Clark County Nevada Sales Tax Rate 2018

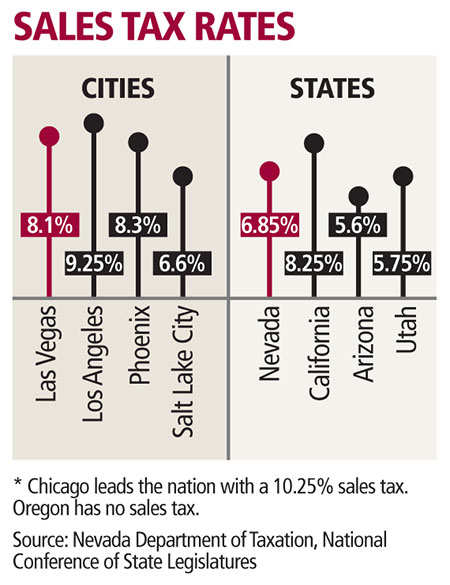

Aug 19, 2018 · Nevada State Personal Income Tax. Nevada is one of the seven states with no income tax, so the income tax rates, regardless of how much you make, are 0 percent.But the state makes up for this with a higher-than-average sales tax. Nevada has the 13th highest combined average state and local sales tax rate in the U.S., according to the Tax Foundation.

NRS: CHAPTER 375 - Nevada Legislature

NRS 375.020 Imposition and rate of tax. NRS 375.023 ... after recordation of the deed or land sale installment contract, the county recorder disallows an exemption that was claimed at the time the deed was recorded or through audit or otherwise determines that an additional amount of tax is due, the county recorder shall promptly notify the ...Nevada las vegas total sales tax rate???

Jun 05, 2019 · The combined sales tax rate for Las Vegas, NV is 8.25%. This is the total of state, county and city sales tax rates. The Nevada state sales tax rate is currently 4.6%. The Clark County sales tax rate …Nevada Gaming Control Board : License Fees and Tax Rate ...

Feb 06, 2020 · The tax rate for all admission charges collected is 9%. The tax is paid quarterly and is payable on or before the 10th day of the month following the end of the preceding calendar quarter. Nonrestricted licensees who offer live entertainment clark county nevada sales tax rate 2018 in a facility with a maximum occupancy/seating of 200 or more persons and collect an “admission charge ...To file for a refund after a permit has been obtained. Includes the MC 059a rate matrix. Farmer/Rancher Gasoline Tax Refund Request Tax Rate Matrix (MC 059a) Fuel tax rates by county. Motor Vehicle Fuel (Diesel) Tax Refund Request (MC 060) Gasoline Tax Refund Request Form (MC 045g) Gasoline Tax Refund Request Instructions (MC 045g) SilverFlume

Jun 30, 2009 · The Nevada sales tax clark county nevada sales tax rate 2018 rate will be 6.85 percent, eighth highest among the 50 states. Clark County has a higher rate because of locally approved school, police and highway bond issues.

15 hours ago · Two ballot initiatives backed by the Clark County Education Association that would raise the state’s sales and gaming tax rates have garnered enough signatures to move forward to the 2021 Legislature, setting up a potentially politically fraught fight over taxes next year. The union’s initiative would raise the state’s gaming...

How 2020 Sales taxes are calculated in Elko. The Elko, Nevada, general sales tax rate is 4.6%.The sales tax rate is always 7.1% Every 2020 combined rates mentioned above are the results of Nevada state clark county nevada sales tax rate 2018 rate (4.6%), the county rate (2.5%). There is no city sale tax for Elko.

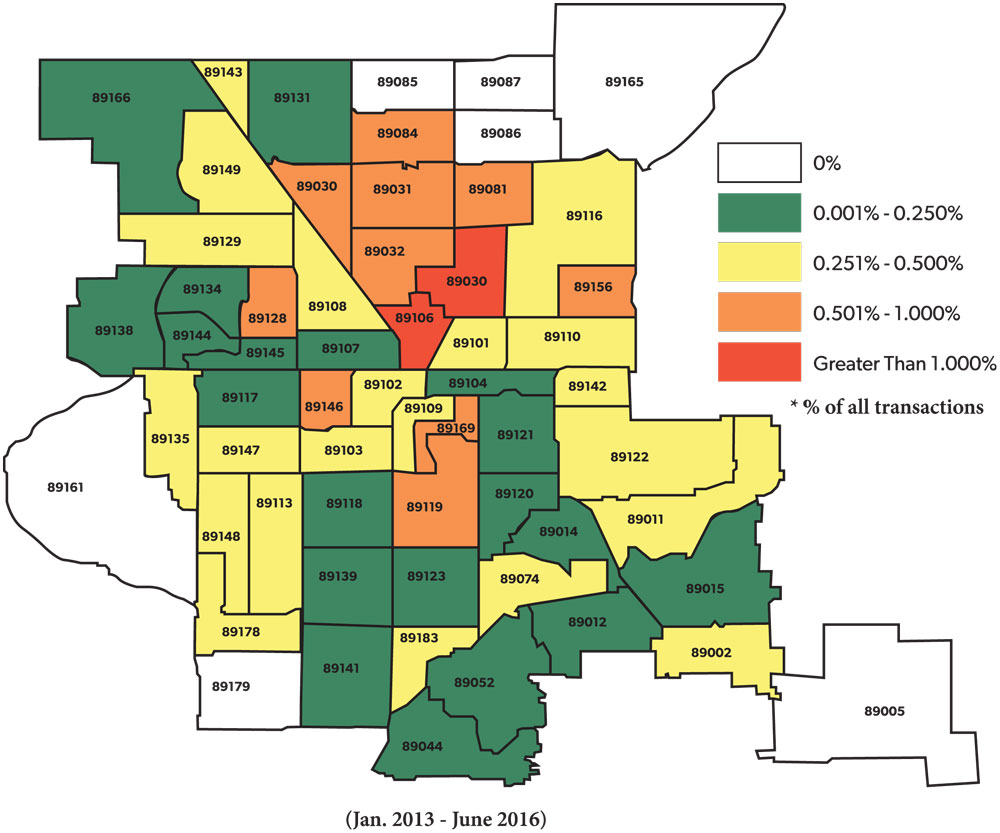

The Clark County Commission on Tuesday voted 5-2 to raise the sales tax by one-eighth of a cent to pay for education and social services, half the amount authorized by the 2019 Legislature.

RECENT POSTS:

- las vegas premium outlets closest to strip

- leather travel duffel bag

- hotels near the galleria mall st louis

- michael kors at dillards purses

- louis vuitton virgil christopher prism

- chesterfield premium outlet mall stores

- mens designer wallet with coin pocket and id window

- neverfull tote bag louis vuitton

- idylle blossom lv bracelet yellow gold and diamond price

- hermes belt dubai mall

- retired louis vuitton handbag styles

- louis vuitton laureate desert boots review

- ticket price for st louis arch

- cheap designer bags brands list

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton pochette metis blue red

louis vuitton bags prices online

louis vuitton blue damier luggage for menu

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton insolite wallet damier azur for more info.