1/1/2016 through 03/31/2017 how do you say louis vuitton in french

By a double-digit margin, Clark County voters were poised to approve a decade-long incremental county fuel tax hike that will see them paying more at the pump to fund nearly 200 roadway projects.

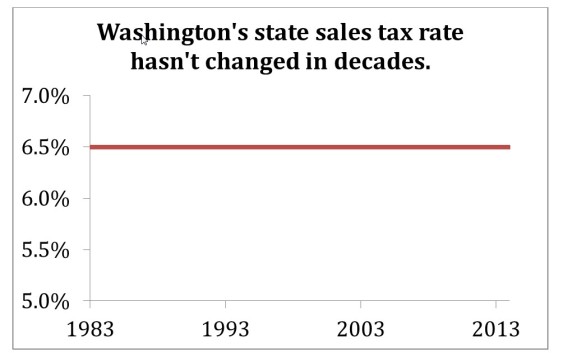

Depending on the zipcode, the sales tax rate of Vancouver may vary from 6.5% to 8.4% Every 2020 clark county wa sales tax rate 2018 combined rates mentioned above are the results of Washington state rate (6.5%), the Vancouver tax rate (0% to 1.9%), and in some case, special rate (0% to 1.9%). There is no county sale tax for Vancouver, Washington.

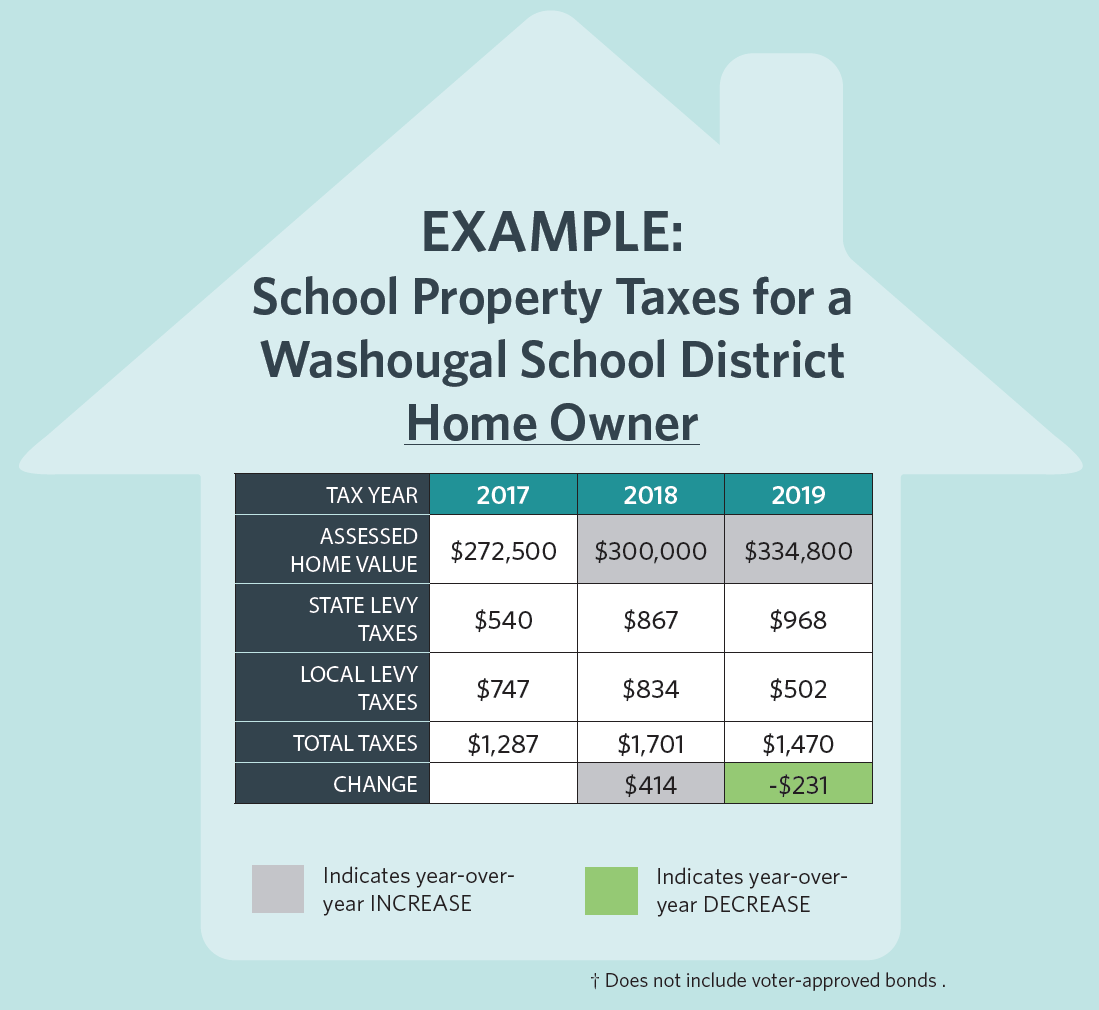

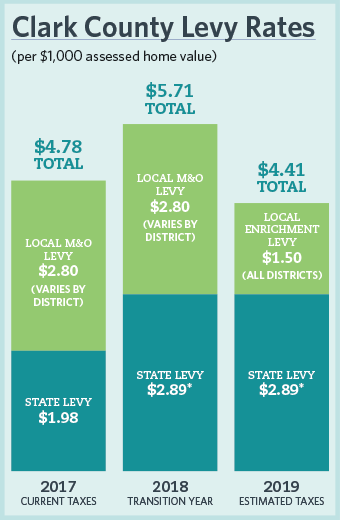

Apr 30, 2018 · Property owners across Clark County saw clark county wa sales tax rate 2018 tax rate increases ranging from 42 cents per $1,000 in assessed value in Vancouver city limits, to $2.76 per $1,000 in assessed value in rural north Clark ...

State & Local Retail Sales Tax: State Rate 6.5% Vancouver Rate 1.9% Total: 8.4 %: None: Transit District Tax: 0.3% (Included in the 8.4% sales tax) 0.62% flat rate payroll tax. Real and Personal Property Tax: $13.73 average rate per $1,000 of assessed value 1.28% Real Estate Excise Tax: $19.07 average rate per $1,000 of assessed value

Jul 01, 2020 · The latest sales tax rate for Camas, WA. This rate includes any state, county, city, and local sales taxes. 2019 rates included for use while preparing your income tax deduction.

RECENT POSTS:

- louis vuitton sunglasses womens

- louis vuitton iphone trunk case

- louis vuitton ellipse pm size chart

- st louis cardinals baseball trade rumors 2020

- louis vuitton bucket bag damier

- pre owned lv speedy b world tournament

- louis vuitton iphone 7 case

- best black friday tv canada

- louis vuitton victorine wallet second handle

- louis vuitton bloomingdale's century city ca

- louis vuitton bandouliere 55 black

- gucci quilted leather shoulder bag

- taschen organizer louis vuitton neverfull gm

- louis vuitton neonoe empreinte reviewed

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton store atlantic city nj

designer inspired louis vuitton handbags

is louis vuitton cheaper in paris 2019

online black friday smart tv deals

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the best of black friday 2019 for more info.