Carson County Sales Tax Rate Nevada

The Nevada Department of Motor Vehicles issues drivers licenses, vehicle registrations and license plates in the Silver State. It also licenses, regulates and taxes the …

Nevada Sales Tax Increase for Public Schools Initiative ...

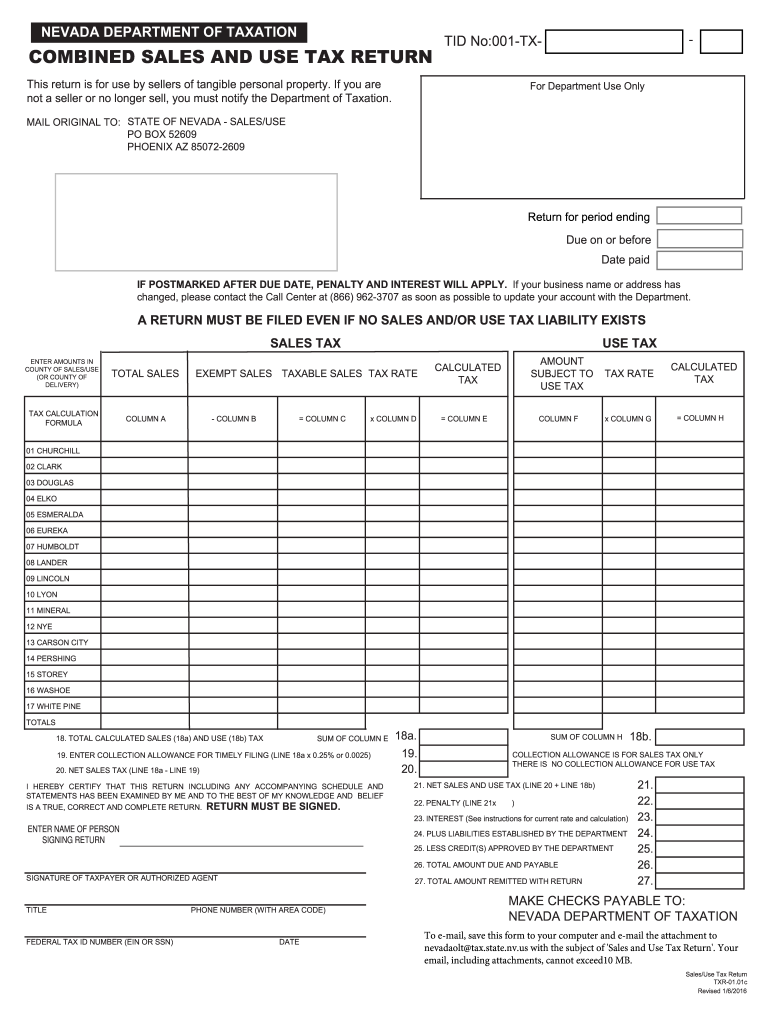

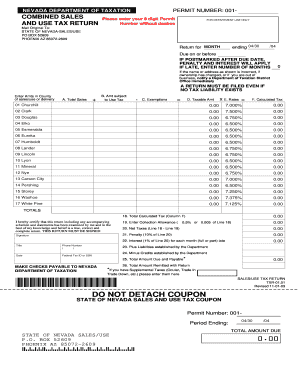

The Nevada Sales Tax Increase for Public Schools Initiative (#02-2020) may appear on the ballot in Nevada as an indirect initiated state statute on November 8, 2022.. This initiative would increase the state sales and use tax rate by 1.5 percentage points with revenue dedicated to public schools. Specifically, the measure would increase the state's Local School Support Tax from 2.25% to 3.75%.U.S. Census Bureau QuickFacts: Carson City, Nevada (County)

QuickFacts Carson City, Nevada (County) QuickFacts provides statistics for all states and counties, and for cities and towns with a population of 5,000 or more.Carson City, Nevada, Sales Tax Rate Change, October 2014 ...

May 13, 2014 · The Nevada Department of Taxation has announced that the sales and use tax rate for Carson City will increase from 7.475% to 7.60%, effective October 1, 2014.. This rate increase was approved by the Carson City Board of Supervisors.Carson CAD – Official Site

Pursuant to Section 11.1825(r) of the Texas Property Tax Code, the Carson County Appraisal District gives public notice of the capitalization rate to be used for tax year 2020 to value properties carson county sales tax rate nevada receiving exemption under this section. A basic capitalization rate of … designer bags and handbags purses #handbagspurses in …Tax Auction The Washoe County Treasurer’s Office holds auctions for delinquent property and mobile home taxes. Nevada State Law provides for the redemption of real estate properties up until 5 pm on the third business day before the day of the sale by a county treasurer (NRS 361.585).

In Nevada, the County Tax Collector carson county sales tax rate nevada will sell Tax Deeds to winning bidders at the Carson City County Tax Deeds sale. Generally, the minimum bid at an Carson City County Tax Deeds sale is the amount of back taxes owed plus interest, as well as any and all costs associated with selling the property.

Changes to tax rates with an effective date of 1/1/2020

Jan 01, 2020 · Location County/City Code Rate Notes Tax Type Brighton Town 18-010 1.00% * Local option Uintah County 24-ALL 0.25% * Transportation Infrastructure Washington City 27-027 3.50% ** Municipal Telecommunication License Tax Castle Dale 08-001 1.00% * Municipal Transient Room Tax Huntington 08-012 1.00% * Municipal Transient Room TaxLocated in western Nevada, Carson City carson county sales tax rate nevada is Nevada’s only independent city, which means that it is not a part of any county. That may be part of the reason property tax rates in Carson City are so much lower than they are in most of the rest of the state. The effective property tax rate in Carson City is 0.66%.

RECENT POSTS:

- louis vuitton eshop cz

- louis vuitton mens bag malaysia

- coach neverfull purse

- wallet with coin purse

- supreme louis vuitton jordan 11 price

- resale louis vuitton handbags

- louis vuitton new york soho new york

- speedy bandouliere 30 vs 35 reviews

- mens zip around wallet australia

- louis vuitton retiro bag organizer images

- giày adidas chính hãng sale

- louis vuitton python bag

- louis vuitton copy purse

- louis vuitton key chain wallets

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

louis vuitton gold bracelet bangle

nike outlet store in cabazon ca

homes for sale st louis hills mo

louis vuitton bloomingdale's men's store

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the lv keepall 60 size for more info.