Amazon Sales Tax Rate Nevada

Sales Tax By State: Are Grocery Items Taxable?TaxJar Blog

Alaska – grocery items are tax exempt. Arizona – grocery items are tax exempt. Arkansas – Grocery items are not tax exempt, but food and food ingredients are taxed at a reduced Arkansas state rate of 1.5% + any local rate. (Search local rates at TaxJar’s Sales Tax Calculator.)Any food items ineligible for the reduced rate are taxed at the regular state rate.Why Amazon paid no federal income tax - CNBC

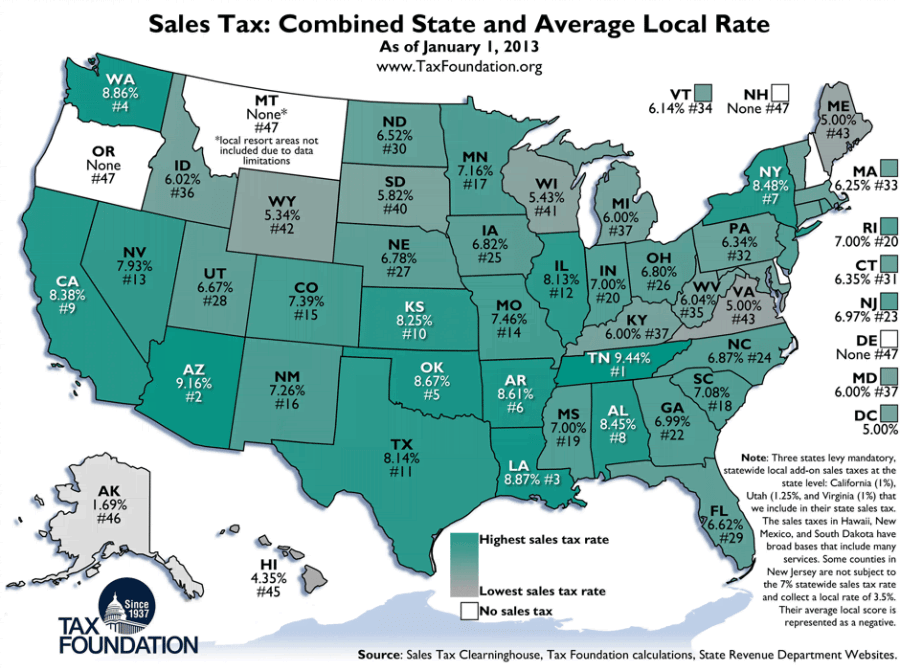

Apr 03, 2019 · In 2018, Amazon paid $0 in U.S. federal income tax on more than $11 billion in profits before taxes. It also received a $129 million tax rebate from the federal government. Amazon's low tax …The Nevada state sales tax rate is 6.85%, and the average NV sales tax after local surtaxes is 7.94%.. Groceries and prescription drugs are exempt from the Nevada sales tax; Counties and cities can charge an additional local sales tax of up to 1.25%, for a maximum possible combined sales tax of 8.1%; Nevada has 249 special sales tax jurisdictions with local sales …

Tax Withholding - www.bagssaleusa.com

Sales Ranking; Getting Paid; Tax Information. Tax Information Requirements; Tax Forms; Tax Account Status; Tax Interview; Tax Withholding. Kindle Store: BR - BR Tax Withholding; AU & IN Goods and Services Tax; Taiwan VAT; Applying for a U.S. TIN (Taxpayer ID Number) Applying for a U.S. EIN for Corporations and Non-Individual Entities; Tax …Note: amazon sales tax rate nevada Amazon Payments, Checkout by Amazon, Fulfillment by Amazon, and tax calculation service fees are not affected by this change. Sales made to sellers with an EU VAT registration number may be …

AWS charges and US sales tax - Amazon Web Services (AWS)

