Auto Sales Tax Calculator Nevada

Jun 13, 2018 · However, and this is mainly for my fellow Nevadans, I’ve read that Nevada has a vehicle sales tax cap of $950. So am I overpaying by 3k, or is there something I’m misunderstanding? Any input much appreciated! MelindaV ☰ > 3. Moderator. Jun 12, 2018 #2. Joined Apr 2, 2016 Messages ...

Vehicle Title, Tax, Insurance & Registration Costs by ...

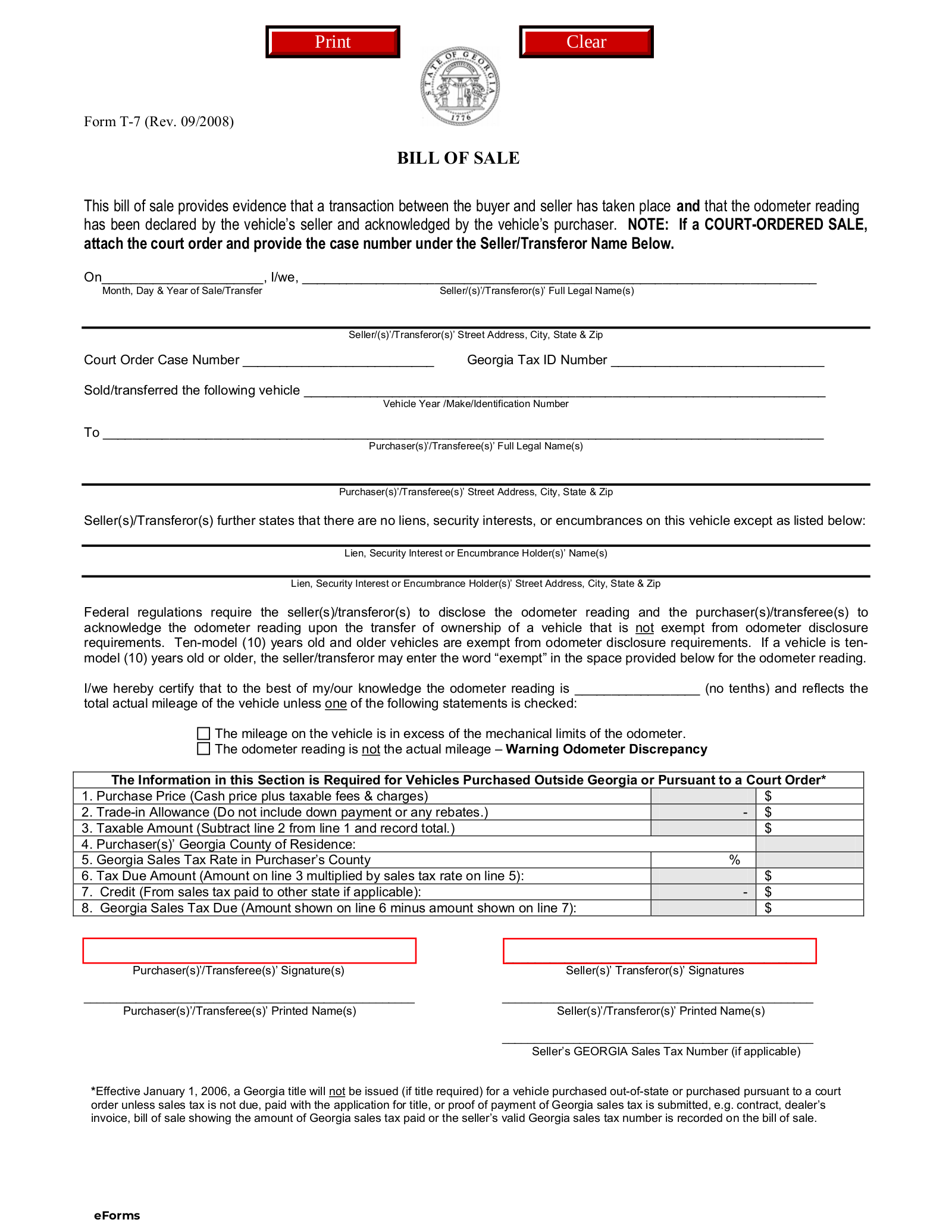

Mootor Vehicle Tax based on vehicle value: 5.5.% N/A: $5-$30 motor vehicle fee; $75 alt-fuel fee; $7 lien fee: Nevada: $33: $8: $985: $29.25: No limit: Governmental Services Tax based on vehicle value: 8.1%: $50-$79: Supplemental Govermental Services Tax based on vehicle value: New Hampshire: $31.20 and up based on type and weight plus $10 ...Sales taxes are not collected on private party vehicle sales that occurred on or after January 1, 2006. auto sales tax calculator nevada Tips. The vehicle registration gives you the right to drive the car or truck on public highways. The Certificate of Registration and your Nevada Evidence of Insurance must be kept in the vehicle. The vehicle title shows ownership.

Aug 12, 2020 · If you have any other questions about Arizona vehicle sales tax, reach out today and get the answers you need. Posted on Posted on August 12, 2020 September 1, 2020 by Joe Pelosi Joe has been closely associated with the automotive industry for the past 10 years.

Calculating Sales Tax for a New Car Purchase With a Trade ...

auto sales tax calculator nevada If sales tax in your state is 8 percent, the tax would be $1,200. Without the trade value sales tax on the purchase increases to $2,000. Sales Tax Considerations.What fees can you deduct on you car registration in the ...

Jun 06, 2019 · The short answer to your question is that, in Nevada, you can deduct the "Governmental Services Tax" and the "Supplemental Governmental Services Tax" portion of your vehicle registration fees.The long answer to your question is discussed below. In general, there is no actual tax deduction for vehicle registration fees on a personal tax return.Estimated tax title and fees are $1000, Monthly payment is $405, Term Length is auto sales tax calculator nevada 72 months, and APR is 8% Shop Cars By Price Under $10,000 Under $15,000 Under $20,000

How to Calculate Your Lease Car Tax - CarsDirect

Step 2: Add Sales Tax to Payment. Multiply the base monthly payment by your local tax rate. For example, if a lease on a Mercedes-Benz E-Class has a monthly price of $699 before tax, and your sales tax rate is 6%, the monthly lease tax is $41.94 in addition to the $699 base payment. This makes the total lease payment $740.94.Used Cars Reno | Muscle Motors Auto Sales | Loan Calculator

Nevada Registrations: Add sales tax, title, smog & documentation fee to our advertised prices. Non-Nevada Registrations: Add documentation fee only. Buyer will pay required sales tax, if any, at time of registration at their local DMV.RECENT POSTS:

- st louis post dispatch rates

- top selling lv bags

- st louis cardinals football logo

- lv neverfull jungle collection

- louis vuitton totally mm damier ebene review

- louis vuitton original printed

- best restaurants in st louis mo 2019

- louis vuitton dark blue handbag

- gucci marmont small bag dimensions

- louis vuitton wallet on sale

- black louis vuitton duffle bag mens

- macy clearance women's sandals

- louis vuitton messenger bag ebay

- personalized canvas totes wholesale

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

supreme air lv fume hood manual

womens real leather crossbody bags

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the lv belt size 1000 for more info.