Clark County Nevada Sales Tax 2018

clark county nevada sales tax 2018 State: Excise tax money now going to schools. In May, lawmakers introduced Senate Bill 545, which proposes moving all money collected from the state’s 10% excise sales tax on marijuana to education.

Clark County approves raising sales tax 1/8 of a cent ...

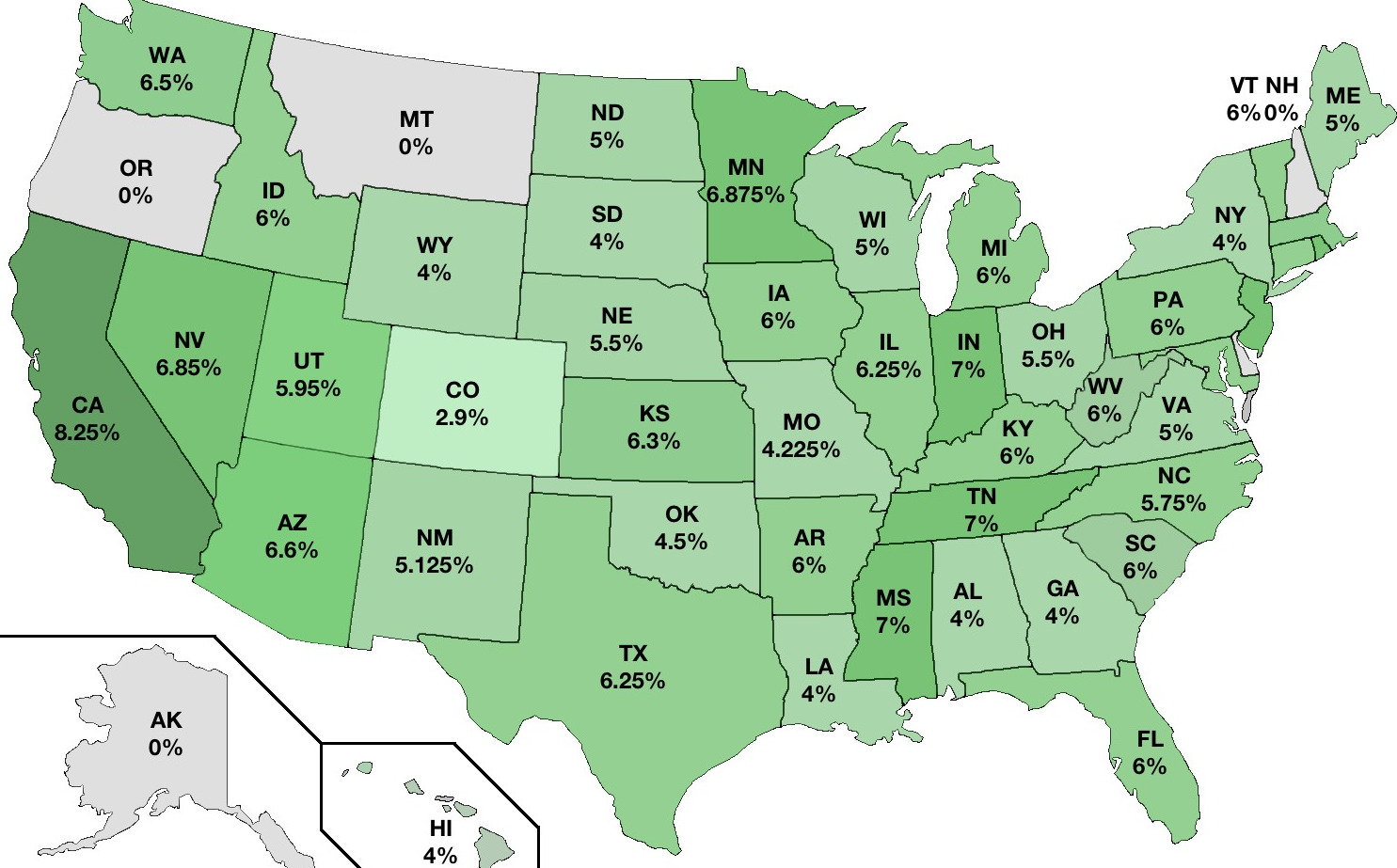

Sep 03, 2019 · The tax increase will take the sales tax in Clark County from 8.25 percent to 8.375 percent. The bill allows money to be used to address homelessness, prevent truancy and chronic absenteeism in school, promote early childhood education, affordable housing, workforce development, and aid in recruitment and retaining teachers in high-risk schools.Welcome to the Nevada Tax Center

Jan 01, 2020 · The Department is now accepting credit card payments in Nevada Tax (OLT). Click Here for details.; NEW! Click here to schedule an appointment; Clark County Tax Rate Increase - …Find and bid on Residential Real Estate in Clark County, NV. Search our database of Clark County Property Auctions for free!