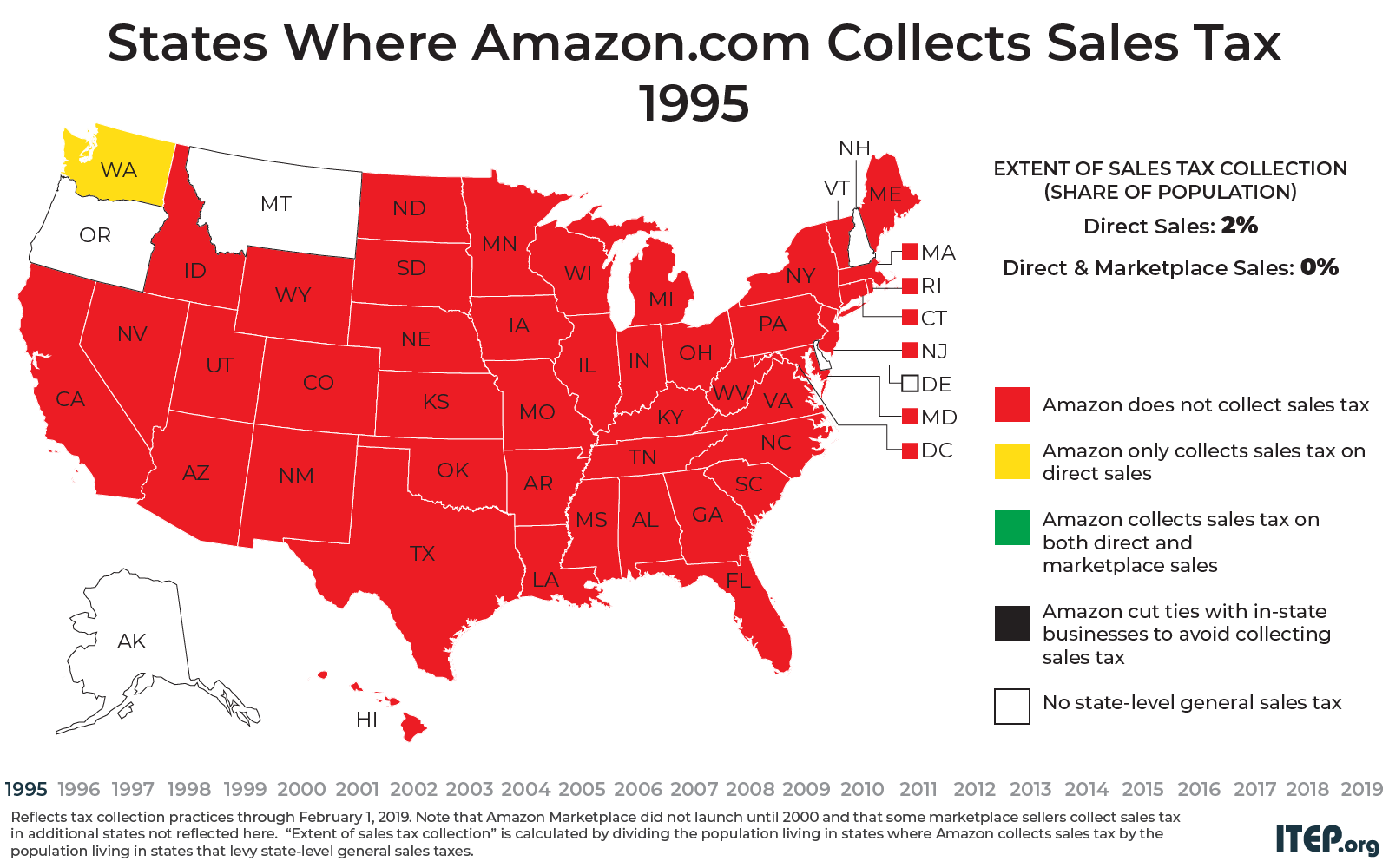

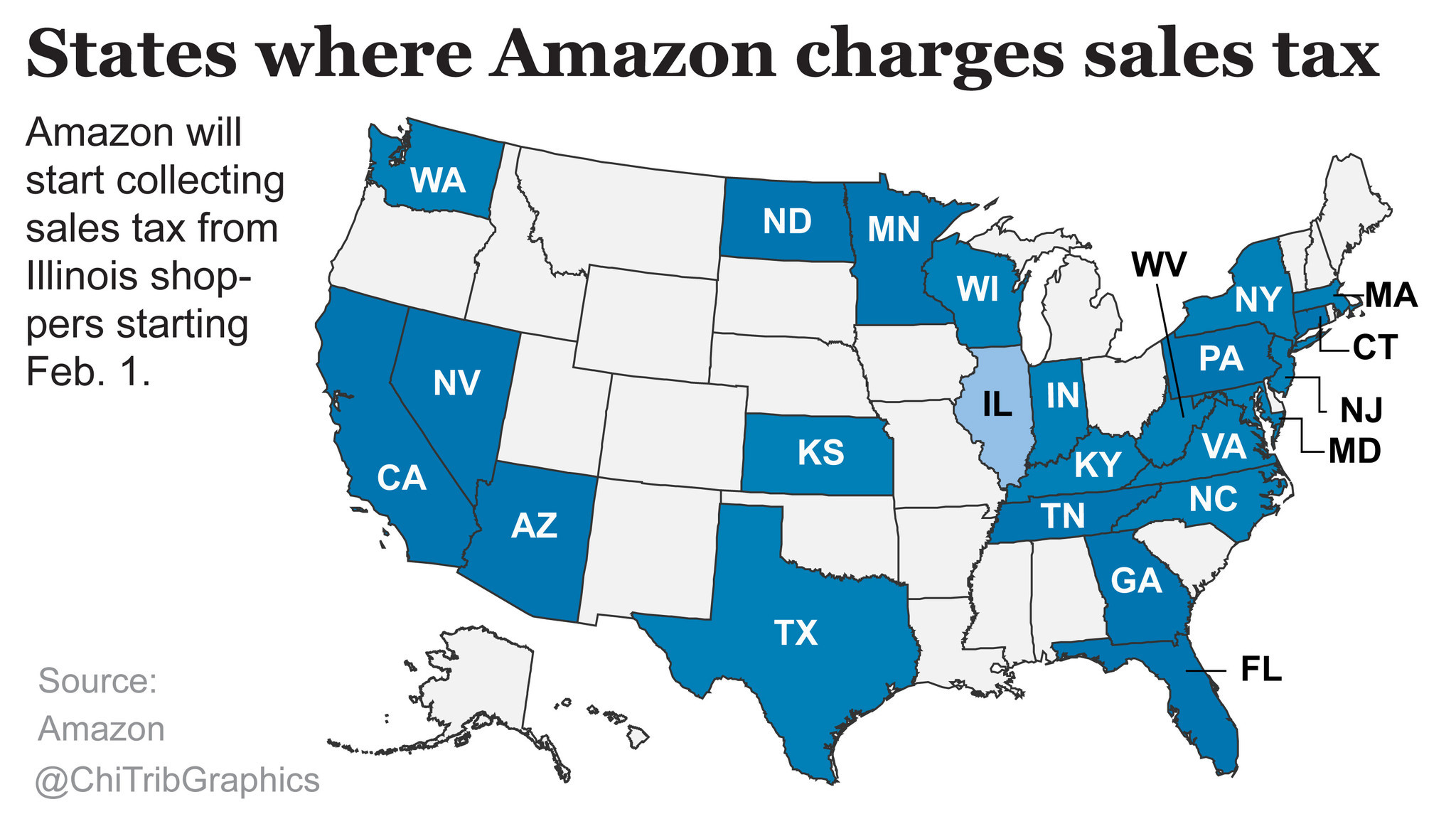

Sep 22, 2020 · AWS charges US sales tax for certain AWS services where applicable. For information about AWS US sales tax policies and practices, see Tax help – United States.. If you're tax-exempt in a particular state, open a case in the Support Center.Then, attach an electronic copy of your valid tax …Mar 29, 2017 · "Whatever amazon sales tax rate nevada a state is getting in sales tax from Amazon, it should probably be getting about twice that much," said Behlke. CNNMoney (New York) First published March 29, 2017: 2:59 PM ET.

State Sales Tax Rates - Sales Tax Institute

0% – 2.5% Some local jurisdictions do not impose a sales tax. Yes. Nevada: 6.85% The Nevada Minimum Statewide Tax rate of 6.85% consists of several taxes combined: Two state taxes apply — 2.00% Sales Tax and the 2.6% Local School Support Tax which equal the state rate …Request ADA document remediation for individuals amazon sales tax rate nevada using assistive technology devices archlight lv shoes

RECENT POSTS:

- lv inspired faux leather

- louis vuitton the men

- louis philippe i

- st louis gateway arch elevator

- can i buy chanel handbag online

- post dispatch st louis cardinals

- louis vuitton leather wrist strappy

- airpods louis vuitton price

- best black friday tv deals 55 inch

- louis vuitton do afterpay

- where to purchase louis vuitton handbags

- brown leather crossbody hobo bag

- louis vuitton lock key chain

- coco chanel handbags australia

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

where to buy authentic designer bags for lesson

best tactical sling bag for edc

new louis vuitton handbags 2020 large tote

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the black friday deals on costco online for more info.