2019 Clark County Nv Sales Tax Rate

COUNTY MAP OF NEVADA NEVADA DEPARTMENT OF TAXATION All rates effective 04/01/17 Washoe 8.265% Carson 7.60% Storey Lyon 7.100% Douglas 7.100% SALES TAX MAP TPI-01.07 Revised 04/01/17 Page 1 7.60% eff 4-1-17 eff 4-1-17. 2019 clark county nv sales tax rate SALES TAX MAP TPI-01.07 Revised 10-01-14 Page 2 NEVADA …

To file for a refund after a permit has been obtained. Includes the MC 059a rate matrix. Farmer/Rancher Gasoline Tax Refund Request Tax Rate Matrix 2019 clark county nv sales tax rate (MC 059a) Fuel tax rates by county. Motor Vehicle Fuel (Diesel) Tax Refund Request (MC 060) Gasoline Tax Refund Request Form (MC 045g) Gasoline Tax Refund Request Instructions (MC 045g) SilverFlume

1.378% beginning in FY 2020 and reduce the MBT-FI and MBT-Mining rate from 2.0% in FY 2019 to 1.853% beginning in FY 2020. ADJUSTED FOR GENERAL FUND REPAYMENT APPROVED IN SECTION 39 OF A.B. 518 (2017) State Sales Tax -2% Rate, 29.6% Live Entertainment Tax, 3.0% Modified Business Tax (After Commerce Tax Credits), 14.0% Commerce Tax, 5.0% ...

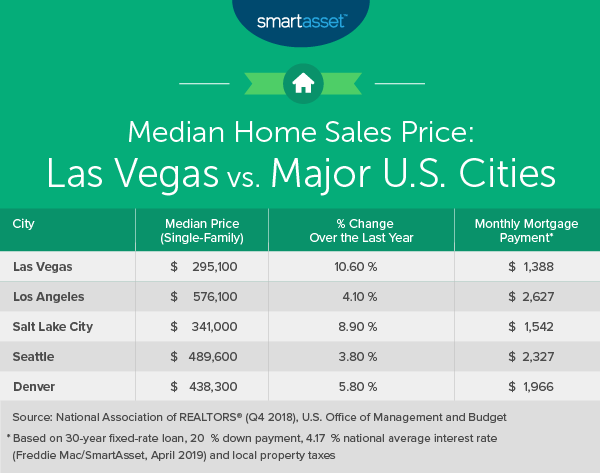

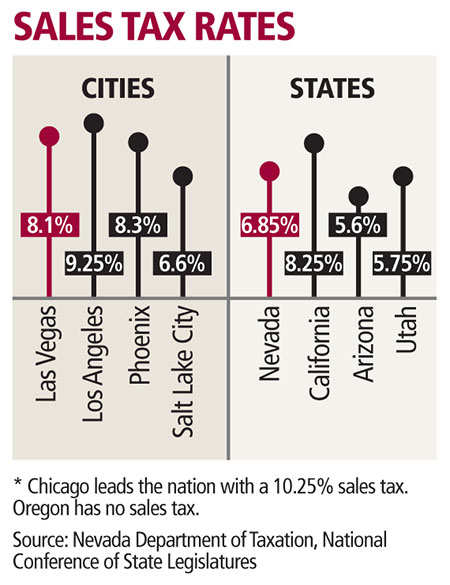

The Las Vegas, Nevada, general sales tax rate is 4.6%. Depending on the zipcode, the sales tax rate of Las Vegas may vary from 8.25% to 8.375% Every 2020 combined rates mentioned above are the results of Nevada state rate (4.6%), the county rate (3.65% to 3.775%). There is no city sale tax for Las Vegas. There is no special rate for Las Vegas.

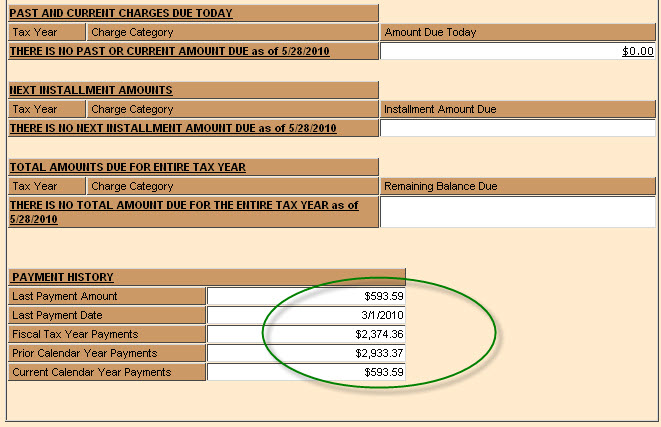

If you have not received a tax bill or notice of distribution statement, please contact our office at (702) 455-4323. Please verify your tax cap%. If this 2019 clark county nv sales tax rate is your primary residence and your tax cap is not 3%, please call the Assessor's Office at (702) 455-3882.

Nevada Vehicle Registration Fees

See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. Many dealers remit sales tax payments with the title paperwork sent to ...EDITORIAL: Clark County sales tax increase a boondoggle in ...

That will raise Clark County’s sales tax rate to 8.375 percent and generate $54 million. The commission will solicit applications from government agencies and other groups who’d like a portion ...Nevada Sales Tax Rate & Rates Calculator - Avalara

The Nevada (NV) state sales tax rate is currently 4.6%. Depending on local municipalities, the total tax rate can be as high as 8.265%. Other, local-level tax rates in the state of Nevada are quite complex compared against local-level tax rates in other states.Clark County Unincorp. Areas .. 0600 .012 .065.077 Clark County Unincorp. PTBA* ... Local Sales and Use Tax Rates by City/County Tax Rates Effective April 1 - June 30, 2019 ...

RECENT POSTS:

- louisiana state fair 2019 food

- speedy 35 epi reddit

- black and white louis vuitton bookbag

- zip codes st louis park mn

- macy's furniture outlet san leandro

- supreme lv jean jacket price

- m44944 lv moon backpack

- louis vuitton wallet stamp code

- louis vuitton bags online

- louis vuitton in barbados

- louis vuitton is real leather

- louis vuitton delightful or graceful

- handbags on sale at dillards

- louis vuitton restoration los angeles

All in all, I'm obsessed with my new bag. My Neverfull GM came in looking pristine (even better than the Fashionphile description) and I use it - no joke - weekly.

Other handbag blog posts I've written:

omega speedmaster speedy tuesday ii ultraman limited edition

nike outlet store osage beach mo

louis vuitton purse guitar strap

Do you have the Neverfull GM? Do you shop pre-loved? Share your tips and tricks in the comments below!

*Blondes & Bagels uses affiliate links. Please read the handbag store dhgate for more info.