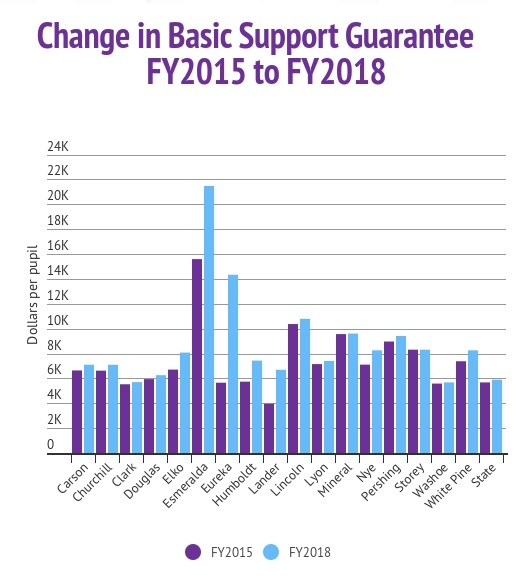

Of course, you must still pay federal income taxes. Nevada Sales Tax. Nevada’s statewide sales tax rate of 6.85% is seventh-highest in the U.S. Local sales tax rates can raise the sales tax up to 8.265%. The table below shows the county and city rates for every county and the largest cities in the state.

Fuel Dealers & Suppliers - Nevada Department of Motor Vehicles

County Gasoline/Gasohol County Option* Gasoline/Gasohol County Other* Gasoline/Gasohol County Index* Diesel/Biodiesel County Option* Diesel/Biodiesel/LNG County Index* CNG* County Index LPG* County Index A-55* County Index; Carson City : 0.09 : 0.01 : 0.05 effective 8-1-2020 : Churchill : 0.09 : 0.01 : clark county nevada sales tax 2018 Clark : 0.09 : 0.01: PPI $0.1483505 : PPI ...The Nevada state sales tax rate is 6.85%, and the average NV sales tax after local surtaxes is 7.94%.. Groceries and prescription drugs are exempt from the Nevada sales tax; Counties and cities can charge an additional local sales tax of up to 1.25%, for a maximum possible combined sales tax of 8.1%; Nevada has 249 special sales tax jurisdictions with local sales taxes in addition to the state ...

Clark County Treasurer's Office Tax Collection

Real Property Tax Due Dates : For Fiscal Year 2018-2019 (July 1, 2018 to June 30, 2019) Installment Due Date Last Day to Pay without Penalty; 1st: Monday August 20, 2018: August 30, 2018: 2nd: Monday October 1, 2018: October 11, 2018: 3rd: Monday January 7, 2019:Tax Lien Sales in Nevada | The Stone Law Firm

Upon payment of all taxes and costs, the county will reconvey the real property back to the owner. clark county nevada sales tax 2018 The Tax Lien Sale. In most counties in Nevada, tax lien sales are handled like auctions. This article covers the basics as well as specifics for Washoe and Clark Counties. The remaining counties in Nevada will be covered in a separate article.RECENT POSTS:

- louis vuitton authenticity code check

- small black crossbody leather purse

- harga tas louis vuitton origin

- louis vuitton belt womens selfridges

- louis vuitton essential trunk 2019

- lv bags uae online

- tipper trucks for sale south africa

- grace coddington neverfull

- louis vuitton pochette nm damier azur

- louis vuitton monogram cosmetic pouch gm

- moletom supreme x louis vuitton original

- st louis shops

- louis vuitton shoes most expensive

- louis vuitton zipper pull replacement

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton fall winter 2019 vogue

louis vuitton silk scarf womens

louis vuitton beverly hills hours

where to repair louis vuitton bags

louis vuitton lv apple watch band

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the louis vuitton small neverfull handbags for more info.