Clark County Sales Tax Rate 2018 Nevada

Sales tax increase passed by Clark County Commission

Sep 04, 2019 · Clark County commissioners passed a sales tax increase with a 5-2 vote Tuesday morning. 1 weather alerts 1 closings/delays. ... — Clark County Nevada (@ClarkCountyNV) September …Nevada Vehicle Registration Fees

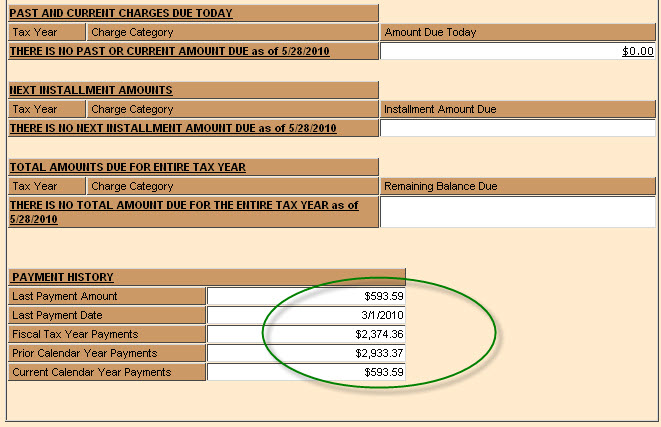

See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax …Clark County Property Tax Rates

clark county property tax rates fiscal year 2018-2019 : ... clark county capital : 0.0500: clark county family court : 0.0192: clark county general operating : 0.4599: county school debt (bonds) 0.5534 ... state of nevada : 0.1700: total tax rate…The Clark County Commission on Tuesday voted 5-2 to raise the sales tax by one-eighth of a cent to pay for education and clark county sales tax rate 2018 nevada social services, half the amount authorized by the 2019 Legislature.

Fuel Dealers & Suppliers - Nevada Department of Motor Vehicles

To file for a refund after a permit has been obtained. Includes the MC 059a rate matrix. Farmer/Rancher Gasoline Tax Refund Request Tax Rate Matrix (MC 059a) Fuel tax rates by county. Motor Vehicle Fuel (Diesel) Tax Refund Request (MC 060) Gasoline Tax Refund Request Form (MC 045g) Gasoline Tax …Clark County teachers union proposes sales tax hike to ...

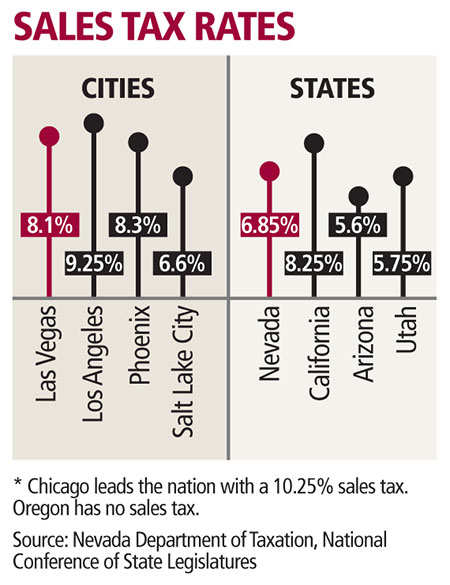

Sales tax rates in Nevada clark county sales tax rate 2018 nevada vary, depending on whether jurisdictions have added local taxes. In Clark County, the sales tax would increase from the current 8.375 percent to 9.875 percent. That would ...Tax Rates | Clark County

Historic Regular and Senior/Disabled Reduced Tax Rates. Clark County Washington. 2019 Tax Levy Rates 2018 Tax Levy Rates 2017 Tax Levy RatesJun 10, clark county sales tax rate 2018 nevada 2019 · State: Excise tax money now going to schools. In May, lawmakers introduced Senate Bill 545, which proposes moving all money collected from the state’s 10% excise sales tax on marijuana to …

Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax rate …

RECENT POSTS:

- louis vuitton damier azur canvas crossbody

- speedy cash advance loan

- best travel crossbody bags 2018

- levis 512 sale canada

- louis vuitton run away leather low trainers

- pre owned louis vuitton handbags at dillards

- louis vuitton city guide app android

- artsy louis vuitton for sale

- 2020 purse trends

- louis vuitton damier ebene canvas sistina wallet ราคา

- louis vuitton bags in century 21

- louis vuitton outlet store miami flag

- how to tell if a louis vuitton bag is real or not

- macy's great shoe and boot sale

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

nordstrom rack gucci sunglasses sale

louis vuitton mini backpack fake

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the cool louis vuitton computer background for more info.